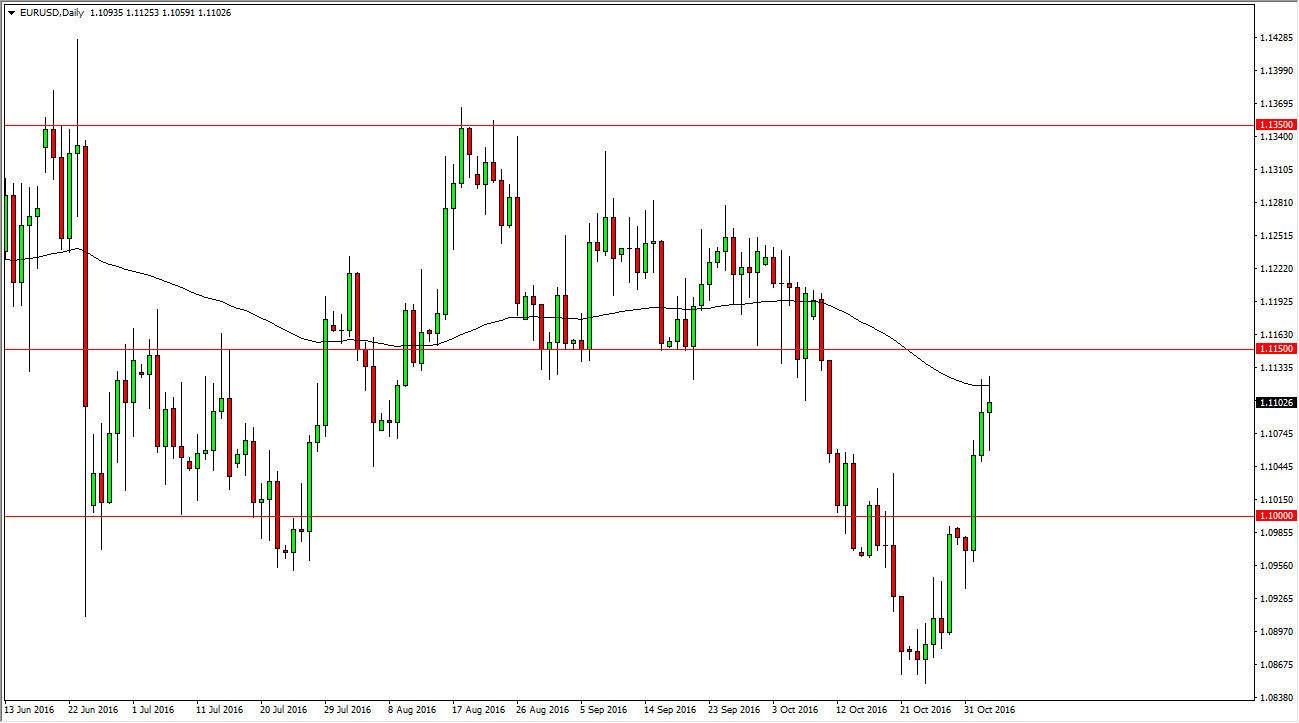

EUR/USD

The EUR/USD pair went back and forth on Thursday as we continue to try to jostle for position at of the Nonfarm Payroll Numbers. Ultimately, this is a market that sees quite a bit of resistance just above, both in the form of the 100-day exponential moving average, and of course the 1.1150 level above. I think that it is far too noisy above that level to go long at this point so this is essentially a “sell only” market at this point in time, and a break down below the bottom of the range for the session on Thursday is reason enough research selling and aiming for the 1.10 level below. Ultimately, I think that we will break down but the question is whether or not we have to rise to find the resistance, or a break down below the bottom.

GBP/USD

The British pound rose during the day on Thursday as the Bank of England failed to raise the amount of quantitative easing going into the market. This suggests that perhaps the British economy is doing better than we had originally anticipated, so of course it makes sense that the British pound would continue to go higher. However, I believe that there is enough resistance above to turn this market back around and force a resistive candle to appear. I believe that the 1.25 level is massively resistive, and I know that the 1.2850 level is massively resistive. Exhaustive candle is what I’m looking for in order to start shorting in taking advantage of the “value” in the US dollar, and am simply sitting on the sidelines and waiting for the signal to start going short again. I have no interest in buying, as there is a significant amount of reasons to think that the British pound will continue to be the “whipping boy” of the Forex world.