Gold prices settled slightly lower on Wednesday after swinging between gains and losses as investors moved to the sidelines ahead of an appearance by Federal Reserve chair Janet Yellen in front of a congressional committee. Her remarks could provide insight into whether the Fed will raise interest rates next month as expected.

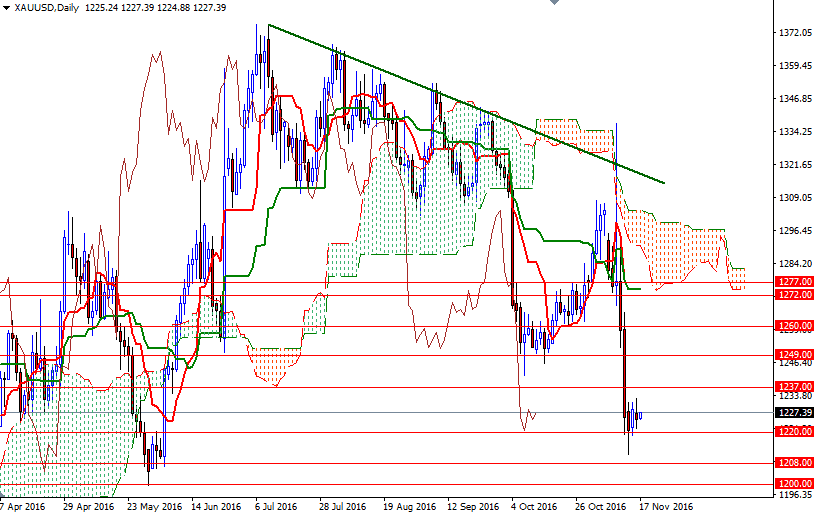

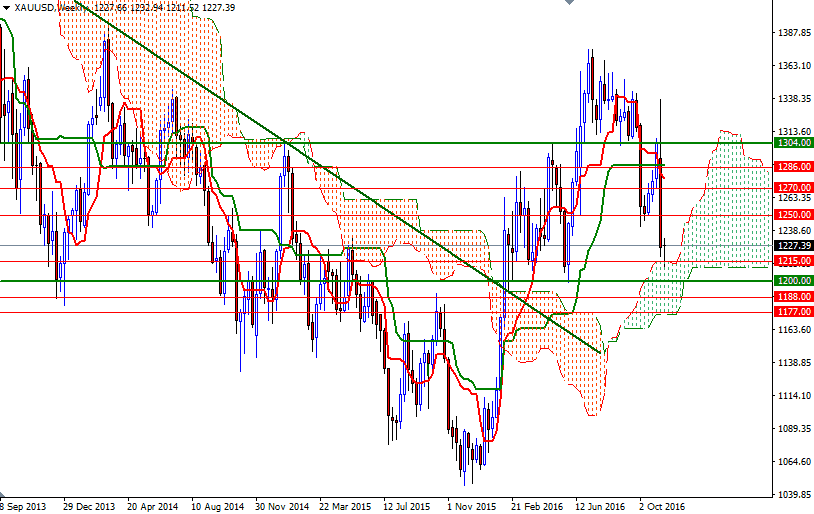

After last week's sharp drop the market has been locked in a narrow range. Prices are below the Ichimoku clouds on the daily and 4-hourly charts, plus we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on the weekly and 4-hourly charts - suggesting that the downside risks remain. However, as you can see on the weekly chart, the area between the 1215 and 1177 levels is occupied by the cloud so it will play an important role going forward.

Technically speaking, the Ichimoku cloud indicates an area of support (or resistance depending on its location) and thickness of the cloud is relevant, as it is more difficult for prices to break through a thick cloud than a thin cloud. With that in mind, I think the XAU/USD pair will have to either break through the 1237 resistance and move towards 1250/49 or drop below the 1220 level and start a journey to the 1200-1199 area. On its way down, support may be found at around the 1215 level and in the 1210/08 zone. If XAU/USD convincingly penetrates 1237, then 1243/0 will be the next stop. The 1250/49 area is the key resistance for the bulls to eliminate so that they can challenge the bears on the 1262/0 battle field.