The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 6th November 2016

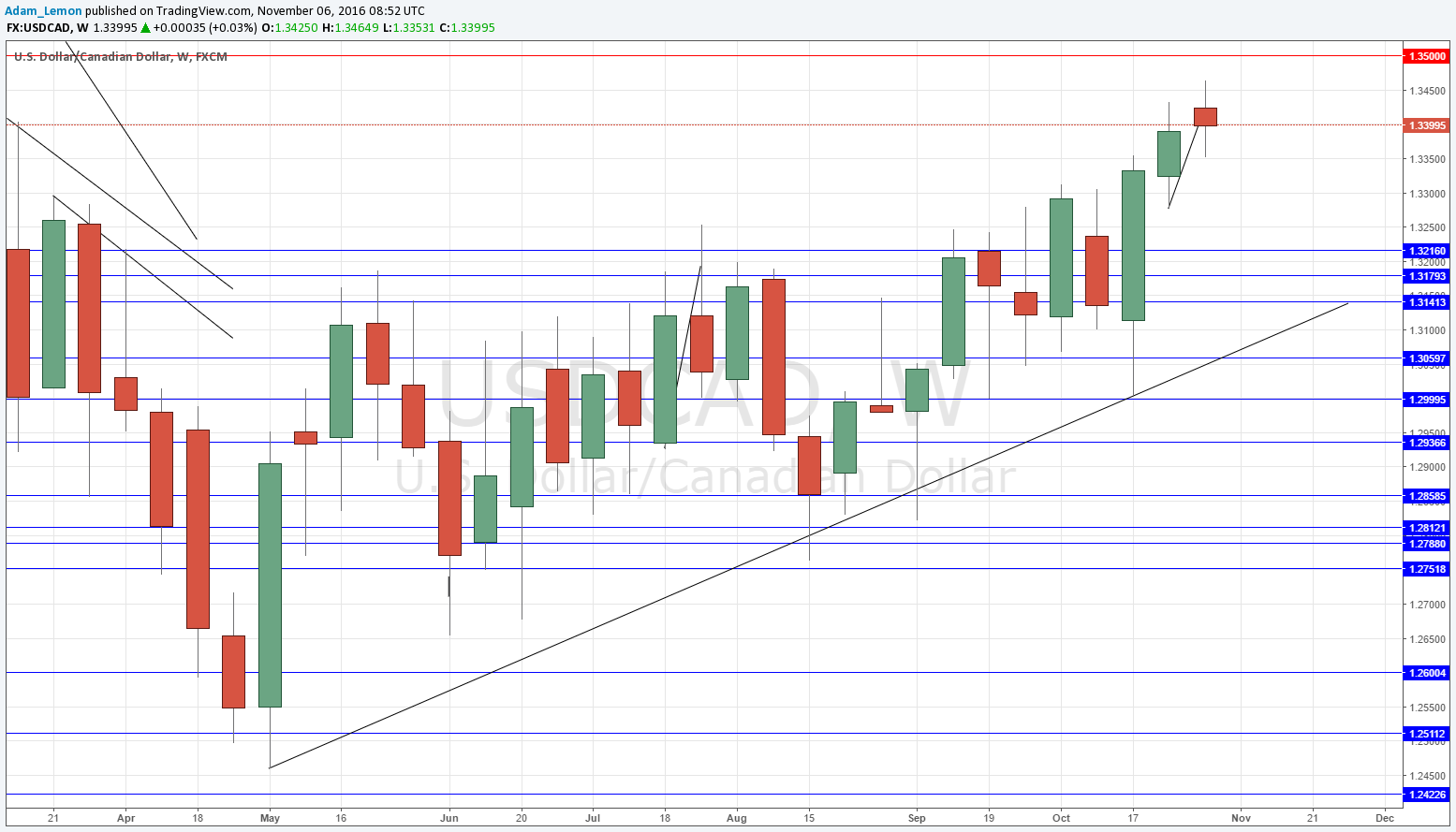

Last week I predicted that the best trade for this week was likely to be long USD/CAD. This trade made a tiny gain of 0.06%.

The market seems harder to forecast this week, as much will depend upon the outcome of the U.S. Presidential Election on Tuesday, the outcome of which is uncertain. Nevertheless, I believe Clinton will win, which should strengthen the U.S. Dollar.

I therefore suggest that the best trade this week is likely to again be long USD/CAD as the USD held up best against the CAD during its period of relative weakness over the past week.

Fundamental Analysis & Market Sentiment

Fundamental analysis is of little use right now, it is more a case of political developments and sentiment being of primary importance, although of course these factors influence fundamental economics.

The two currencies that stand out here are the U.S. Dollar and the British Pound.

