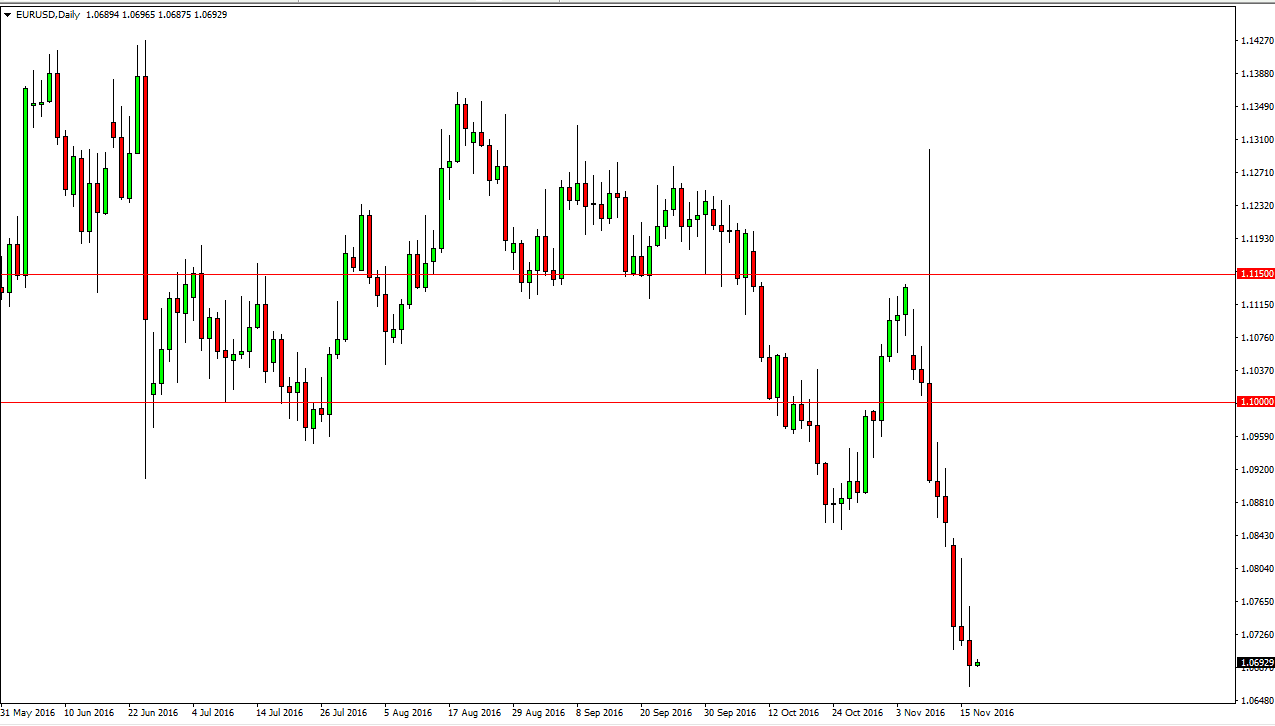

EUR/USD

The EUR/USD pair when back and forth on Wednesday, as we continue to see quite a bit of negative pressure going forward. I think that we will eventually reach the 1.05 level below, which has been massively supportive in the past. We are getting very oversold of this point, so a bounce would be reasonable to expect. However, I think that it would be a selling opportunity more than anything else, and as a result I still favor the US dollar in general. Ultimately, I think that the US dollar will continue to strengthen due to not only the Donald Trump presidency, but also interest rate expectations which are obviously much more hawkish in Washington DC than they are in Brussels.

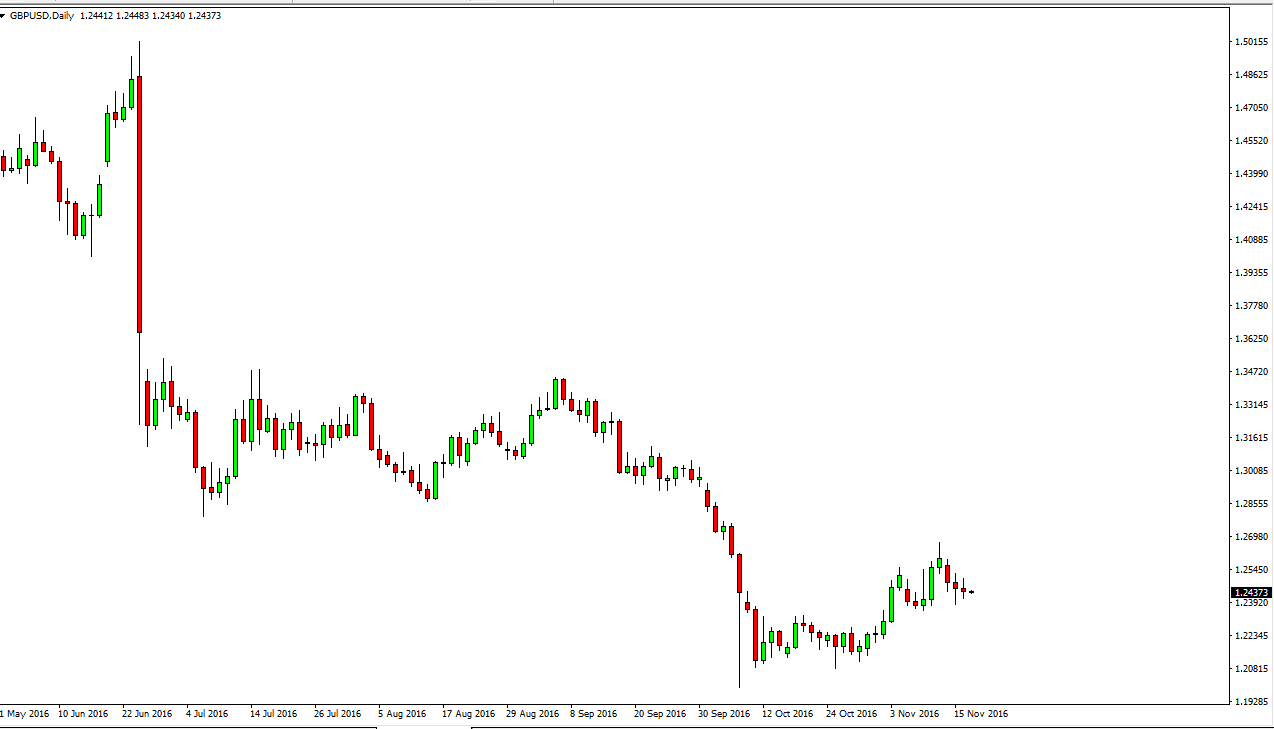

GBP/USD

The British pound did almost nothing during the day on Wednesday, as we continue to drift just below the 1.25 handle. That is an area that of course has a certain amount of large, round, psychological significance, so I think it makes sense that the market continues to hang about this area. I don’t necessarily like buying this parent I believe that the 1.2850 level above continues to be an area of importance. So if we rally, I believe that the market will probably find the sellers somewhere above. I have no interest whatsoever in buying this market, I believe that the British pound will continue to be patient longer-term, not only because of the exit bill, but the fact that the United States economy will more than likely bounce. After all, we have a very business friendly administration coming into the White House, and it of course should encourage quite a bit of speculation on the idea of higher interest rates coming sooner rather than later, especially considering the Donald Trump has openly said that interest rates are far too low. With this, the US dollar should continue to strengthen.