The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 27th November 2016

Last week, I predicted that the best trades for this week were likely to be long USD against the JPY, AUD, CHF and EUR. The average result of these trades was positive but at only 0.22%. The result was dragged down by the strong performance of the AUD, and the USD performed best against the JPY which is the weakest of all the major currencies right now.

The Forex market seems to be moving into a less predictable mode now, with some signs that the strong rally in the USD since 8th November is beginning to run out of steam.

I therefore suggest that the best trades this week are likely to be long USD, GBP and AUD against the Japanese Yen.

Fundamental Analysis & Market Sentiment

Fundamental factors are playing a role right now but are difficult to explain fully. What is becoming increasingly clear is that Trump will need to try to deliver on his promise of generating jobs for lower-skilled Americans, and the logically easiest way to achieve that will be federal spending on infrastructure projects. This is boosting the American stock market overall, led by companies that will logically stand to gain from the range of Trump’s known policy positions. As money flows into America to buy American stocks, so the U.S. Dollar is bought and rises in value.

Overall, sentiment is still bullish on the USD, but it may be that other currencies start to lead the pack.

Sentiment is weak on “haven” currencies such as the Japanese Yen, Swiss Franc and precious metals.

The Australian Dollar and British Pound are showing some surprising resilience. It is hard to find good reasons for these movements, except in the case of the British Pound it may be that the growing political push back against Brexit is raising some hopes that it may be watered down or even abandoned somehow.

Technical Analysis

USDX

The U.S. Dollar has made a new all-time high this week, which is always a bullish sign. However, this week’s candle is a doji, which indicates a possible retracement, so some caution is advisable.

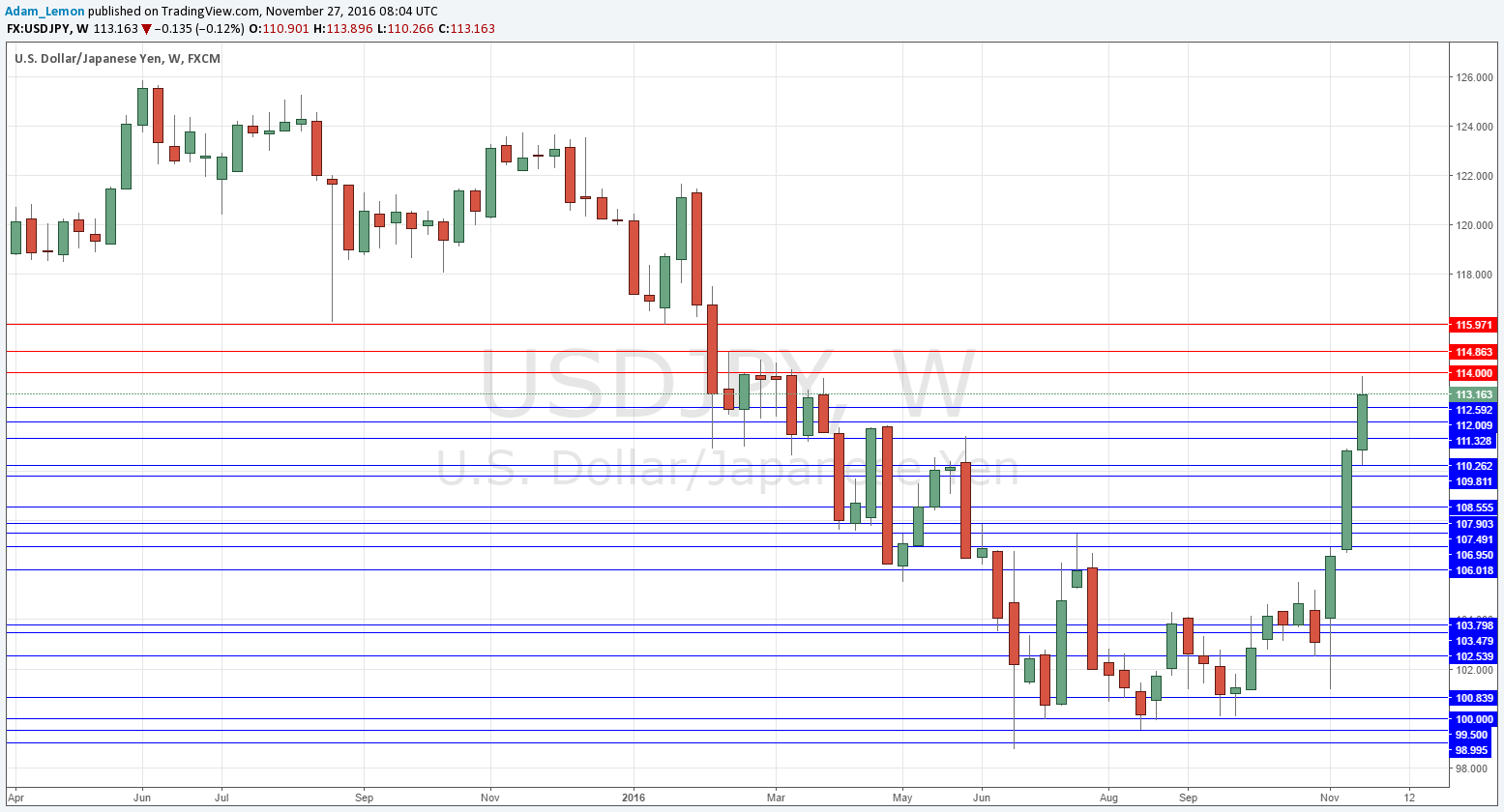

USD/JPY

The strongest mover of the week of all the major pairs, rising by a total of a little more than 2% in value. This pair is still at the heart of the Forex market but it may be that Yen weakness is taking over from U.S. Dollar dominance. There is reason for a little caution as we can expect strong resistance at 114.00, as shown in the chart below. Overall, though, still a bullish outlook.

