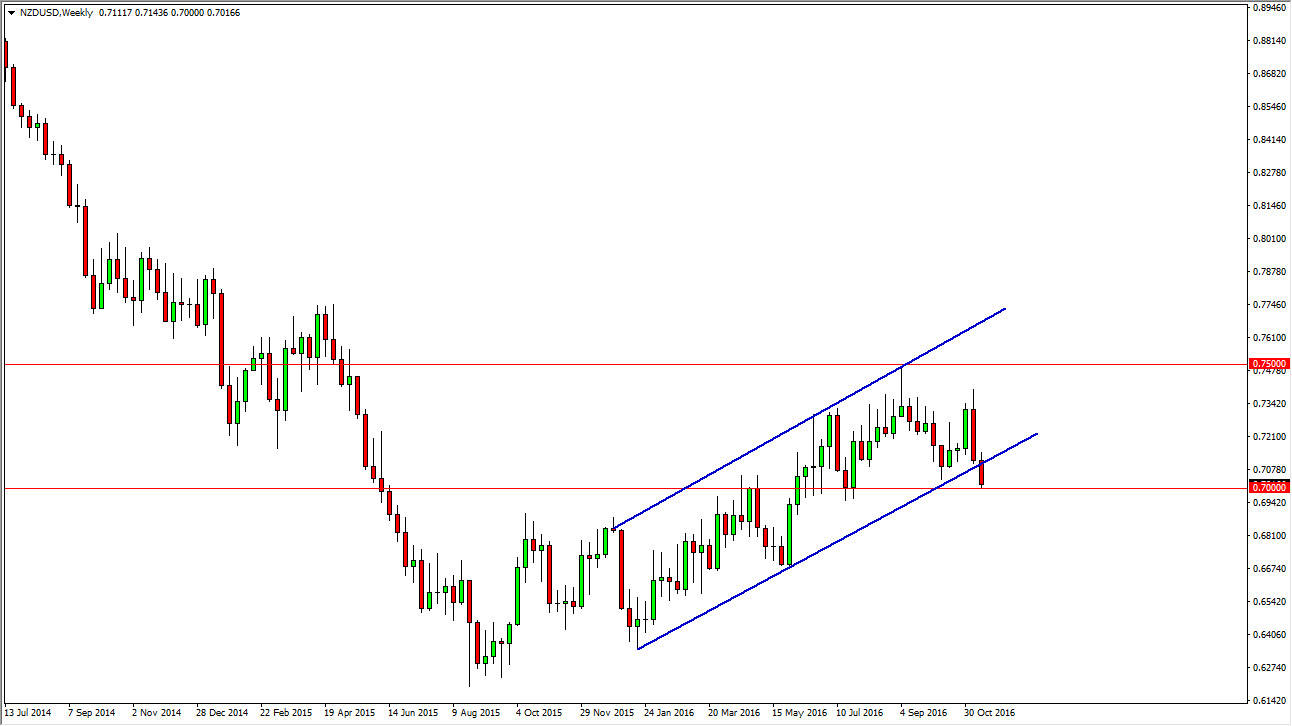

The NZD/USD pair rallied rather significantly during the month of October, and now finds itself above the 0.72 handle. This is an area that has been quite interesting for the markets, and now that we’ve gotten above and I think that there is no reason to suspect that we won’t be able to continue to grind higher. The 0.75 level above was massively resistive previously, mainly because it is the 50% Fibonacci retracement level from the massive move lower starting in August 2014.

We ended up forming a shooting star that level, and have pullback quite nicely but you can also see that there was an uptrend line that held its ground, and it now appears that we are ready to continue going higher. I don’t necessarily think that we’re going to have an easy move higher, but I think that the buyers will continue to have quite a bit of momentum in their favor.

Commodity markets

You do have to keep in mind the commodity markets are highly influential on the New Zealand dollar in general, as they tend to push the Kiwi dollar in general. It’s not necessarily in particular market, it’s just the general “attitude” of those markets. At this point, I think that pullbacks will continue to offer buying opportunities, and we will more than likely see a bullish move but with quite a bit of choppiness, and probably based upon short-term charts more than anything else.

I don’t have any interest in selling this market, at least not until we break down below the bottom of the uptrend line, or perhaps if we see an exhaustive candle near the 0.75 handle. That is an area that should continue to cause quite a bit of selling pressure, so I don’t necessarily think that we are going to break above there anytime soon. Given enough time, it’s likely that the market must decide what it wants to do in that area, but I don’t think it happens this month.