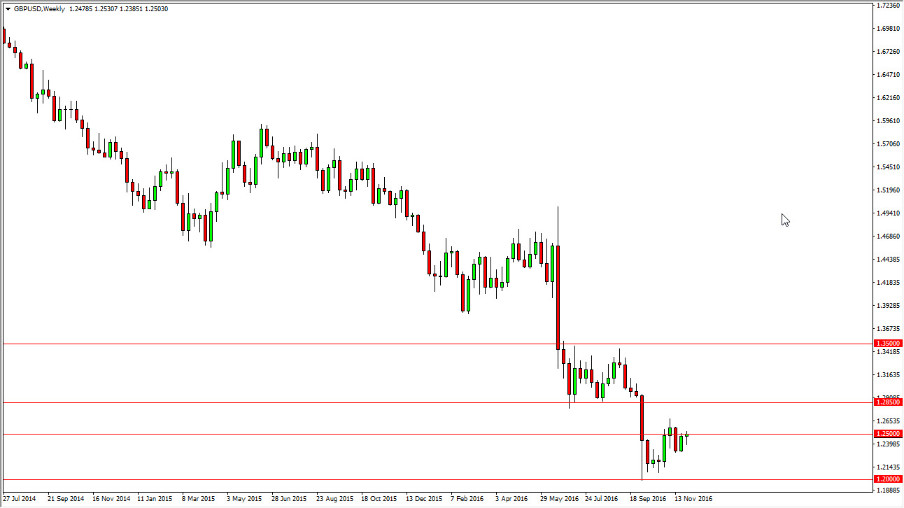

The GBP/USD pair continues to go sideways overall, as the last couple of weeks has shown. However, I think it’s only a matter of time before we get some type of move. I think that the beginning of the month could be a bit positive for the British pound, but I see a bit of a ceiling at the 1.2850 level. Ultimately, I think it’s much easier to sell this market been buying it, so with this being the case IE and waiting to see signs of exhaustion that I can take advantage of. The British pound should continue to be soft in general, as the exit vote still has a lot of people concerned.

Federal Reserve

Another thing that you have to keep in mind is that the Federal Reserve is likely to raise interest rates in December, and possibly even farther down the road. A lot is going to ride on the statement the comes out after the interest-rate hike in December, and whether or not it suggests that the Federal Reserve is going to become more aggressive. If that’s the case, this continues downwards as far as I can see and we will more than likely test the 1.20 level. If we can break below there it will be very negative for this market, and send it down to the 1.15 level which is a massive support level on the longer-term monthly charts. Rallies at this point I think you’re still going to have to deal with a lot of headwinds, so quite frankly there’s no desire on my part to buy this pair for any real length of time. I believe it’s going to be easier to continue to sell and sell again, but currently it looks as if we need to rally in order to build up downward pressure in a market that may have been a little oversold for the last couple of weeks.