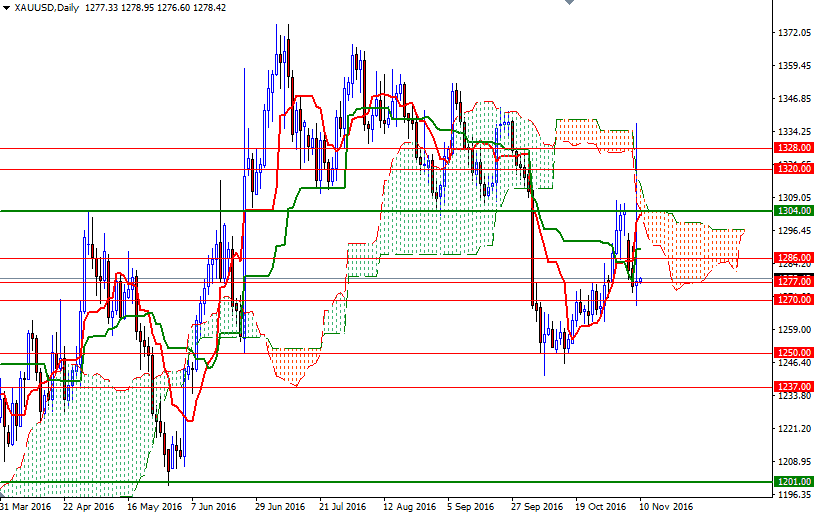

Although safe-haven bids pushed up gold prices to their highest level since September 27, the market erased gains as global stock markets recovered and investors digested Donald Trump's surprise victory, leaving a tall upper shadow on the daily candle. The dollar recouped losses after market participants turned their attention to a possible Fed rate hike, which is expected to happen next month. The XAU/USD pair is currently trading at $1278.42, slightly lower than the opening price of $1277.33.

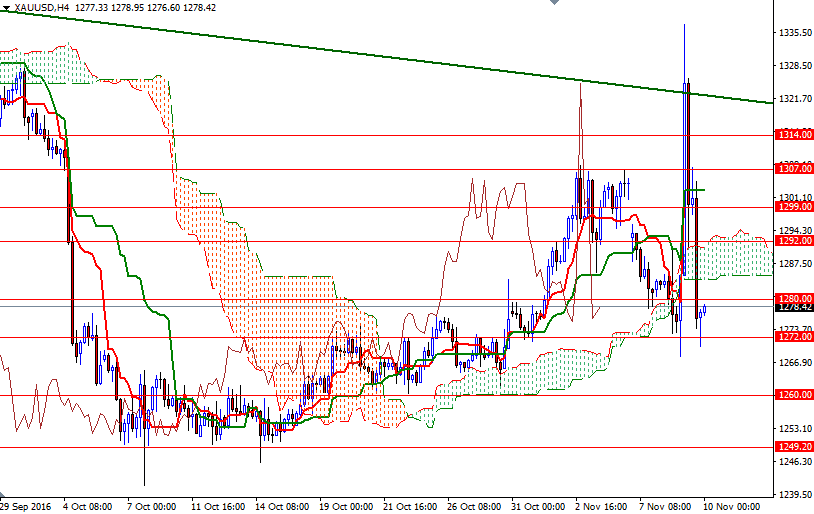

From a technical perspective, there are two things catch my attention at first glance. Firstly, yesterday's price action dragged prices back below the Ichimoku cloud on the 4-hour time frame, putting the daily and 4-hourly chart in the same direction. Secondly, the market found some support in the 1272/0 zone. With that in mind, it wouldn't be surprising to see an attempt towards the 1292/86 area occupied by the 4-hourly cloud. These clouds not only identify the trend but also define support and resistance zones. Therefore, expect this region to be resistive.

That means, if the bulls intend to take the reins, they will have to push the market beyond the 1292 level first. Technically, breaking above 1292 could signal a run up to 1300-1299. If the bulls capture this strategic camp, they probably will find another chance to test the 1307/4 area. However, if the bears increase downward pressure and prices drop through 1272/0, then the 1260 level could be the next stop. Closing below 1260 would suggest that the bears are getting ready to tackle 1250-1249.20.