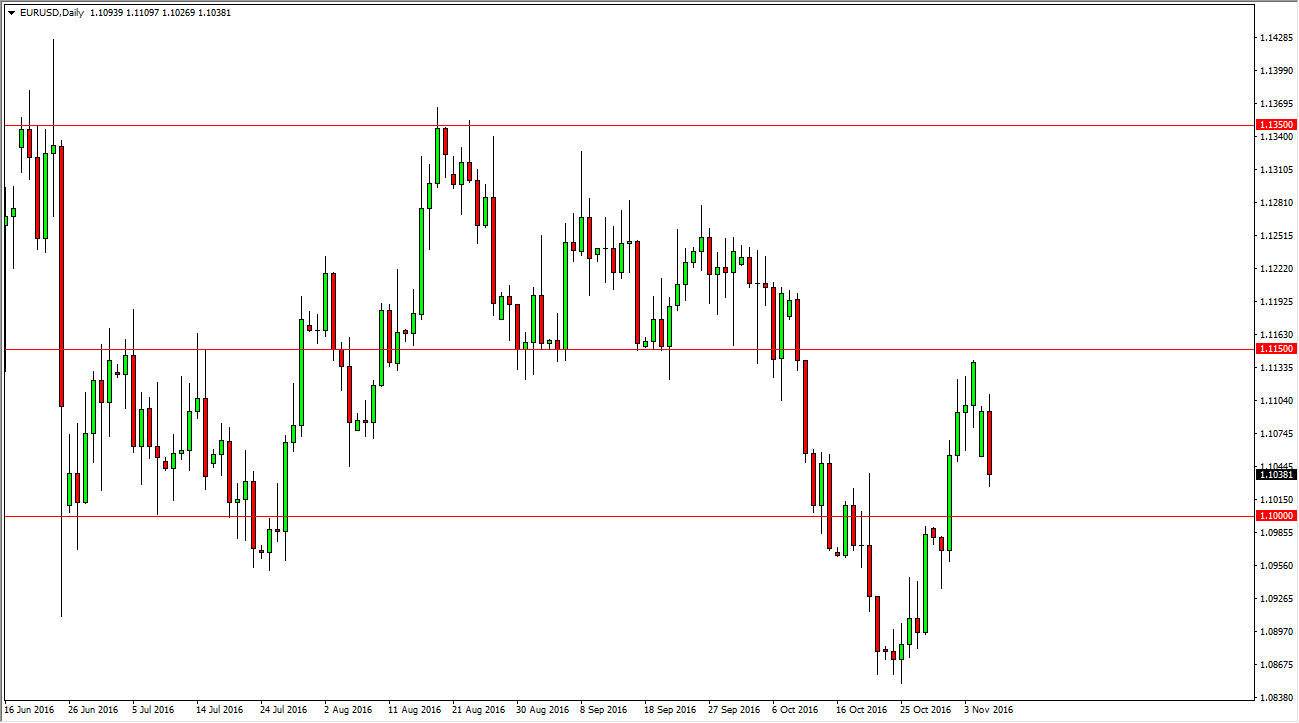

EUR/USD

The EUR/USD pair fell significantly during the day on Monday, as word got out that Hillary Clinton was not going to be indicted. Because of this, it’s likely that the markets seem to be more comfortable with the “status quo” than the uncertainty of a nationalistic America. At this point, looks as if the market is reaching down to the 1.10 level below, which has previously been support and resistance. With this, I feel that it’s only a matter of time before the market tries that area and perhaps breaks through. A bit of a bounce or supportive candle in that area could be reason enough to think that we try to reach towards the 1.1150 level above. With this, I feel that the market is very difficult to deal with now.

GBP/USD

The British pound fell significantly during the day on Monday, as the 1.25 level has offered quite a bit of resistance yet again. The fact that we did up forming this negative candle suggests that the market should continue to drop from here. The 1.20 level below is essentially the “hard floor” at this point, and because of this it’s very likely that the market will continue to bounce off that area and attack it again and again as we have significant pressure on the British pound in general. With the negativity of the exit boatswain upon the British pound, it’s likely that the market will offer selling opportunities every time we rally as it begins to show “value” in the US dollars general.

If we did break above the top of the candle from the Friday session, the market would probably reach towards the 1.2850 level above, which should be massively resistive and what I think of as the “ceiling” in this market as there has been far too much negativity surrounding the British currency.