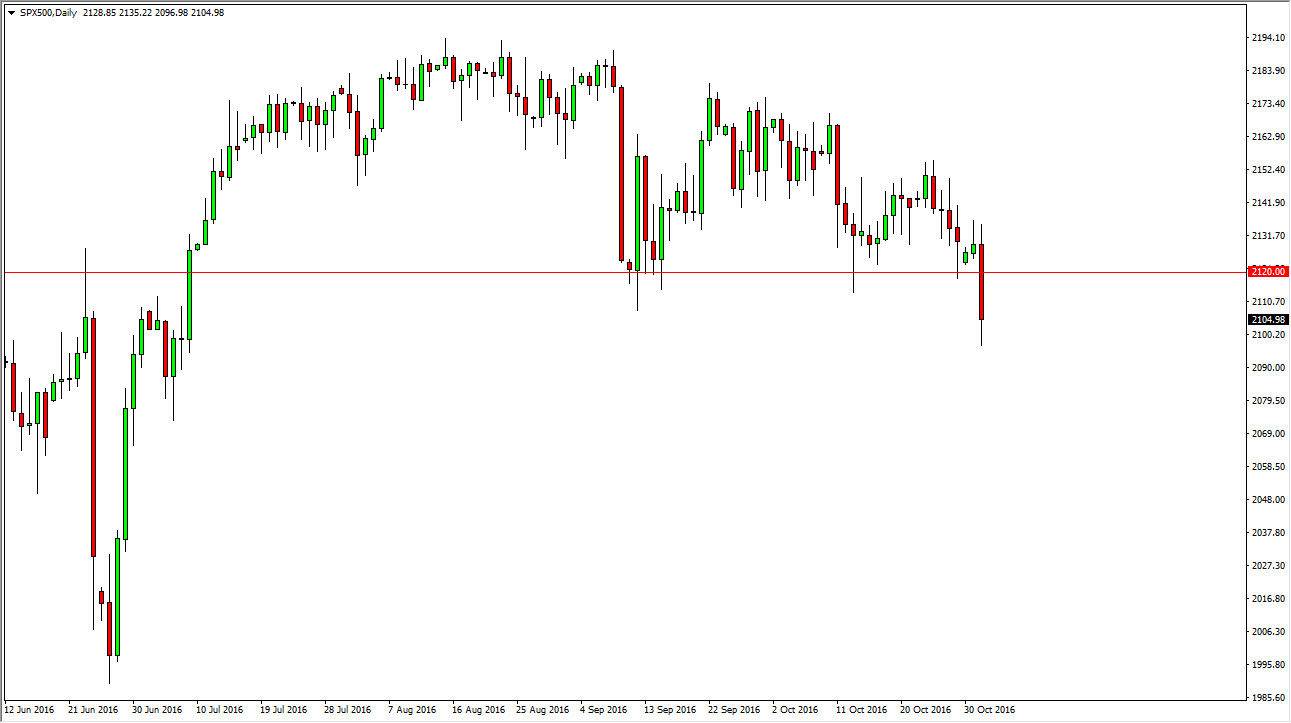

S&P 500

During the day on Tuesday, the S&P 500 broke down significantly during the course of the day on Tuesday, as we have sliced through the 2120 handle. However, we did find a bit of support at the 2100 level as I had suspected previously, so this point in time I feel it’s likely that we may try to bounce from here. Even if we do break down from here, I think that this is a bit of an overreaction to the potential change in the election results in America. A supportive candle would be reason enough to buy, and I would most certainly go long of this market if we can break above the top the shooting star from the Monday session. If we cleared the 2100 level, I think the next level that the market will reach towards is the 2080 level.

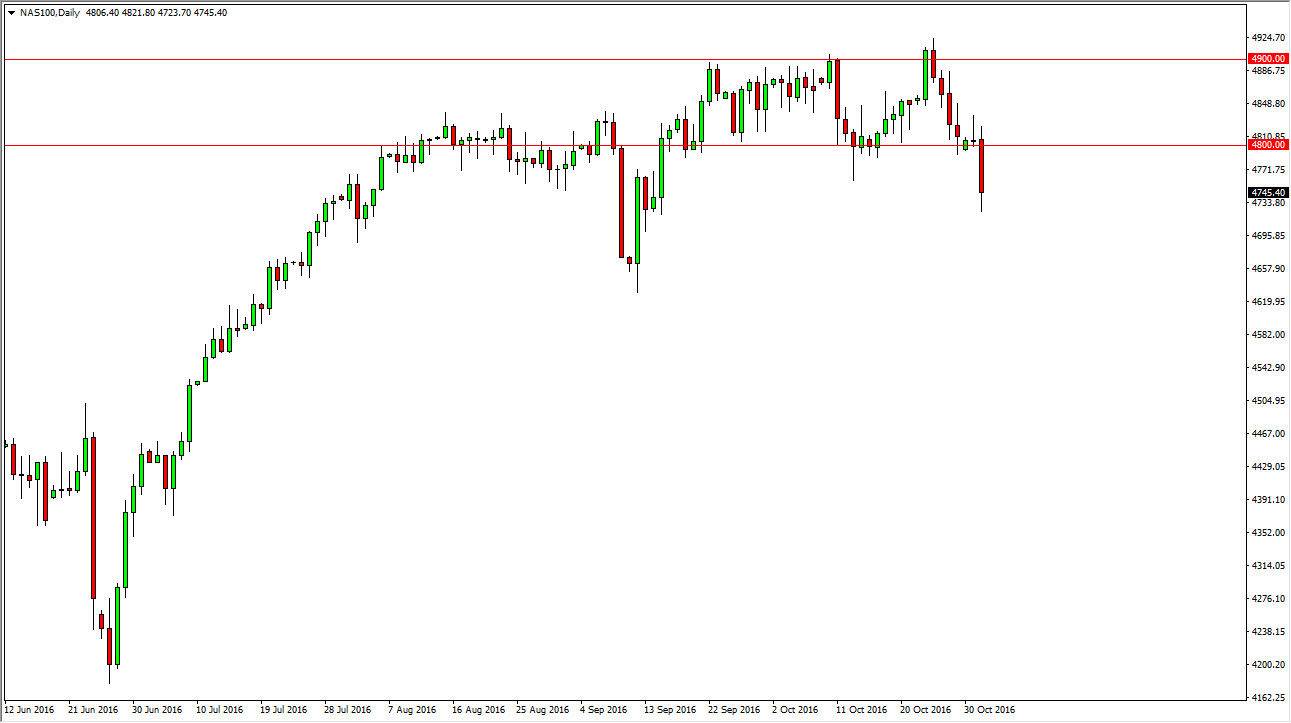

NASDAQ 100

NASDAQ 100 traders initially trying to go long during the day but turned things back around as we crashed through the 4750 handle. This is an area that should be rather supportive, and the fact that we stopped down in this general vicinity late in the day suggests that perhaps the market isn’t quite ready to break apart, but you have to be aware the fact that it could happen. A supportive candle could have the market turning right back around towards the 4800 level. If we can get above there, the next potential resistance barrier will be the top of the shooting star from Monday. If we break above there I feel that the market will then eventually reach towards the 4900 level.

At this point, if we break down below the bottom of the range for the day on Tuesday, we could reach down to the 4650 level below, which is the next massive support level that I see on this chart right now.