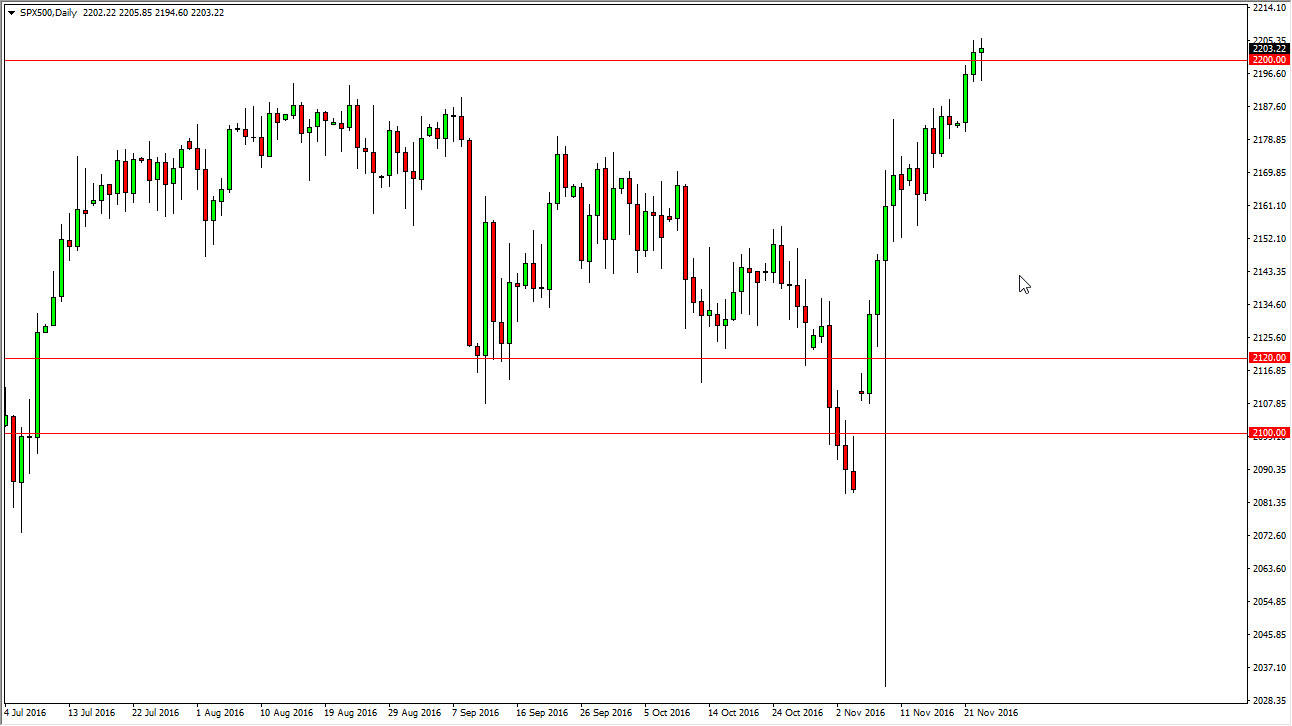

S&P 500

The S&P 500 fell initially on Wednesday, but turned around to form a hammer. The hammer of course ended up forming a bullish candle sitting right at the 2200 level suggesting that were going to go much higher. A break above the top of the hammer would send this market looking for the 2300 level as far as I can see, and I also believe that we will continue to go even higher. We could pull back towards the 2180 handle as well, and at that point I feel that it’s only a matter time for the buyers involved in the way. After all, the US indices continue to be very strong, and of course it seems as if the recent move only solidifies that we are going to continue to see buyers enter the market based upon the surprise election of Donald Trump as well.

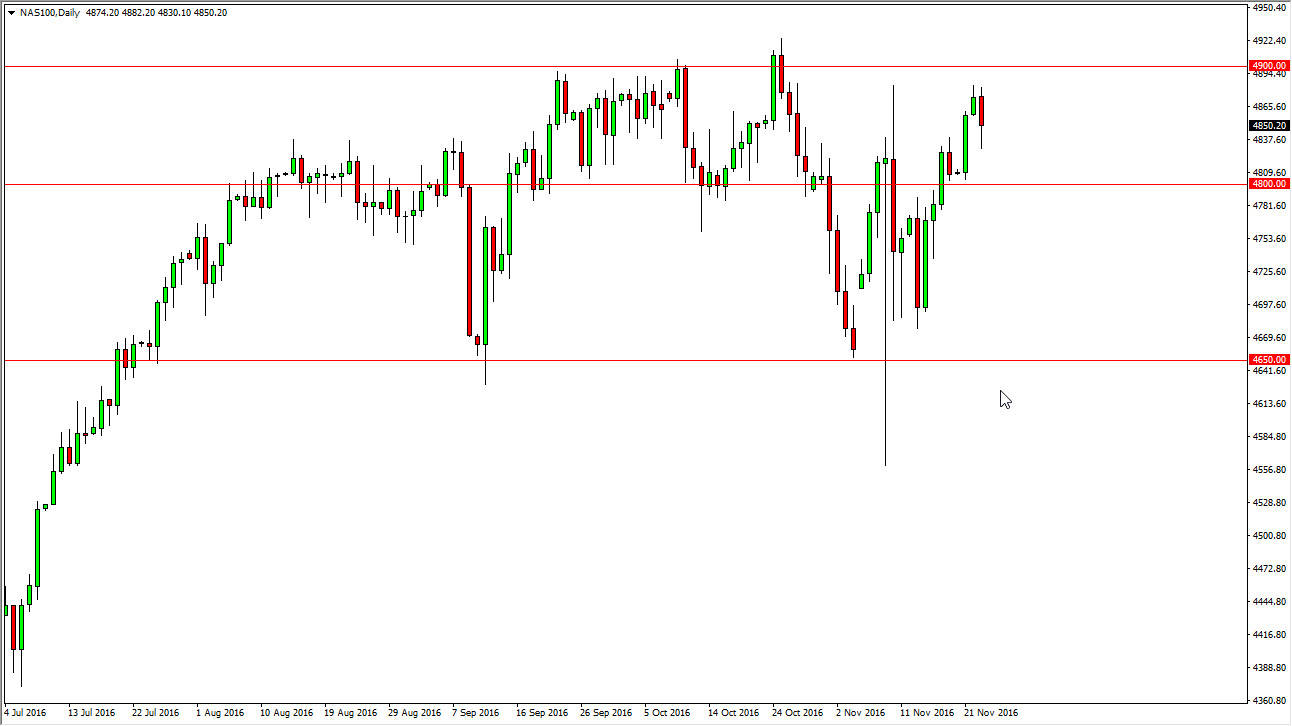

NASDAQ 100

The NASDAQ 100 fell slightly during the session on Wednesday, testing lower levels but then bouncing by the end of the day. Because of this, I think there is an argument to be made that buyers will return every time we dipped, and I believe that the 4800 level below should continue to be supportive. I think that the bounce should send the market looking for the 4900 level above which is resistive. If we can break above there, at that point in time I feel that we will reach towards the 5000 handle.

Ultimately, the 5000 level is the longer-term target that I have had for some time and that certainly has not changed after we’ve seen the recent positivity and US indices overall. I think that the NASDAQ 100 might be a bit of a laggard, but it should follow the S&P 500 and quite frankly the Dow Jones 30 much higher as they continue to rally.