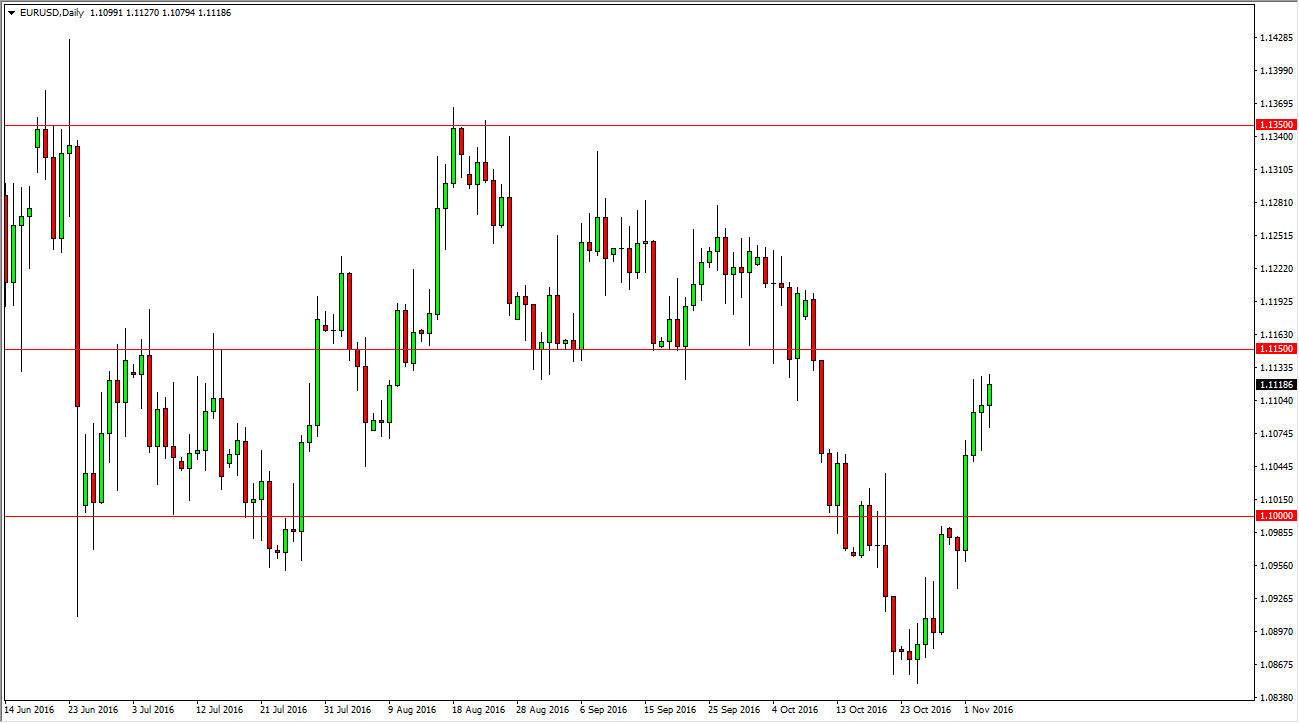

EUR/USD

The EUR/USD pair fell initially on Friday, but turned around to form a supportive candle. However, I see a lot of resistance above at the 1.1150 level, and with that being the case is likely that the sellers will return. That’s at least until we get the US presidential election numbers, and we won’t have those until late Tuesday, possibly even early Wednesday. Because of this, I feel it’s probably best to sit on the sidelines as the market probably will do much in the way of volatility until we know what’s going to happen. On the other hand, if we break down below the bottom of the candle could be a negative sign. We could get a surprise headline during the course of the weekend, and that of course could have trader’s jumping into the market during Monday’s trading hours. Unless we get something like that, it’s very unlikely that the markets will be doing much.

GBP/USD

The British pound tried to rally during the day on Friday but found the area above the 1.25 level to be far too resistive to continue going higher. The market should then reach towards the 1.2850 level above, which has been previously very supportive. However, the fact that we find a shooting star at this area suggests that we aren’t going to do much today, perhaps drift a little bit lower. Ultimately, this is a market that will be highly influenced by the US presidential elections obviously, and as a result it’s hard to place any type of faith in a position. I do believe that selling this market is probably the only thing that we will do over the longer term, but at this point in time it’s probably best to sit on the sidelines and wait for a little bit more clarity here.