Gold prices settled at $1209.08 an ounce on Friday, suffering a loss of 1.51% on the week, as renewed risk appetite and strong demand for the greenback continued to weigh on the market. The outlook for the dollar remained upbeat on the back of encouraging U.S. economic data. Federal Reserve Chair Janet Yellen’s testimony on the economic outlook to Congress, along with hawkish comments from several Fed officials, bolstered the case for an increase in the federal funds rate next month. "...holding the federal funds rate at its current level for too long could also encourage excessive risk-taking and ultimately undermine financial stability" Yellen said.

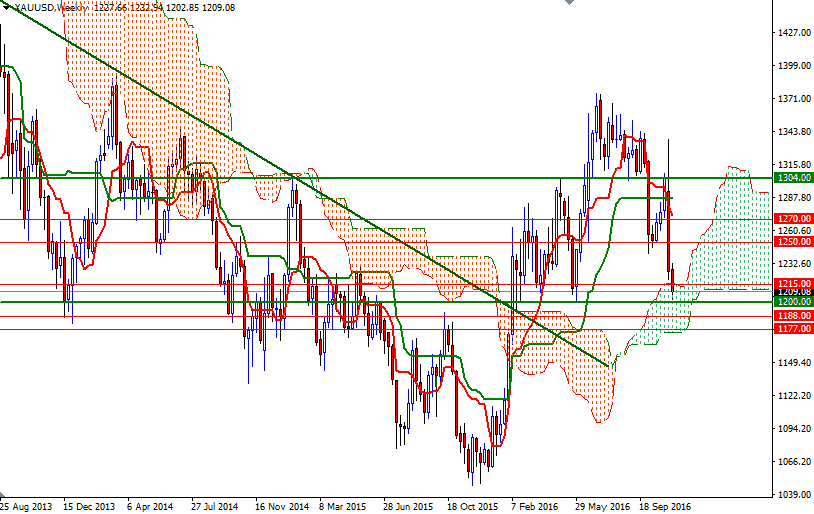

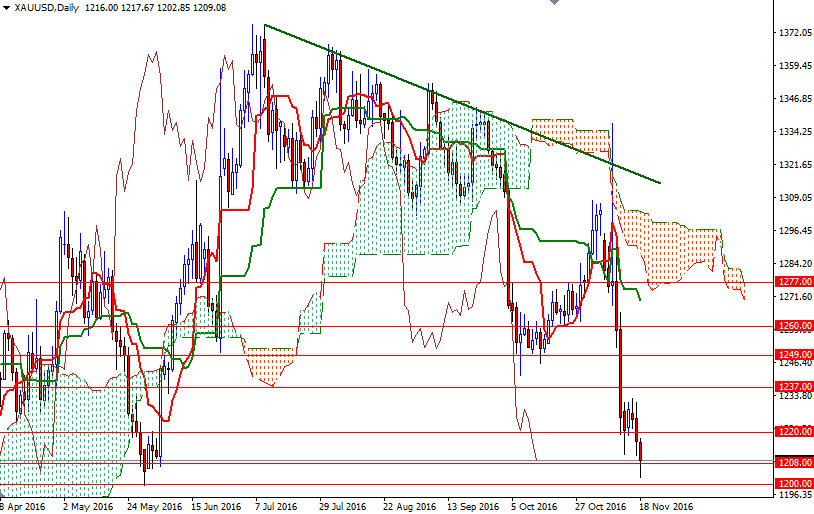

Although Yellen didn’t guarantee a policy tightening in December, federal funds futures contracts already imply a greater than 85% chance of a quarter-point hike. The latest data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold (first advance in seven weeks) to 177660 contracts, from 212238 a week earlier. Speaking strictly based on the charts, the short-term charts remain bearish, with the market trading below the daily and 4-hourly Ichimoku clouds. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned.

Last week, breaking down below the 1220 level started a journey towards the 1200-1197 area as anticipated and I think these two will be keys in the near term. The XAU/USD pair will have to either break through the 1222/0 resistance and march towards 1237 or drop below the 1200-1197 support and retreat towards the 1177/5 area. On its way up, expect to see resistance in the 1230/28 zone. Penetrating the 1237 level where the bottom of the cloud sits on the H4 chart would suggest that the bulls will be aiming for 1243/0 afterwards. The real challenge will be waiting the bulls at around the 1250 level. If the market falls through 1200-1197, then the 1189/6 zone will probably be the next stop. The bears will have to drag prices below the bottom of the weekly cloud in order to set sail for 1171/69.