The U.S. Presidential Election will complete on Tuesday, and the result is likely to have a meaningful effect upon stock markets (especially the U.S. stock market) and the U.S. Dollar, with an against-the-odds Trump victory likely to be bad for both, at least over the short term.

Last week saw a court ruling in the U.K. which puts Brexit in possible danger, and this boosted the British Pound over recent days to the extent that it was the biggest riser of the week. It is probable that this effect will continue for some time.

Technical Analysis

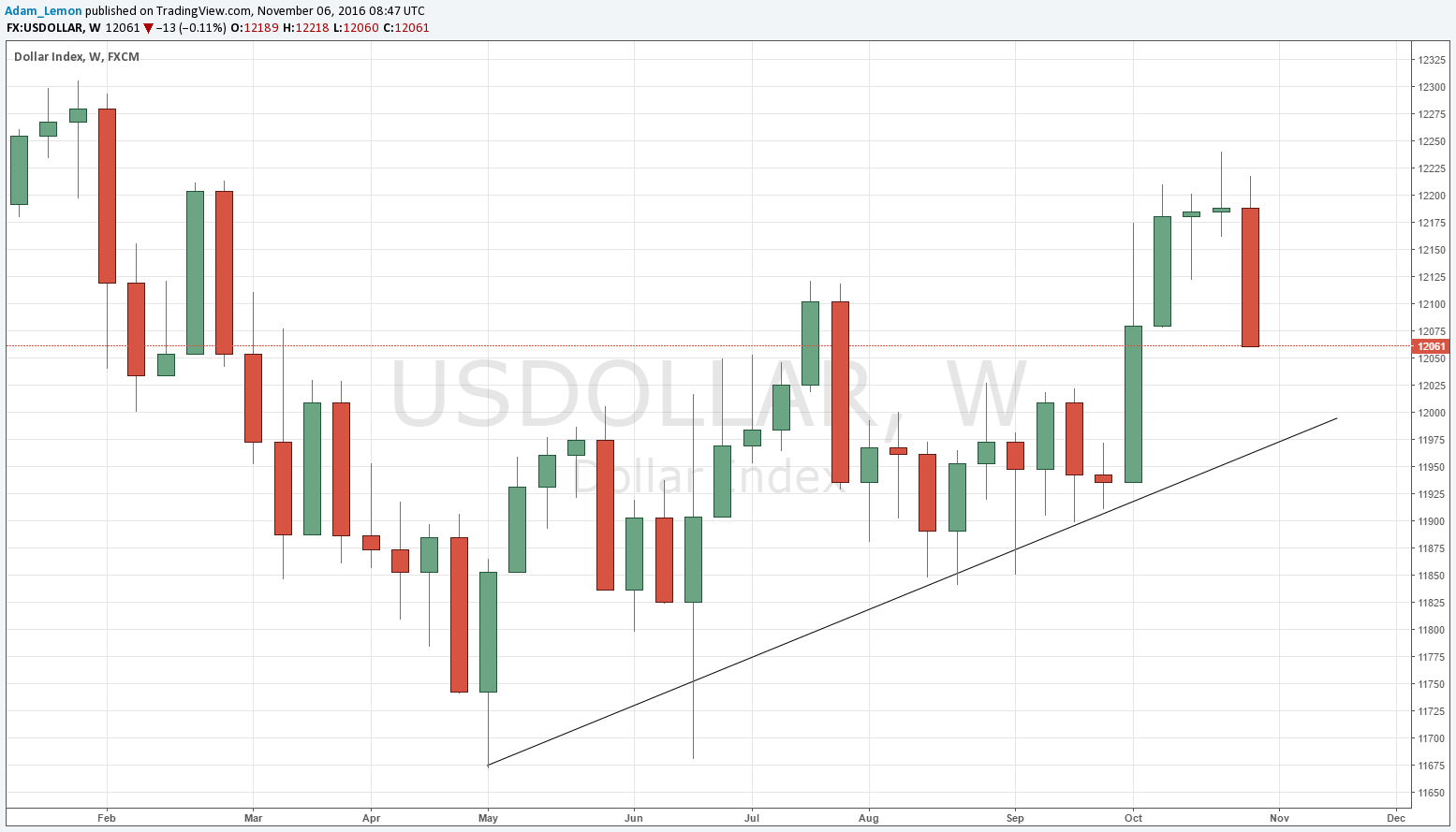

USDX

The U.S. Dollar has remained within a bullish trend, being above its historical prices from both 13 and 26 weeks ago, and above a clear and supportive trend line which can be drawn connecting the recent lows. However, the weekly candle was strongly bearish and is showing a turn in the price, so technically this upwards trend is in doubt.

