Gold ended the week down $23.73 at $1183.97 as the latest batch of U.S. economic data continued to support views the Federal Reserve will raise interest rates in December. “Some participants noted that recent committee communications were consistent with an increase in the target range for the federal funds rate in the near term or argued that to preserve credibility, such an increase should occur at the next meeting,” according to the minutes of the Federal Reserve's November 1-2 meeting. The greenback was also boosted by weakness in the euro, which hit its lowest level since December 2015. Since midsummer, the market has been reacting to expectations of a rate hike before the end of the year and now investors see an increase in borrowing costs in December as a certainty.

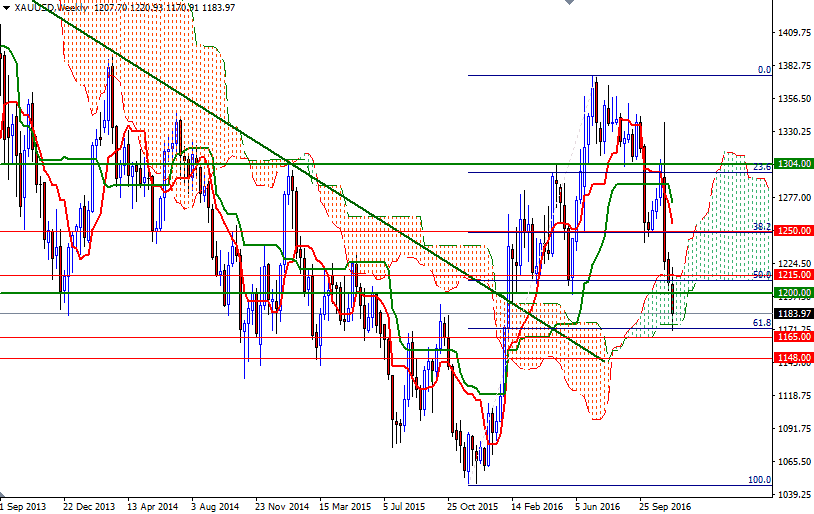

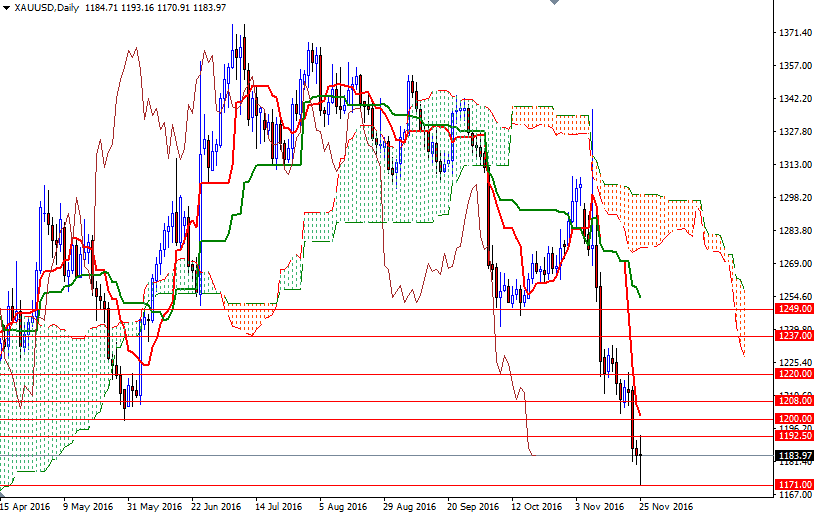

Gold's drivers will remain the same going forward: the pace of future rate increases, the strength of the dollar and overall performance of the U.S. stock markets. The short-term outlook is bearish at the moment, with the market trading below the Ichimoku clouds on the daily and 4-hourly charts. In addition to that we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. However, the market is within the borders of the weekly Ichimoku cloud and this (along with Friday's candle which left a long lower shadow) suggest that the XAU/USD pair will tend towards consolidation.

That said, I will maintain a neutral bias in the near-term pending a rally towards the resistance at 1215 or a break below the strategic support in the range between 1171 and 1169. If the 1171/69 support is broken, then 1165/0 area will probably be the next port of call. The bears will have to penetrate this key support so that they can have a chance to make an assault on the 1151/48 zone. To the upside, XAU/USD has to push its way through the 1192.50 resistance zone in order to gain momentum and tackle the 1120-1197 barrier. If the market can cleanly break above the 1200 level, we could see a bullish run targeting 1205 and possibly 1210/08. Once beyond 1210, look for further upside with 1215 and 1220 as targets.