The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 20th November 2016

Two weeks ago, I predicted that the best trade for this week was likely to be long USD/CAD. This trade made a nice gain of 1.48%.

The market seems very predictable right now, with the shock victory of Donald Trump in the U.S. Presidential Election on 8th November sending the U.S. Dollar roaring ahead at the expense of most other currencies, particularly the Japanese Yen, Australian Dollar, Swiss Franc and the Euro. This move will run out of steam eventually but there is no reason why it should not continue for a while. The momentum is certainly there and this is a train that is worth being on board.

I therefore suggest that the best trades this week are likely to be long USD against the Japanese Yen, Australian Dollar, Swiss Franc and the Euro.

Fundamental Analysis & Market Sentiment

Fundamental factors are playing a role right now but are difficult to explain fully. What is becoming increasingly clear is that Trump will need to try to deliver on his promise of generating jobs for lower-skilled Americans, and the logically easiest way to achieve that will be federal spending on infrastructure projects. This is boosting the American stock market overall, led by companies that will logically stand to gain from the range of Trump’s known policy positions. As money flows into America to buy American stocks, so the U.S. Dollar is bought and rises in value.

Overall, sentiment is bullish as we are now seeing the strongest movements in the market since Brexit and speculators are jumping on the bandwagon.

Sentiment is weak on “haven” currencies such as the Japanese Yen, Swiss Franc and precious metals.

The Australian Dollar is being hit by a perception of increased divergence in is monetary policies compared to the U.S. Federal Reserve, as well as Trump’s anti-free trade positions which could have a negative impact upon the Australian economy.

Technical Analysis

USDX

The U.S. Dollar has produced its largest weekly move in years, and closed near its high at an all-time high. This is not something that happens every week! Bullish, bullish, bullish.

