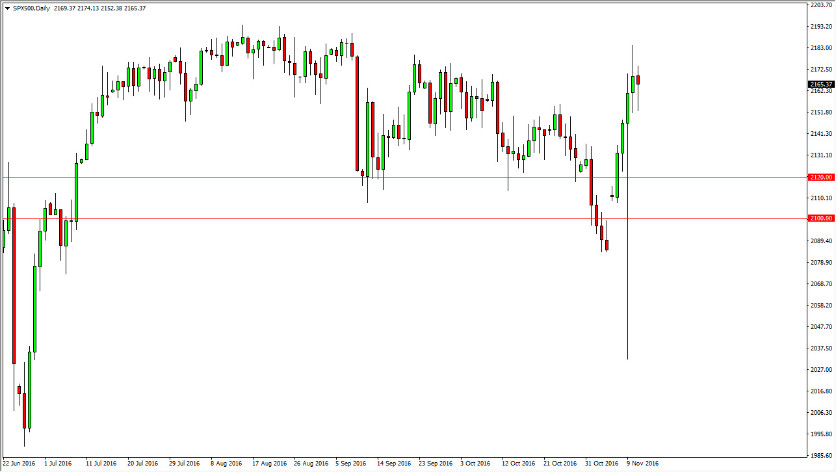

S&P 500

The S&P 500 initially fell on Friday but turned around to form a fairly productive looking hammer. This is a market that obviously has a lot of bullish pressure underneath it, as denoted by the massive Wednesday hammer. I think that there is a huge amount of support below the 2120 handle, and extending all the way down to the 2100 level. Because of this, I am looking at pullbacks as potential buying opportunities, and will use them as such. We should continue to see bullish pressure again and again, and as a result I think that there should be no plans whatsoever on shorting this market. In fact, I believe that we will see quite a bit of bullish pressure over the longer term and I think we will eventually break above the highs.

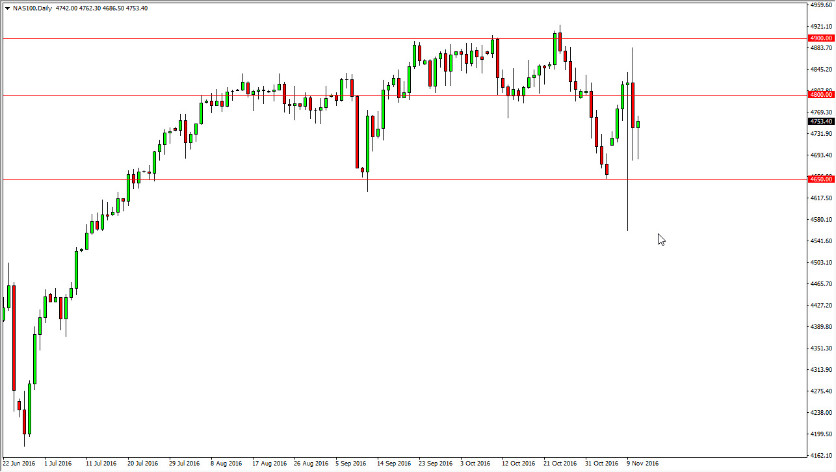

NASDAQ 100

The NASDAQ 100 initially fell but then turned right back around to form a hammer on Friday. This suggests to me that we will see some type of move higher, but I do recognize that the 4800 level above will be resistive. Once we break above there, the market will more than likely try to reach towards the 4900 level past that. A break above that sends this market to the 5000 level but I think it will take quite a bit of momentum and of course time to get there. With this, I am bullish of this market but recognize that it will probably be very volatile. I feel much better about being involved in the S&P 500 or even the Dow Jones 30 at the moment as they both clearly look a bit stronger than the NASDAQ 100. However, I do believe that the NASDAQ 100 will continue higher, just that it will probably be a bit of a laggard when it comes to US indices.