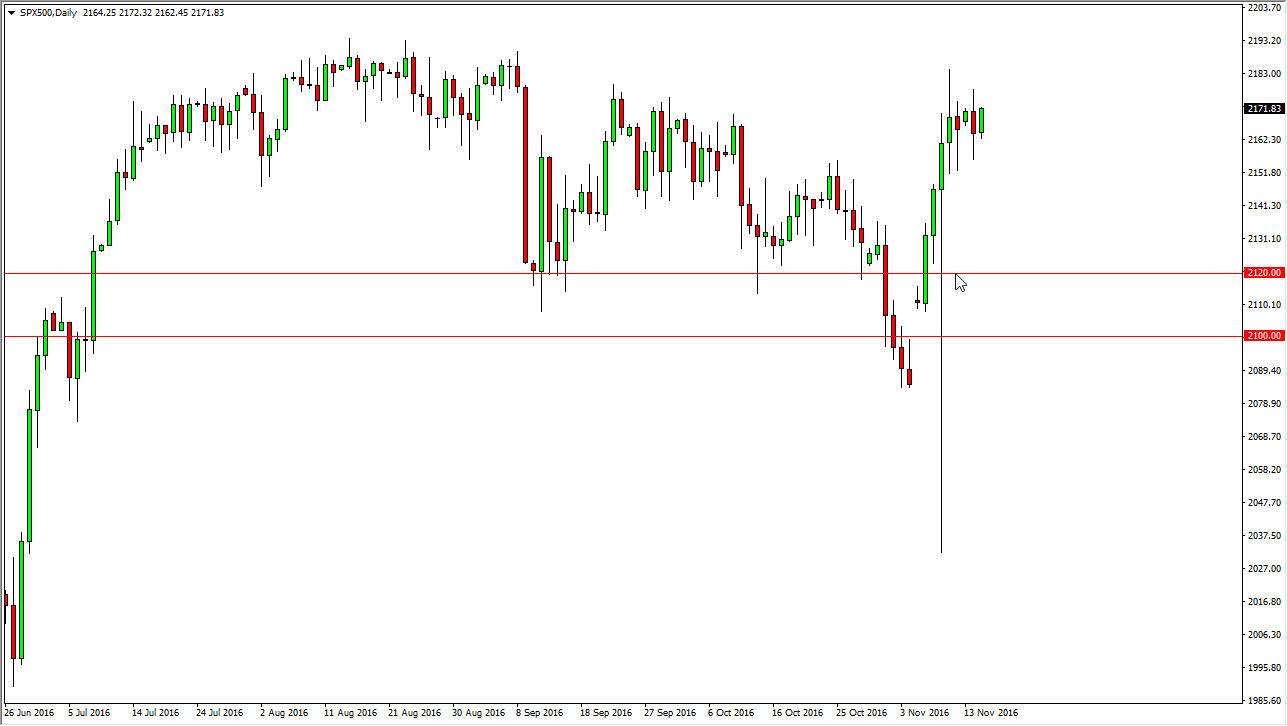

S&P 500

The S&P 500 rally during the day on Tuesday, showing real signs of strength. This is a market that continues to find buyers, and thus every time it falls I’m willing to buy on signs of support. I have no interest in shorting this market and I believe all the way down to the 2120 level we will see plenty of support. Given enough time, I think we break above the 2200 level, and that should send the market looking all the way to the 2500 handle over the longer term. Granted, it’s Take a very long time to reach that area, but in the meantime, I am looking at this as a market that should be bought only and not sold. With this, I remain bullish over the longer term but recognize that we are overbought currently.

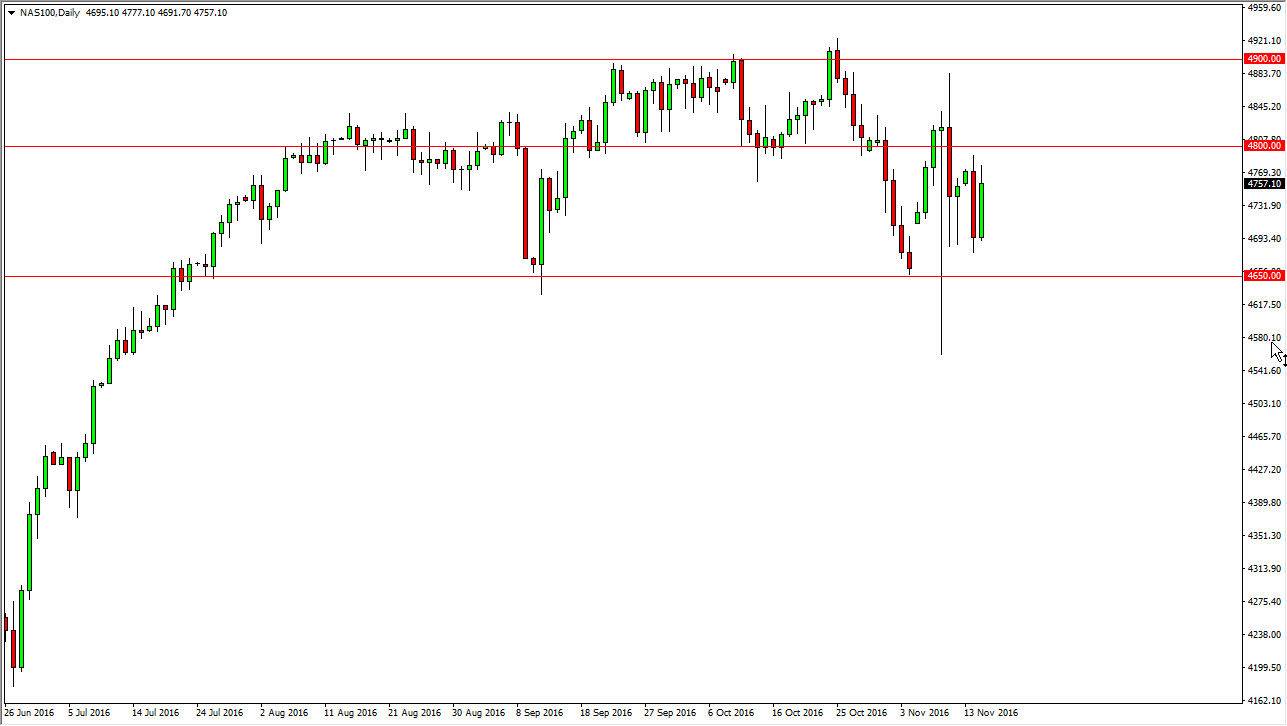

NASDAQ 100

The NASDAQ 100 bounced during the day on Tuesday, as the area continues to see quite a bit of volatility and more importantly, support below. I think that the 4650 level below is massively supportive, and I think given enough time we will break out to the upside. The 4800 level above is resistance, so I think pullbacks may happen between now and a break out above there in order to build up the momentum necessary. However, we break above the 4800 level we could then reach towards the 4900 level next. I still have a long-term target of 5000 for the NASDAQ 100, but with this being the case it’s likely that we continue to bounce around and act very volatile in this market. I believe that the market continues to find plenty of reasons go higher, especially considering the reaction that the market had last week after the initial selloff due to the Donald Trump surprise election.