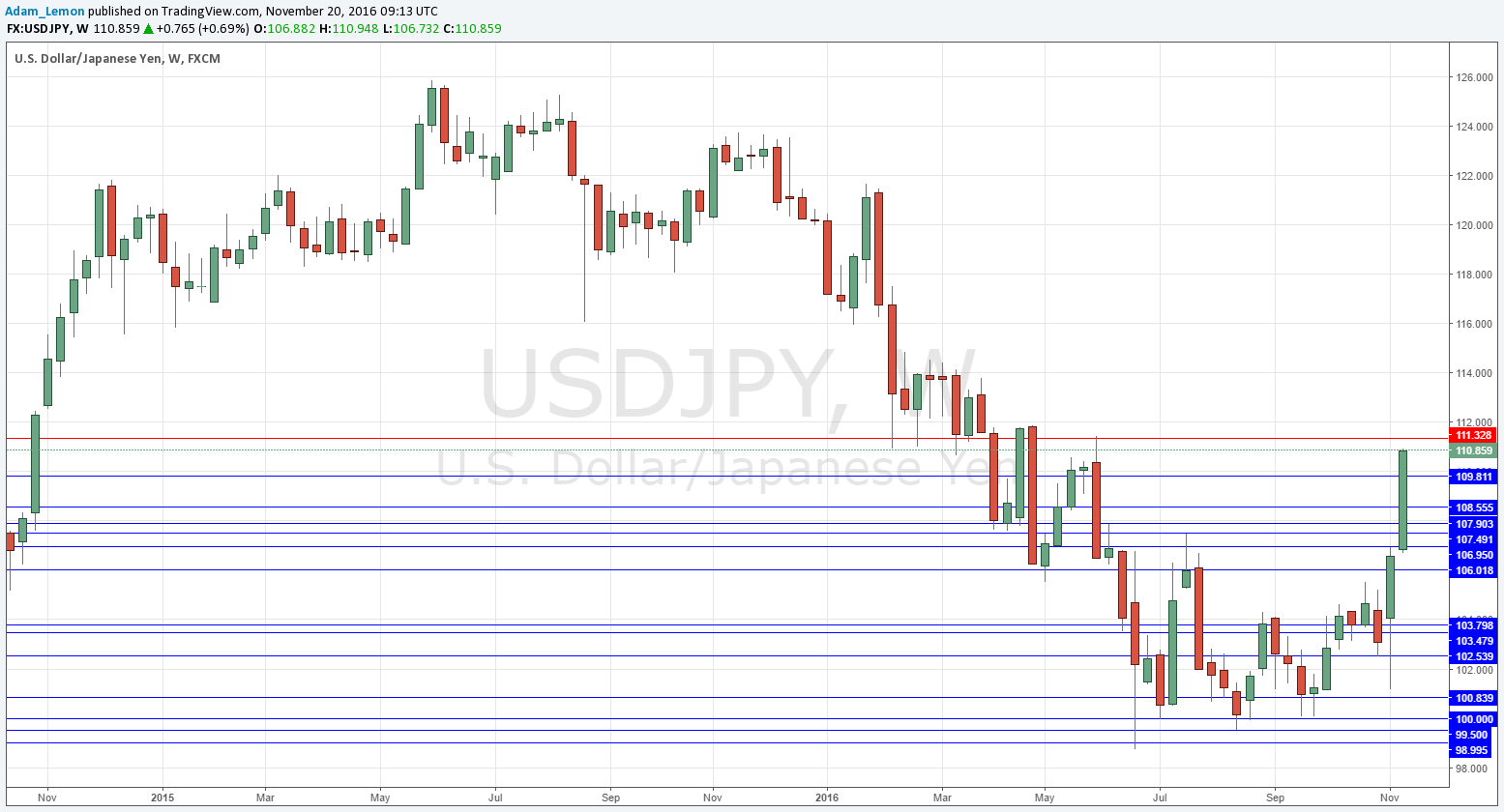

USD/JPY

The strongest mover of the week, rising by a total of almost 4% in value. This pair is at the heart of the Forex market now. There is reason for a little caution as the area between 111.33 and 112.00 was very pivotal during the first half of this year, as can be seen in the chart below. Overall, a very bullish outlook.

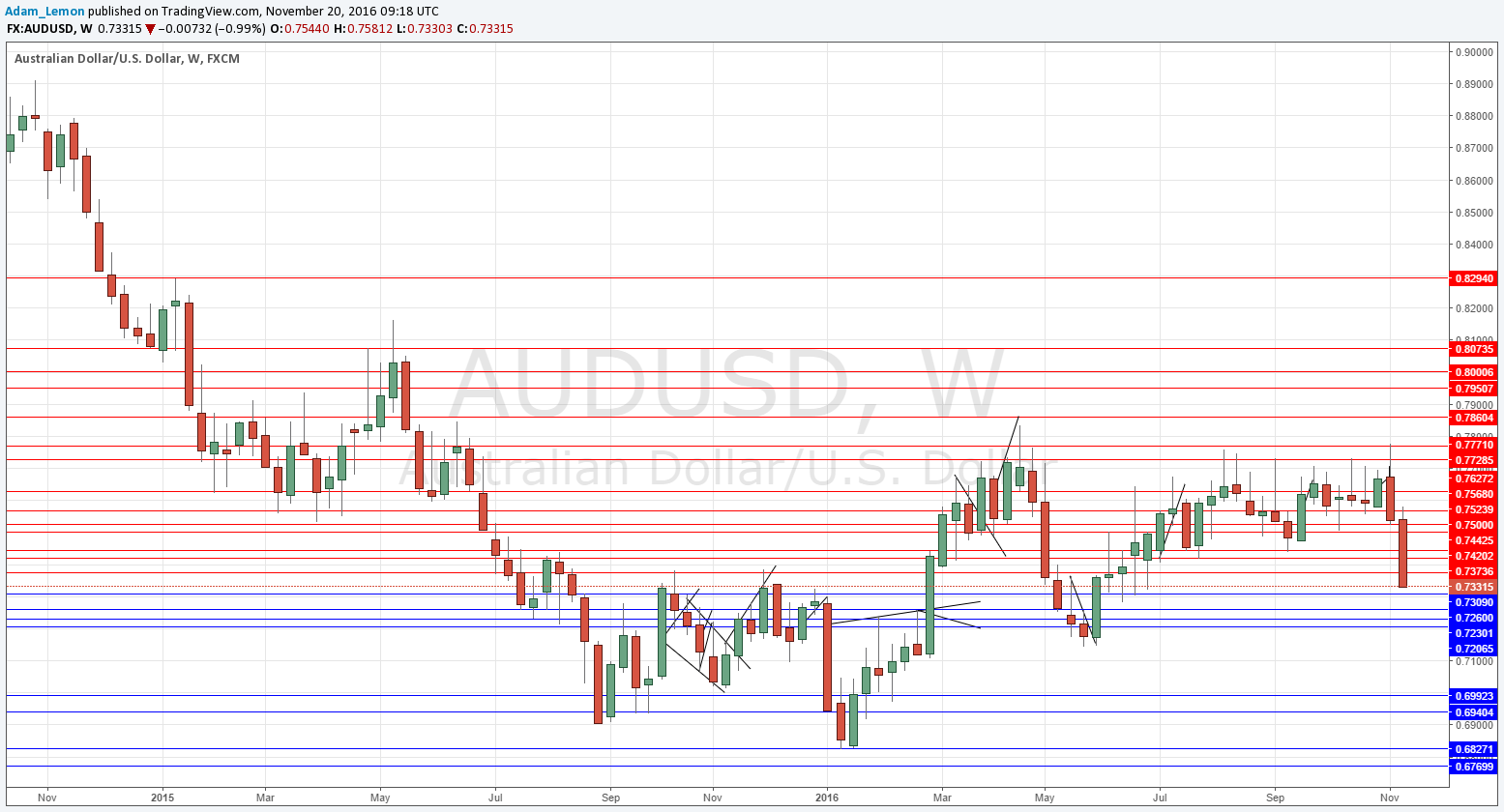

AUD/USD

The second strongest mover of the week, falling by a total of almost 3% in value, its largest weekly drop since last May. There is some key support at around 0.7300 but if that is broken, the way seems clear for the price to fall considerably further, to at least 0.7150. Overall, a bearish outlook, but maybe a little less so than USD/JPY.

