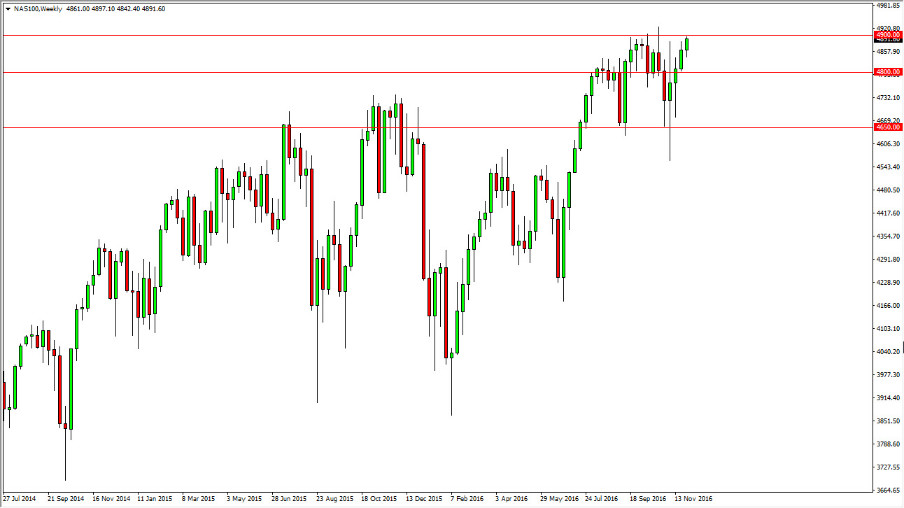

The NASDAQ 100 has been very bullish of the last several weeks, slamming into the 4900 level at the end of the month of November. This market is a bit of a laggard though, as US indices all look very positive. Most of them have either broken out to the upside, or getting ready to announce where we find the NASDAQ 100. One of the reasons I think we are struggling a bit here is that the NASDAQ 100 is highly reliant on foreign sales. Because of this, it might have a little bit of the concern when it comes to whether customers will be willing to buy technology, but at the end of the day US indices in general continue to show quite a bit of overall bullish pressure, and that should continue over in this market.

Laggard offering value?

Is possible that this market will offer value as it has been a laggard and once the buying frenzy picks up in the S&P 500 and Dow Jones 30, we could find yourselves watching this market go much higher as all things American get snapped up. Given enough time, I think that’s what happens and I believe that a daily close above the 4900 level would send this market to the 5000 handle. It’s possible that we may find the market pulling back first, but that should only offer more value going forward, and probably attract more people as the markets certainly know by now that the upside Yellen way to go. As we pullback, and gives us an opportunity to get involved in a market that we may have missed. That’s the theory at least, and that’s how I’m going to trade this market.

I have no interest whatsoever in selling, and quite frankly can’t even make an argument for it until we break down below the 4650 handle, something that isn’t going to happen anytime soon.