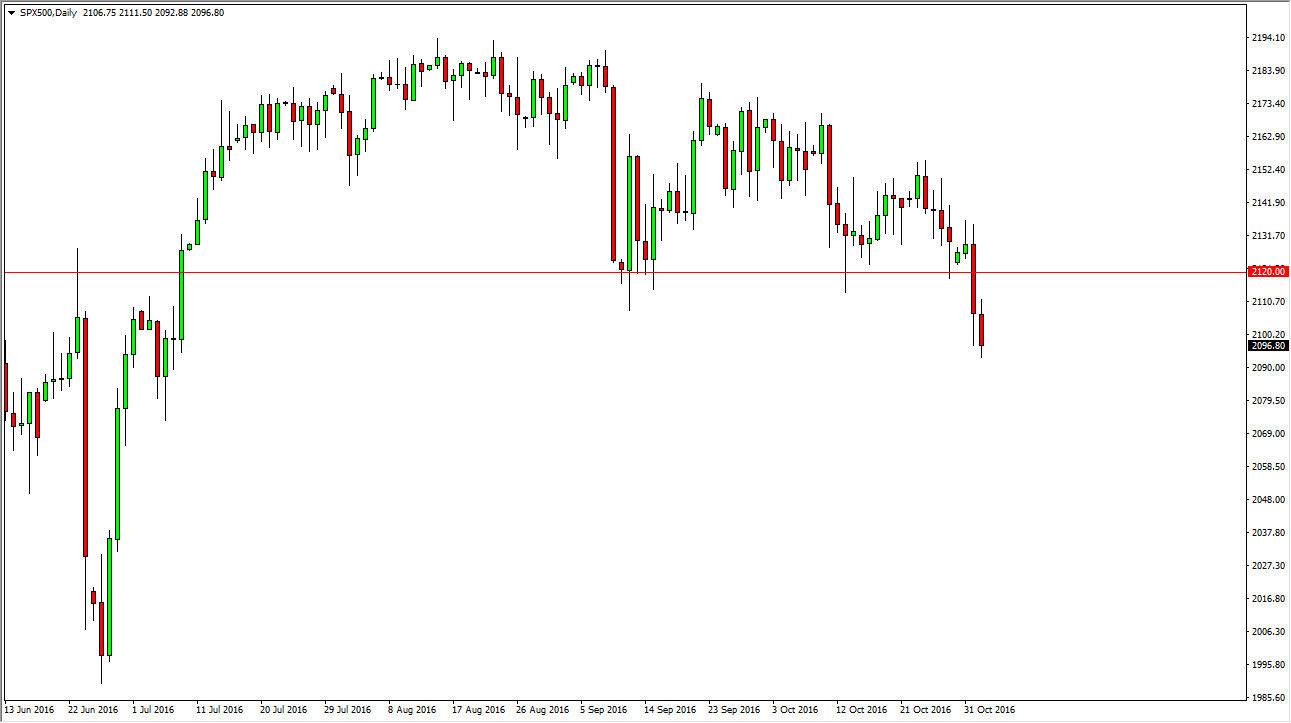

S&P 500

The S&P 500 went back and forth during the course of the day on Wednesday, as we continue to see quite a bit of bearish pressure in this market. We are just below the 2100 level, so we can break down below the bottom of the range for the day I feel that we will continue to go lower, perhaps reaching towards the 2080 handle. This is a market that I have no interest whatsoever in buying, at least not until we break well above the 2120 handle, and maybe even more importantly, the Monday shooting star. Ultimately, I believe that the market will continue to be very volatile and of course very soft as long as the presidential polls offers such uncertainty when it comes to the election next Tuesday.

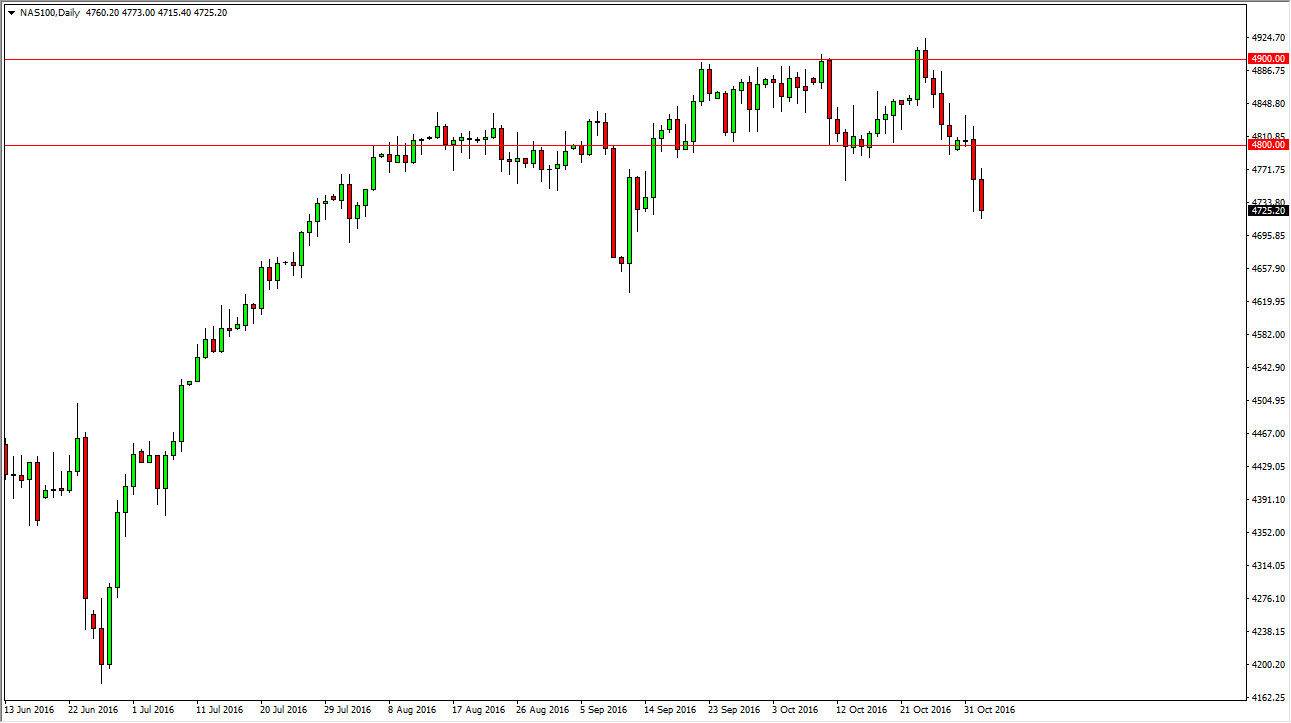

NASDAQ 100

The NASDAQ 100 fell during the day on Wednesday, breaking below the 4750 handle. Ultimately, this is a market that should continue to go lower, perhaps reaching towards the 4650 level. That is an area that has been supportive in the past, so it makes sense that we could reach back down towards that area in order to retest that level. I think rallies at this point in time the show signs of exhaustion can also be selling opportunities, as long as we stay below the 4800 level that has been so important over the last couple of months.

Keep in mind that this is a market that will be reacting to the presidential polls showing such uncertainty, but at this point in time it’s likely that sooner or later we will have some semblance of stability return to the market. The election is next Tuesday, and of course between now and then we should continue to see quite a bit of choppiness between now and then, and as a result I think that short-term trades are about the only thing that you can put into the market right now.