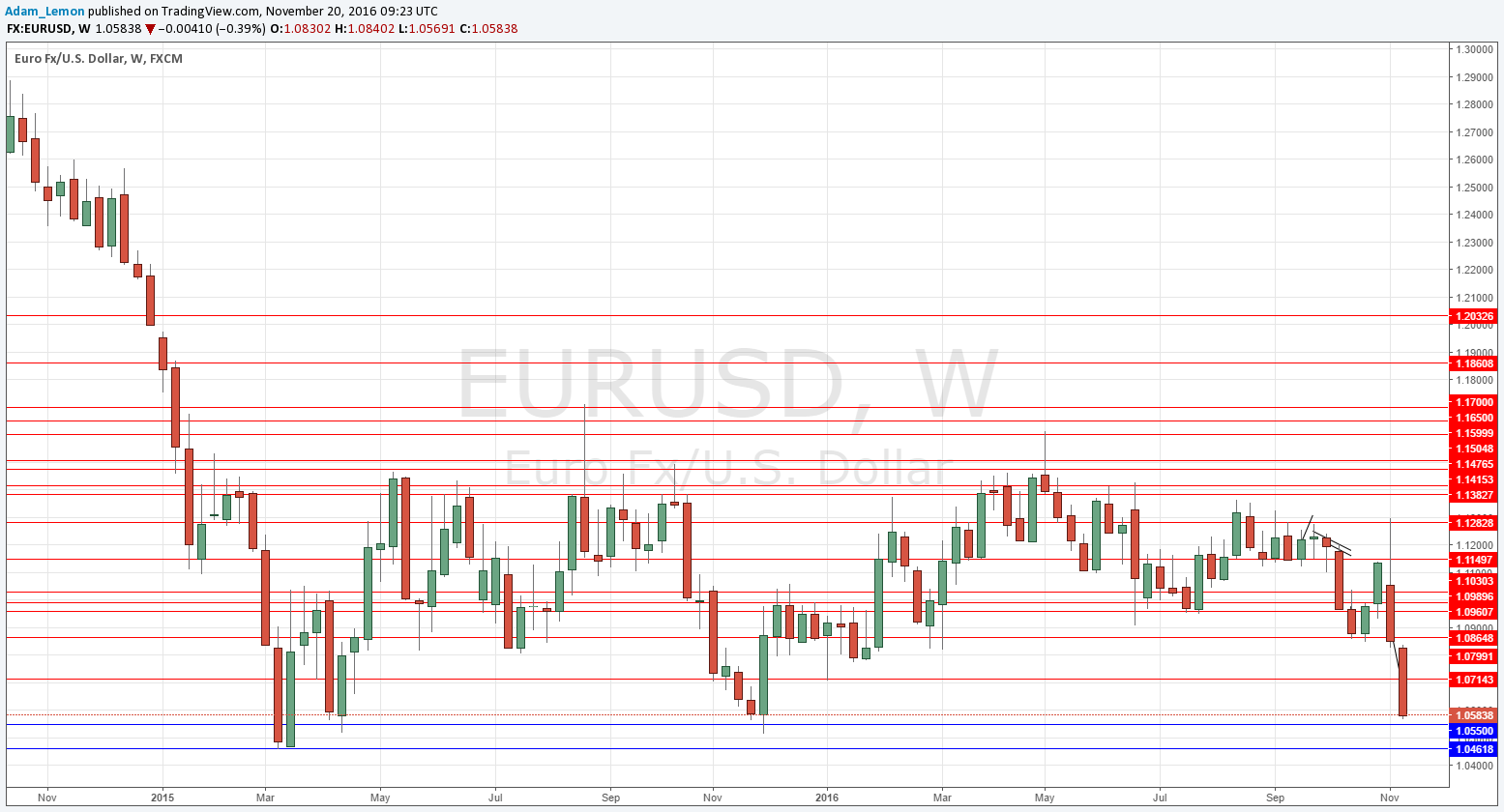

EUR/USD

The third strongest mover of the week, falling by a total of almost 2.3% in value, its largest weekly drop since a year ago. There is some danger ahead for bears, however: there is a very long-term double bottom at 1.0550 which is not far away from the current price, as well as a multi-year low at 1.0461. Overall, a bearish outlook, but some caution is warranted at those support levels.

USD/CHF

The fourth strongest mover of the week, rising by a total of almost 2.2% in value, its largest weekly rise since a year ago. There is potential immediate danger ahead for bulls, however: there is resistance at 1.0110 which has already had an effect, as well as a very key swing high at 1.0250 beyond that. If the price can break 1.0110 convincingly, it has a good chance to make that quarter number. Overall, a bullish outlook, but some caution is warranted.

Conclusion

Bullish on the USD, bearish on the Japanese Yen, Australian Dollar, Euro and Swiss Franc.