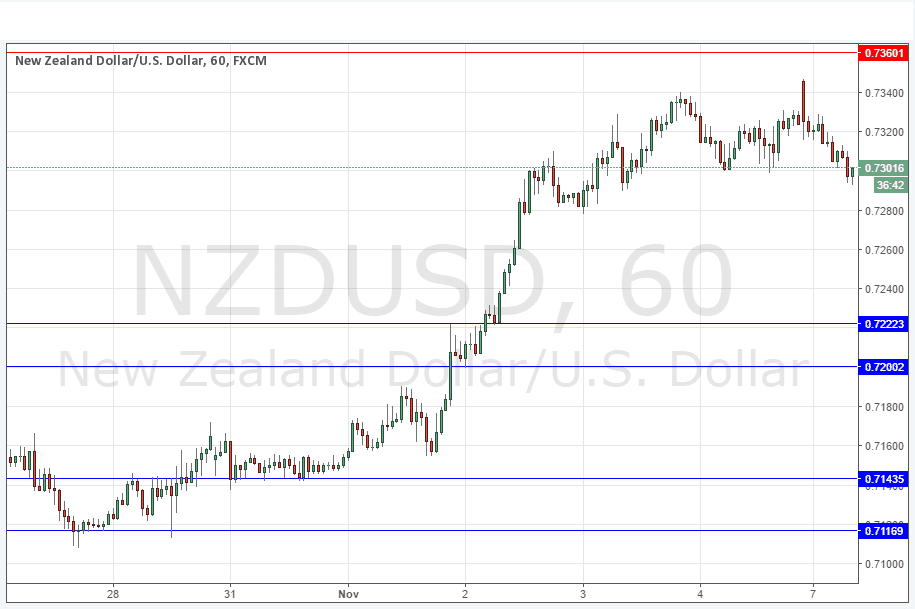

NZD/USD Signal Update

Last Thursday’s signals were not triggered as none of the key levels were ever reached.

Today’s NZD/USD Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time, during the next 24-hour period only.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7222.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7360.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

This pair has moved in line with the strengthening of the U.S. Dollar since the weekly open some hours ago, showing that the NZD is weaker than its sister currency the AUD.

It looks as if there is a lot of selling the closer the price gets to 0.7360, so another rise to that area might prompt a big sell-off.

It is likely that the market movements over the next 48 hours will be driven entirely by the American Presidential election, although there will be a key release from New Zealand’s central bank on Wednesday. Until then, the better opportunities are probably going to arise in other currency pairs.

There is nothing due today regarding either the NZD or the USD.