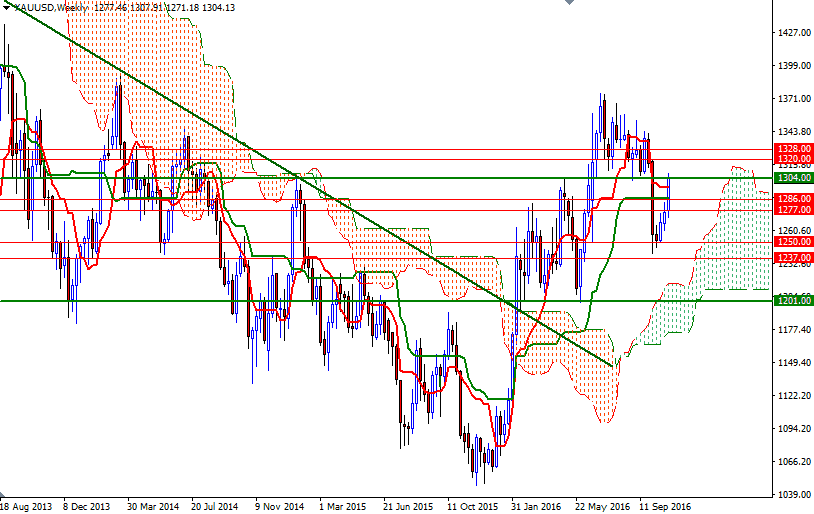

Gold ended the week up $26.67 at $1304.13, as a weaker dollar, sagging risk appetite and intensifying worries over the outcome of Tuesday's presidential election helped lure buyers back into the market. The XAU/USD pair initially tested the $1272/0 area but found enough support to reverse and broke through a key resistance at $1286. As a result, the market reached the $1307/4 zone. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 215131 contracts, from 196980 a week earlier

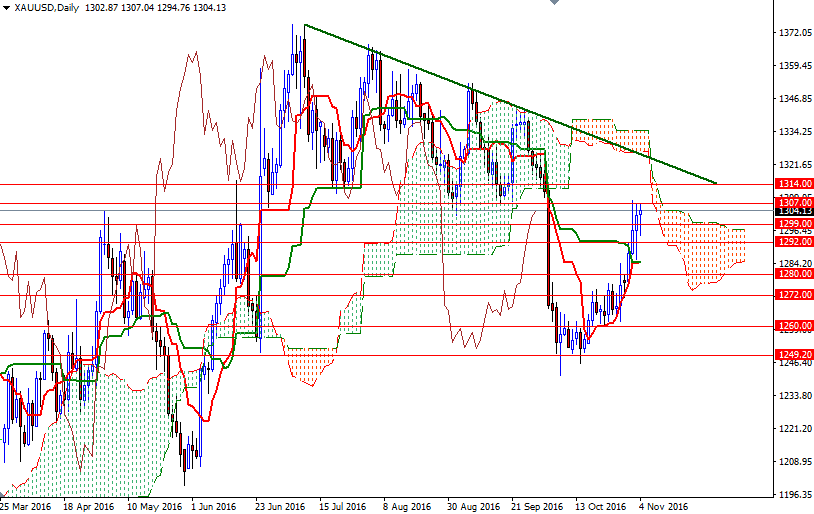

The Federal Reserve kept interest rates unchanged last week but signaled it could raise borrowing costs in December if the economy remains on track. Although the recent batch of economic data supports expectations for a rate hike next month, the focus remains on an increasingly uncertain race for the White House. Technically speaking, the weekly and 4-hourly charts are bullish while the XAU/USD pair is trading above the Ichimoku clouds. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are positively aligned and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices on both charts.

However, as I pointed out last week, the potential upside is likely to be limited until the key 1307/4 resistance area (a former support that held the market up during the summer) is convincingly broken. A break up above 1307 would open a path to 1314. Beyond that the first solid resistance is located in the 1323/0 zone where the daily cloud and a descending line coincide. If XAU/USD passes through 1323, then the 1328 level could be the next port of call. On the other hand, a failure to climb beyond the daily cloud could increase the downward pressure and pave the way for a test of the 1292/0 zone. If this support is broken, then the 1286/5 area probably will be the next stop. Closing below 1285 would suggest that the bears are getting ready to tackle 1280. Once below that the market will be targeting 1272/0.