The EUR/USD pair has been going higher recently, mainly due to the presidential polls in the United States tightening up. After all, a lot of money has gone into the market expecting Hillary Clinton to win the presidency, but at this point in time looks very likely that the polls are tightening enough that quite a bit of uncertainty can be expected. On top of that, the FBI investigating Hillary Clinton certainly cannot help the situation either. Because of this, a lot of money has jumped out of the marketplace in the US dollar has sold off recently. However, I think that the markets have overreacted.

Knee-jerk reaction

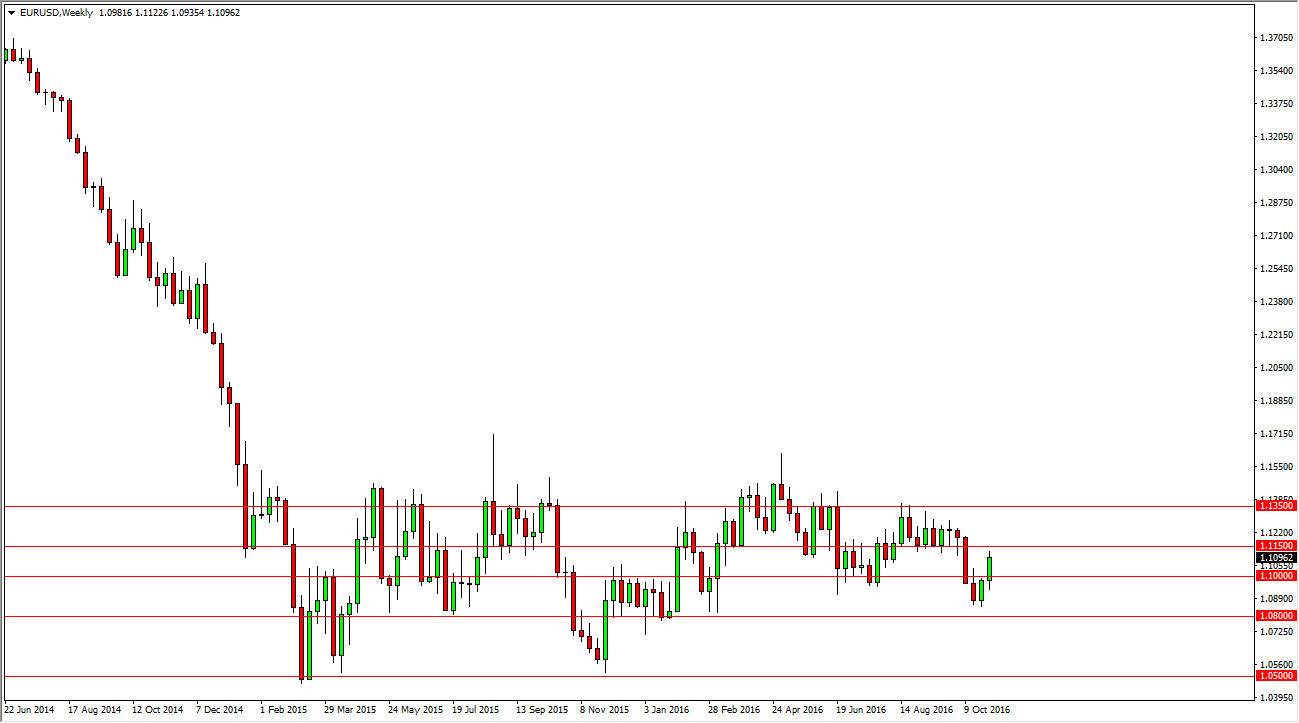

I believe this point in time we are looking at a knee-jerk reaction more than anything else. After all, at the end of the day in the US economy is much larger than any president that could be elected, and with that being the case it is likely that the overreaction will be turned back over. Because of this, I think that the recent rally will more than likely be a nice selling opportunity. As I write this, I still suspect that the 1.1150 level continues offer resistance, and an exhaustive candle is reason enough for me to start selling. There is a lot of noise just above the 1.1150 level, and extending all the way to the 1.350 level. It’s not that we can’t go higher and reach towards the top of this range, it’s just that there is so much noise that it’s likely that the sellers will return.

Keep in mind that the European Union has many of its own issues, not the least of which that some of the anti-EU parties in both France and Holland are starting to lead the polls, and that threatens the very existence of the European Union. With that in mind, I do not think that this market can break out significantly. I look for sellers to return relatively soon.