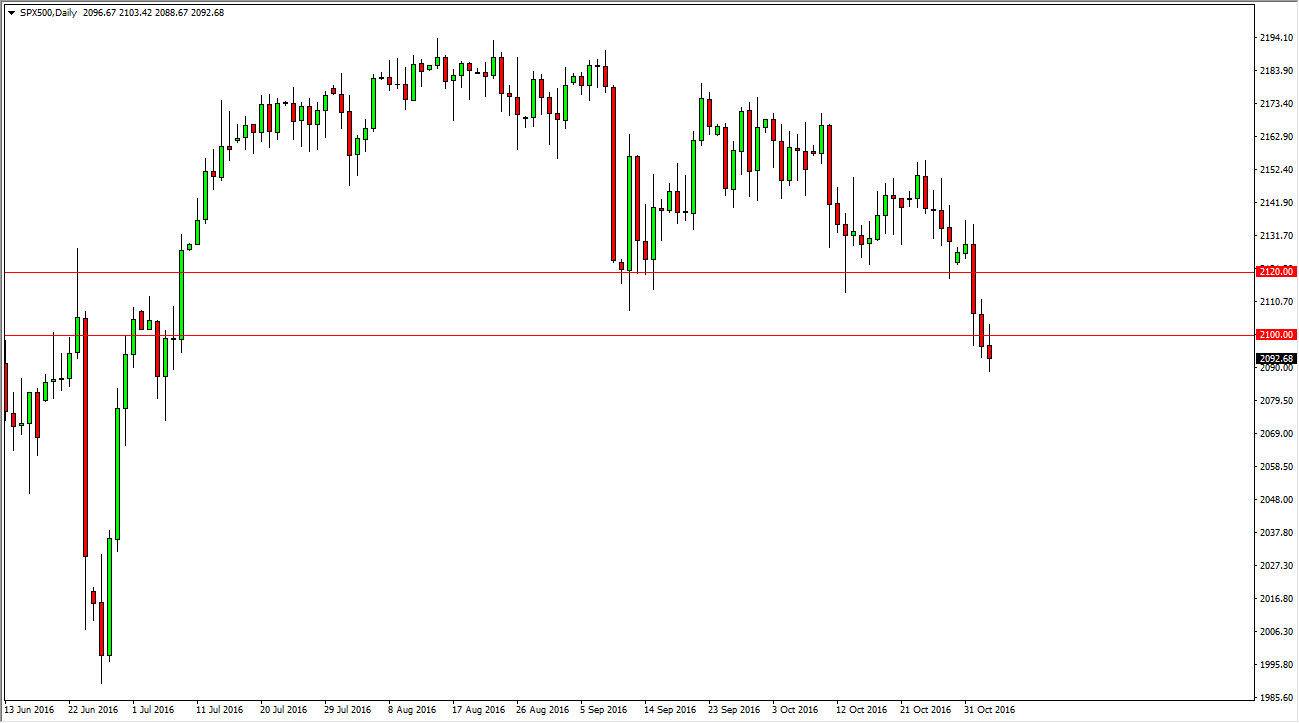

S&P 500

The S&P 500 initially tried to rally during trading on Thursday but turned around to form an exhaustive looking shooting star. This suggests that the sellers are still very much in control but we do have quite a bit of support just below. Because of this, I think we are getting continue to see quite a bit of volatility and with the jobs number coming out today that makes a lot of sense. With this being the case, break above the top of the candle I think will send this market looking for the 2120 handle, and a break below could have this market looking for 2080. Because of this, I think you must wait for the jobs number to come out before making any type of trading decision.

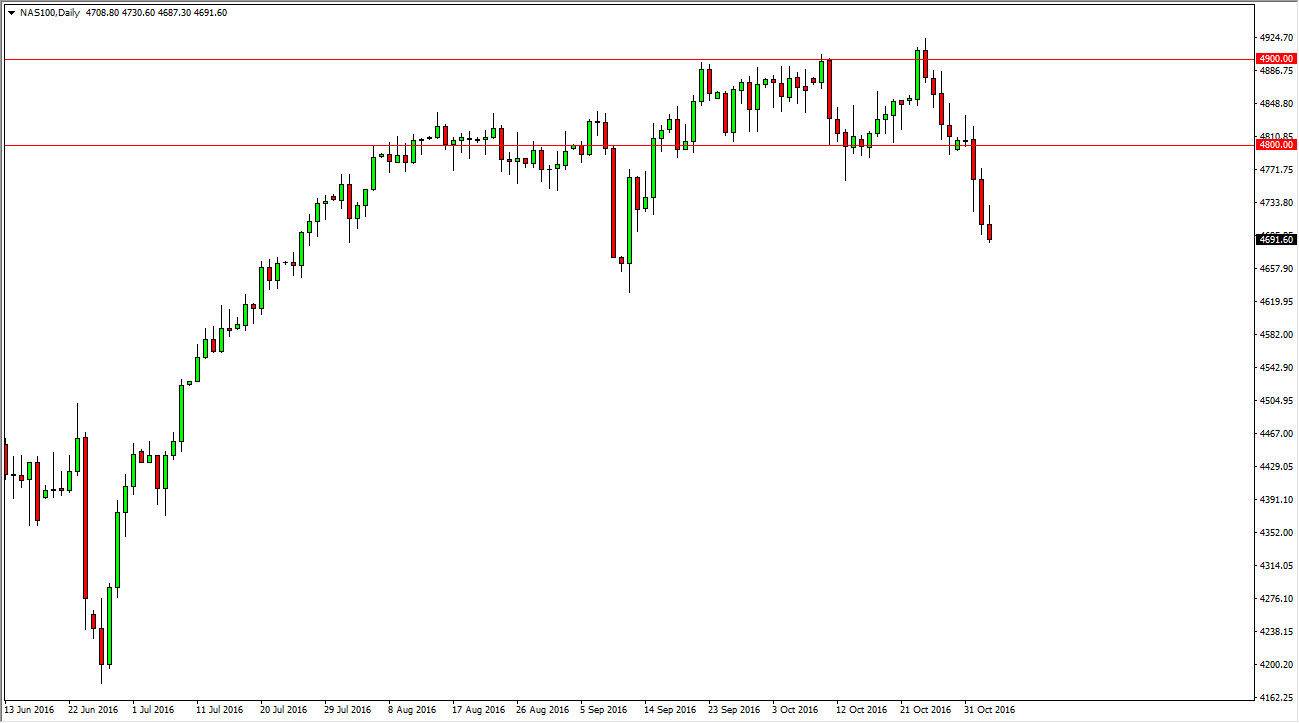

NASDAQ 100

The NASDAQ 100 also rose during the day initially but turned around to form a shooting star. This shows a real negativity and I think that not only do we have concerns about the jobs numbers coming out today, but the presidential polls are starting to show the perhaps we may get a President Trump, which of course Wall Street was not prepared for. Because of this, there’s a bit of readjustment the probably has to happen but at the end of the day I think there is massive support near the 4650 handle, so I think that’s about as low as it goes.

If we break above the top the shooting star, I feel the market will then reach towards the 4800 level again, and perhaps even beyond that. Ultimately, we cannot place a trade until the job announcement comes out obviously, because it throws so much in the way of volatility into the marketplace. On top of that, headlines coming out during the Friday news cycle could affect this market also, as the recent “bombshells” in the political process have been released on Friday. In other words, expect a lot of choppiness.