USD/CAD

The price has been coiling bullishly for many weeks now, but finally two weeks ago we got a high close above the long-term range, formed by a very bullish outside candle that closed near its high price. There has now been another small candle, although the price ended the week still held by resistance around 1.3400. Overall, it looks like the most clearly bullish currency pair for the U.S. Dollar.

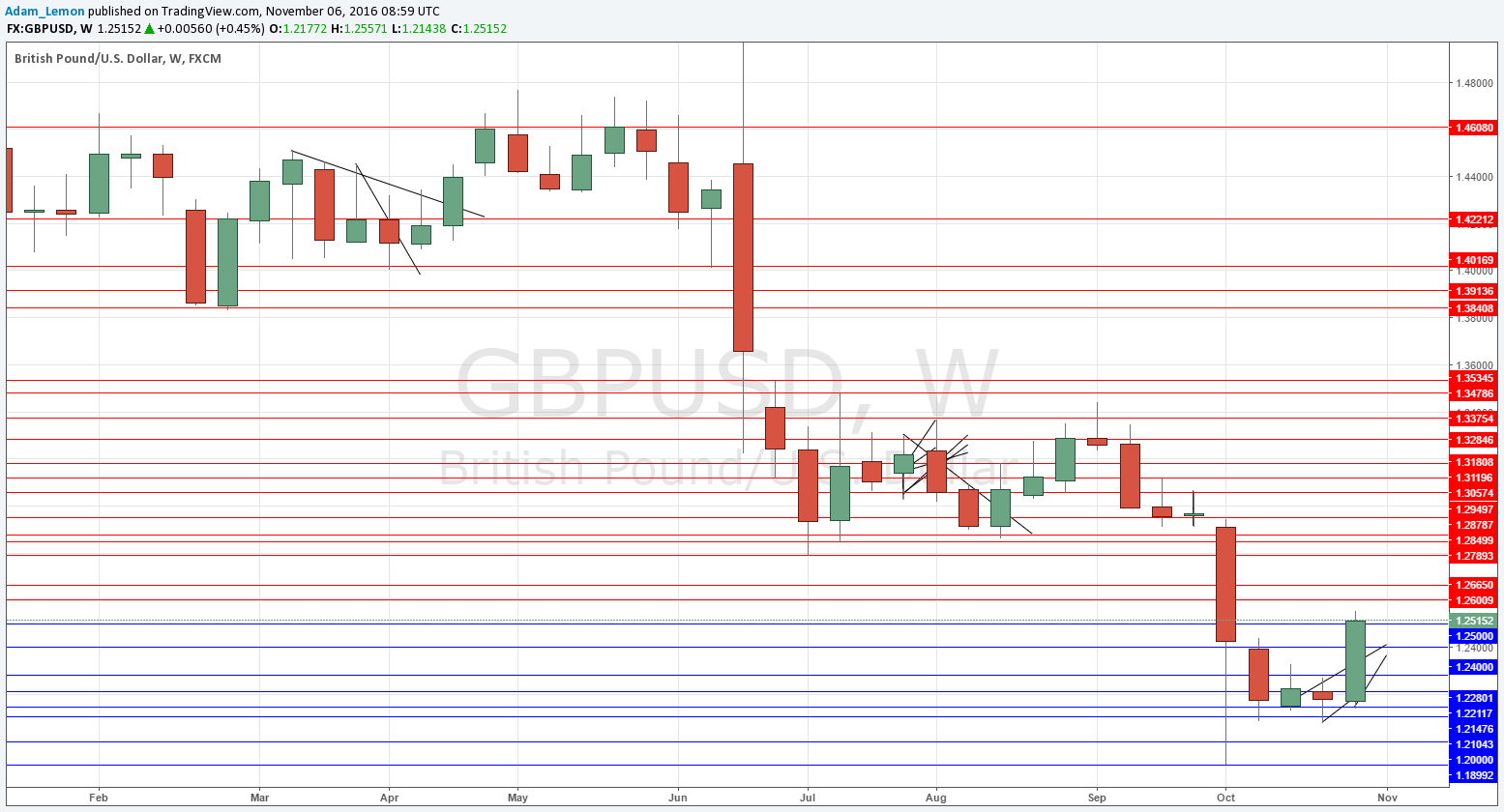

GBP/USD

The British Pound had its best-performing week since February, and the U.S. Dollar was weak on Trump’s improving poll numbers, so this pair produced a strongly bullish candle this week. The price has been making 1 month highs.

There is certainly a long-term downwards trend, and as the U.S. Dollar is likely to pick up when the U.S. election results become clear (provided they favor Clinton), this pair will probably not be the best pair to use to take advantage of any continuing strength in the British Pound.

Conclusion

Bullish on the USD and British Pound, bearish on the Canadian Dollar.