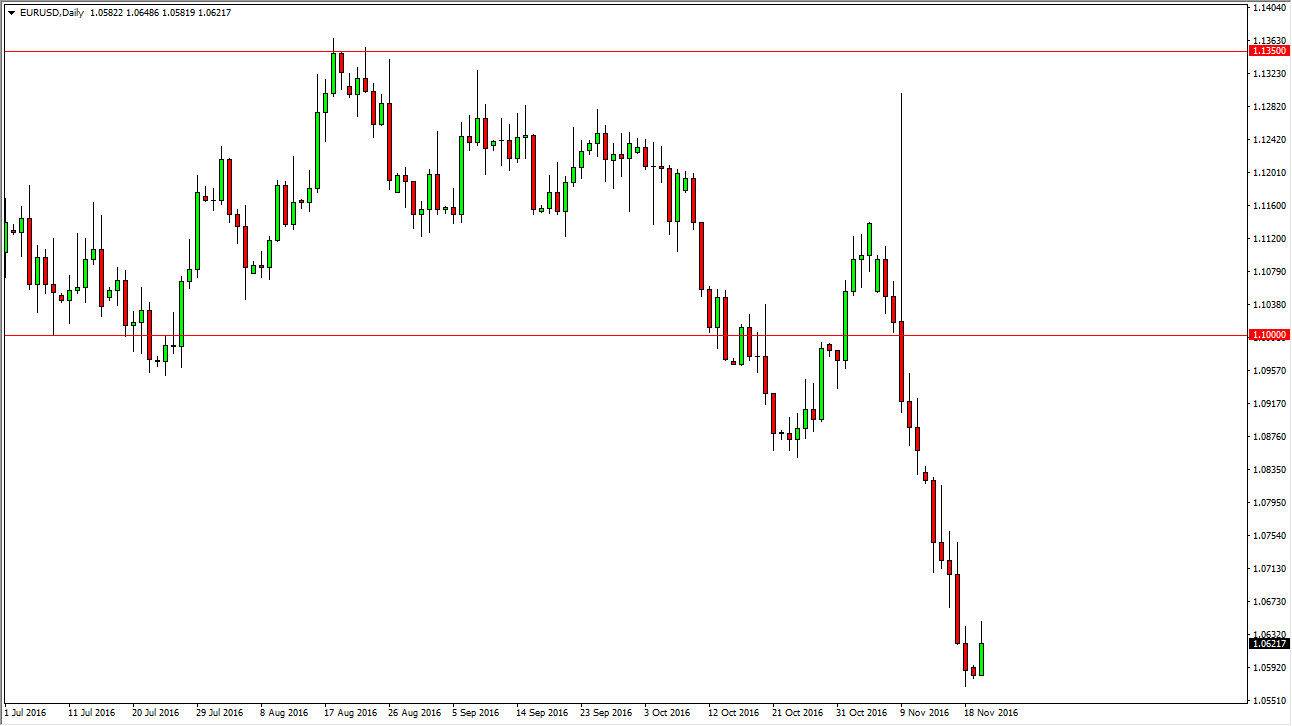

EUR/USD

The EUR/USD pair rallied during the session on Monday, as the market has been far too oversold at this point to continue going lower. At this moment, I believe that it’s simply a matter of waiting for exhaustion above in order to start selling. I have no interest whatsoever in buying this market, and I believe that the bearish pressure on the Euro will continue going forward because of all of the issues in the European Union. Furthermore, the Federal Reserve is likely to raise interest rates fairly soon and this of course is not a surprise or secret. The US dollar will continue to strengthen based upon that and the election of Donald Trump as it is considered to be a much more friendly environment for businesses. Ultimately, I believe that we will test the 1.05 level again, and possibly even break below there and reach towards the parity level.

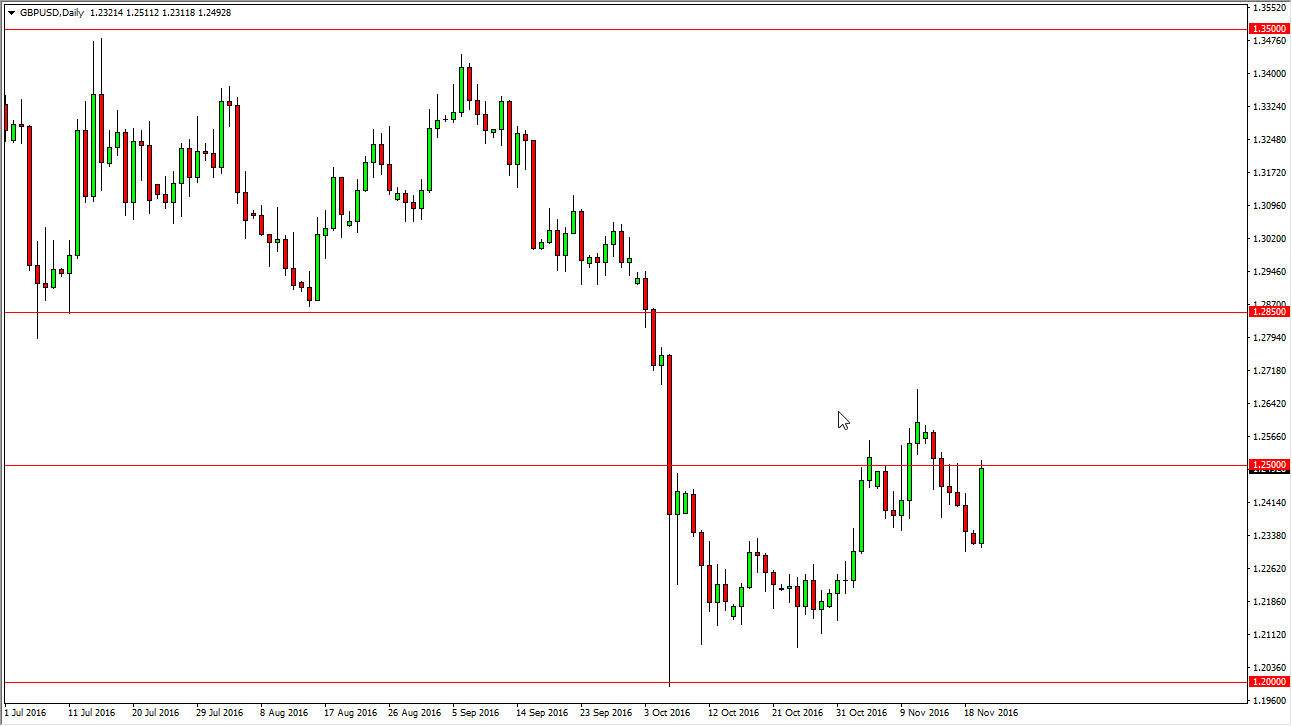

GBP/USD

The British pound had a very strong showing on Monday, slamming into the 1.25 handle. This is an area that could very well be significantly resistive though, so I’m not necessarily looking to go long yet. Because of this, I believe that an exhaustive candle is what we have to wait for in order to start shorting. I think that the market will have quite a large barrier to overcome if we are to ever break above the 1.2850 level, so it’s above there that I actually become much more confident buying the British pound. I think that sooner or later we will get a selling opportunity, but I am the first to admit that the candle for the day has been rather strong and of course could warrant some follow-through. I will make my decision based upon daily closes, and nothing lower than that.

I recognize of the British pound had been oversold, and that the “doomsday scenario” that traders have placed upon the United Kingdom was overdone. However, the US dollar is still a very strong currency so I don’t want to trade against it.