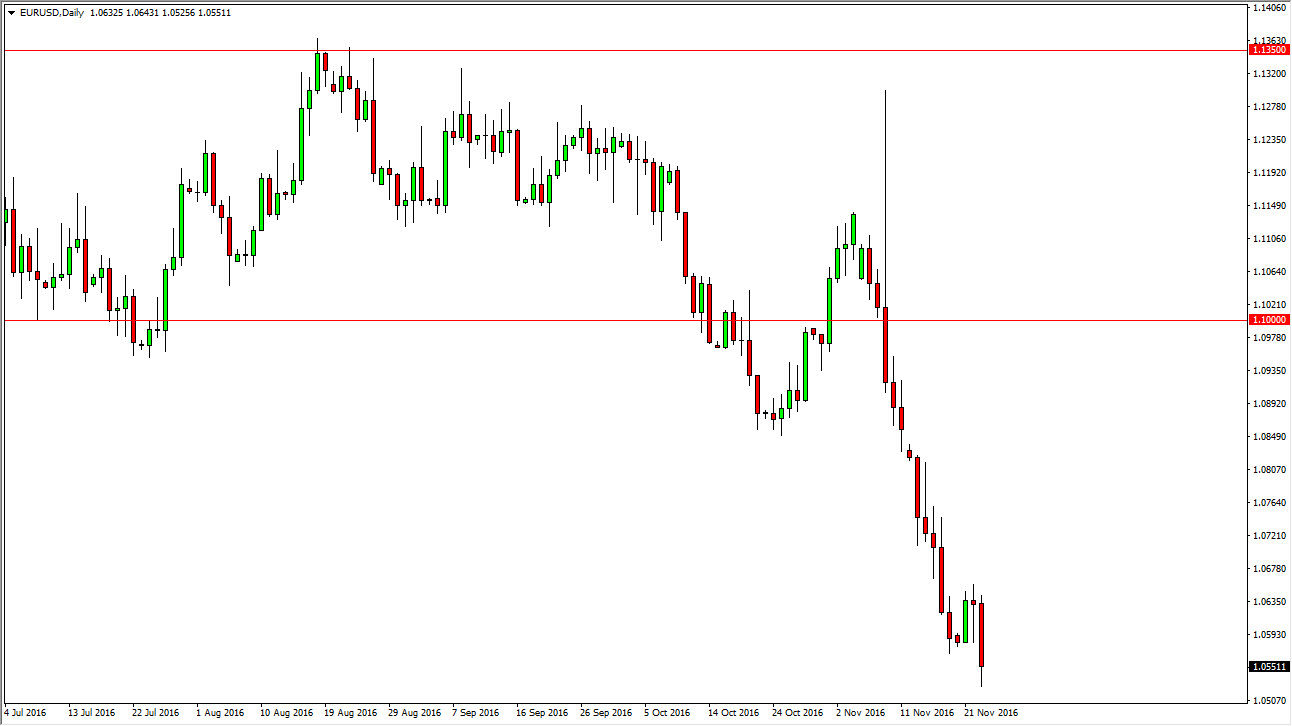

EUR/USD

The Euro fell during the day on Wednesday as we continue to see weakness in the common currency. This is a market that looks like it’s ready to try to break down below the 1.05 handle, which I see as massive support on the longer-term charts. Because of this, I think it’s only a matter of time before we sell off every time we rally. I think that the concerns inside the European Union and of course the potential interest-rate hikes coming out of the United States will continue to move this market in one direction, down. I believe that the 1.0650 level is massively resistive, and I believe that above there we have even more resistance near the 1.08 handle. It might take several attempts, but I think we break down below the 1.05 handle and start reaching towards the parity level soon.

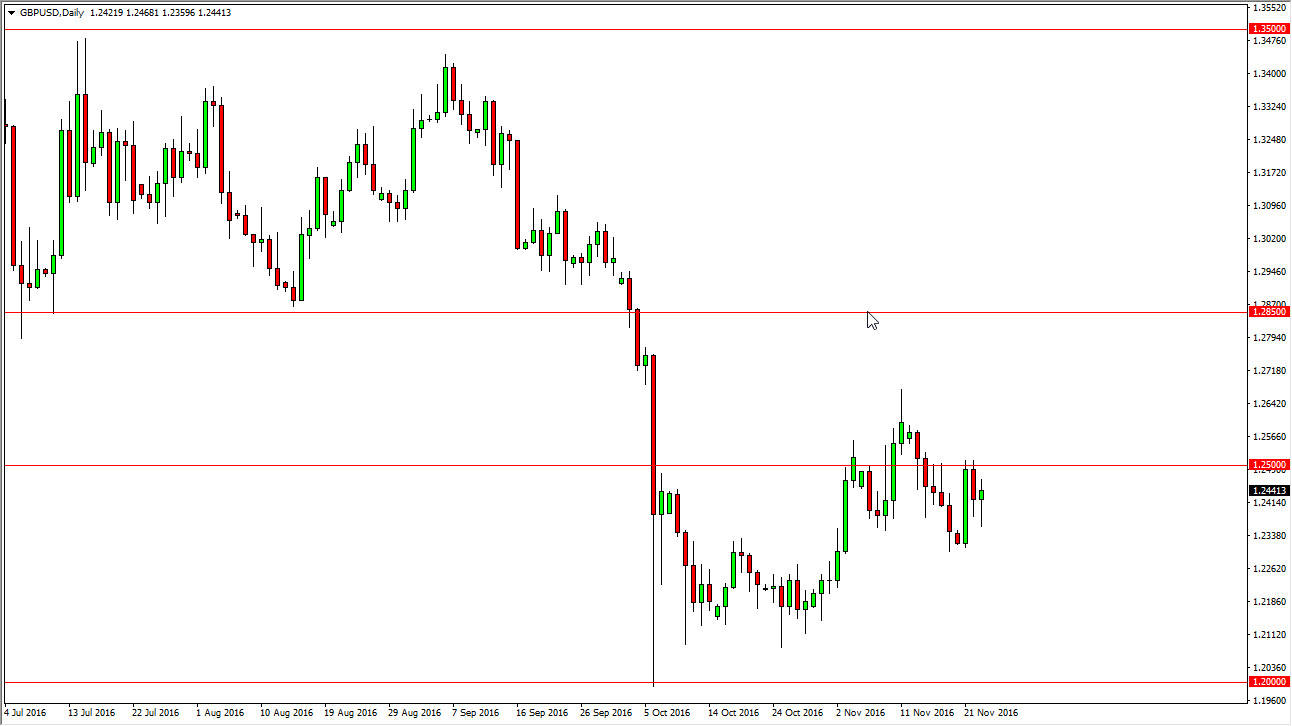

GBP/USD

The GBP/USD pair had a volatile session on Wednesday as well, initially falling then turning around to form a hammer for the day. The hammer sits just below the 1.25 level, which of course has a certain amount of psychological importance. I think that if the market can break above the 1.25 level we will more than likely try to reach a little bit higher than last time. However, I think that on the whole, the British pound is going to be relatively choppy and stagnant.

It is a necessarily that the British pound is strengthening massively, it’s just that it’s been oversold for quite some time and perhaps there is more focus on the Euro at the moment. A break down below the 1.23 level would send this market lower though, and with that I would be willing to not only sell but perhaps get aggressive about it. Currently, I think that this is probably a market that is best avoided.