AUD/JPY

This cross saw an even stronger rise than USD/JPY. It looks as if it has the momentum to reach the 86.00 area so overall, a bullish outlook.

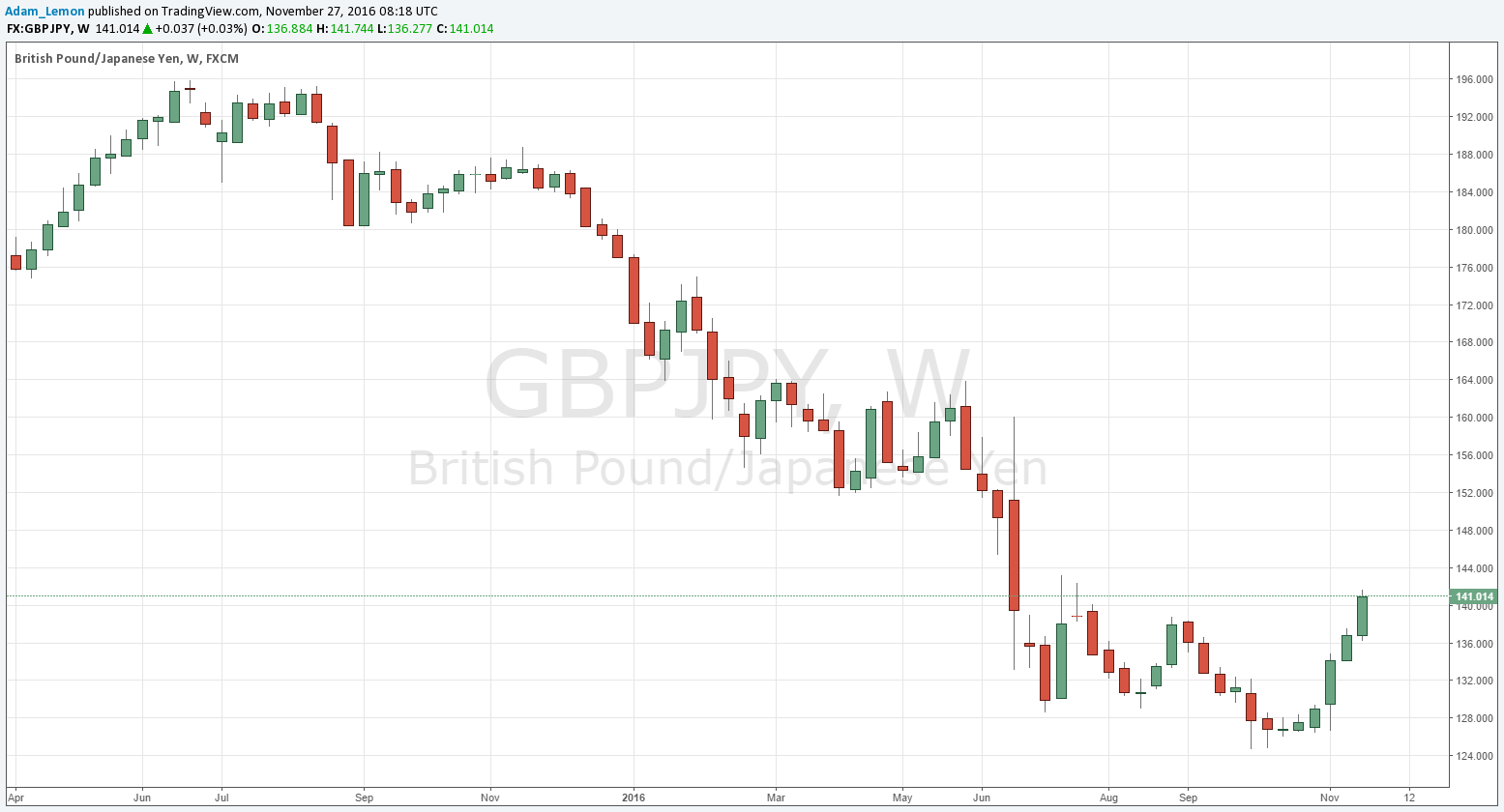

GBP/JPY

This cross saw an even stronger rise than USD/JPY. The problem with the British Pound however is that it seems to be facing very strong resistance against the USD at 1.2500 which may hold it back from rising much more strongly here, at least over the near term. The Pound is also prone to political instability due to Brexit, although this can work in both directions.

Conclusion

Bullish on the U.S. Dollar, Australian Dollar and British Pound, bearish on the Japanese Yen.