NZD/USD Signal Update

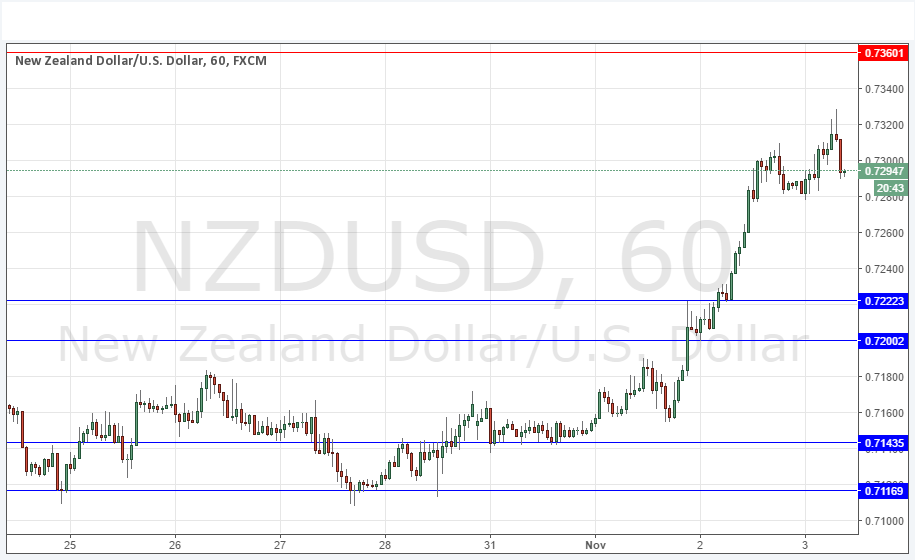

Yesterday’s signals were not triggered as the bearish price action took place a little way above the identified resistance level at 0.7300.

Today’s NZD/USD Signals

Risk 0.75%

Trades may only be entered between 8am New York time and 5pm Tokyo time, over the next 24-hour period.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7222.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7360.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

NZD/USD Analysis

I wrote up a bullish outlook for this pair yesterday and over the course of the day, it was the strongest bullish mover (NZD bullish against the USD). It is significant that the price managed to rise above the resistance at 0.7300 even though it back below there now.

If the USD remains weak, I see no reason why this pair will not continue to rise strongly.

There is nothing due today regarding the NZD. Concerning the USD, there will be a release of Unemployment Claims data at 12:30pm London time followed by ISM Non-Manufacturing PMI at 2pm.