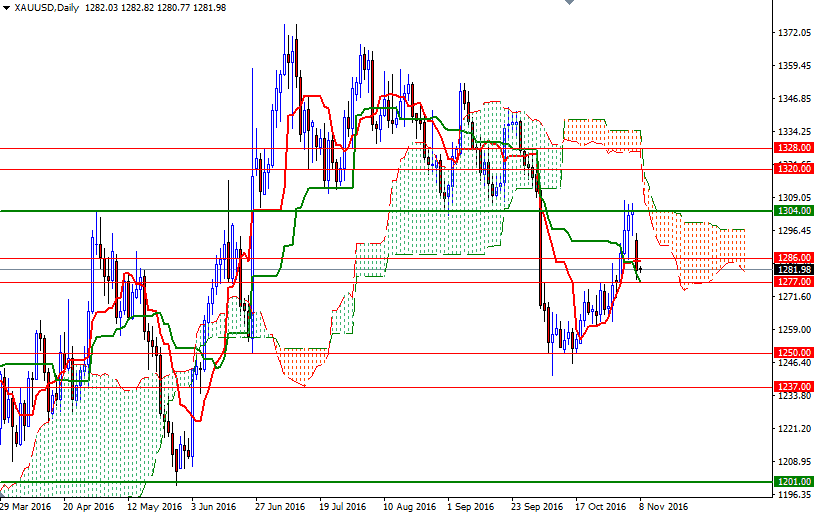

Gold prices ended Monday’s session down 0.89%, or $11.57, to settle at $1281.31 an ounce as investors rushed back into U.S. stocks and the dollar strengthened after the FBI said it had found no new evidence against Hillary Clinton. The XAU/USD pair had traded as high as $1307.91 last week on safe-haven buying as Donald Trump gained against Hillary Clinton in the polls. Aside from signs of stabilization in the markets, investors are growing more confident that the Federal Reserve will raise interest rates at its next policy meeting.

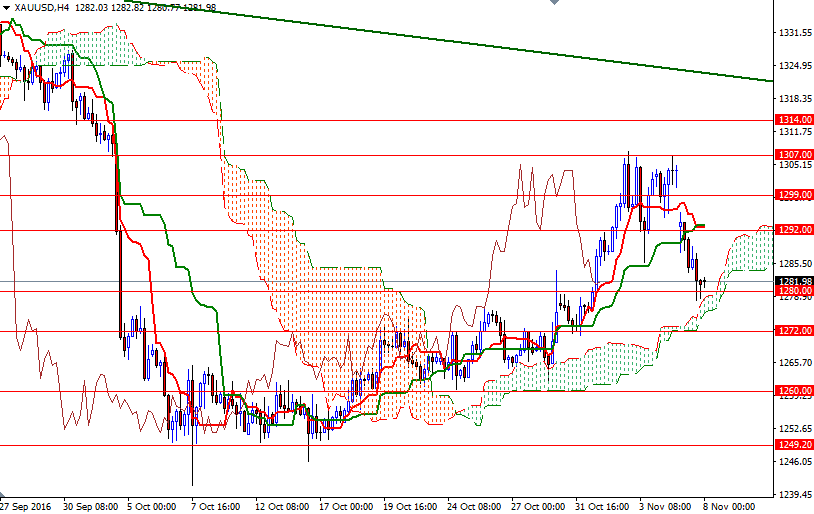

Last week’s positive U.S. data increased expectations that the Federal Reserve will deliver a rate hike in December. XAU/USD is trapped in a narrow range so far today. The fall was eventually halted in the 1280/77 region which now stands out as obvious resistance flipped to support. This area is also occupied by the Ichimoku cloud on the 4-hour chart so we need to get down below there in order to continue to the downside.

If the bears can successfully drag prices below 1277, then it is likely that the market will visit 1272/0 afterwards. Falling through this support may pull the market back to the 1260 region. A daily close below the key support at 1260 could see a fall all the way down to 1250/49. On the other hand, if the 4-hourly cloud continues to act as an effective support and prices start to rise, the market will have a tendency to visit the 1286 level. The market has to push through 1286 in order to approach the next barrier sitting in the 1292/0 zone. Penetrating this barrier could foreshadow a move towards 1300-1299. Once beyond that, the bulls will be aiming for 1307/4.