EUR/USD Signal Update

Yesterday’s signals were not triggered as there was no bearish price action at either 1.1004 or 1.1028.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be entered before 5pm London time today only.

Long Trades

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1028 or 1.1004.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Short Trades

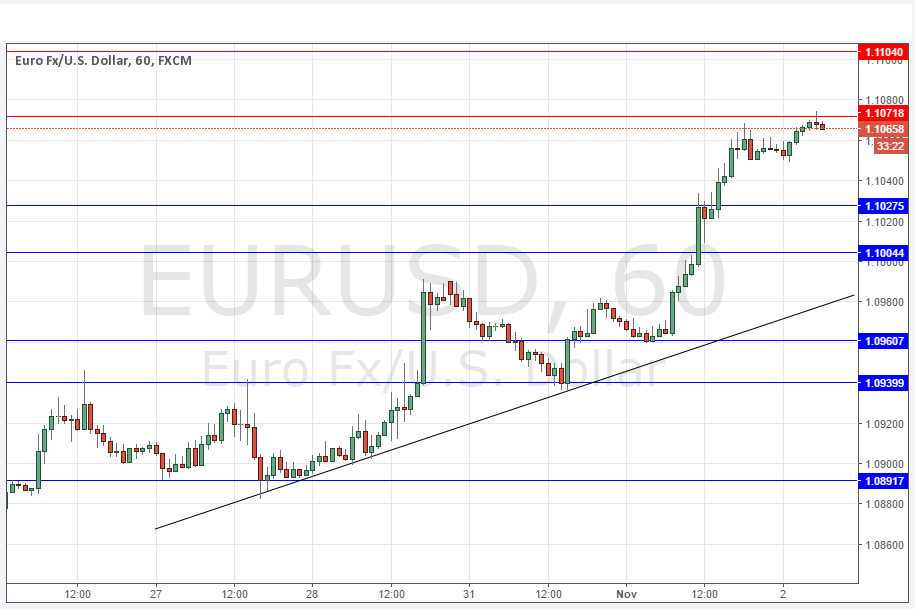

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1072 or 1.1104.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

This pair was almost the strongest mover of the day, but was just slightly behind its sister pair USD/CHF. The rise was strong and a look at the daily chart shows that we have had a real bullish turn with yesterday being a bullish trend day, the kind of day you wish you had bought if you didn’t.

At present, the price is stalled at the resistance level of 1.1072. There may be a pull back from here, but it is difficult to judge that until after the London Open. In the current climate, a retest of the nearest support level would look very attractive to long if there will be a bullish bounce there.

The U.S. Dollar is very weak and suffered a serious reversal yesterday against almost all currencies.

There is nothing due today regarding the EUR. Concerning the USD, there will be a release of ADP Non-Farm Employment Change data at 12:15pm London time followed by Crude Oil Inventories at 2:30pm and the FOMC Statement and Federal Funds Rate at 6pm.