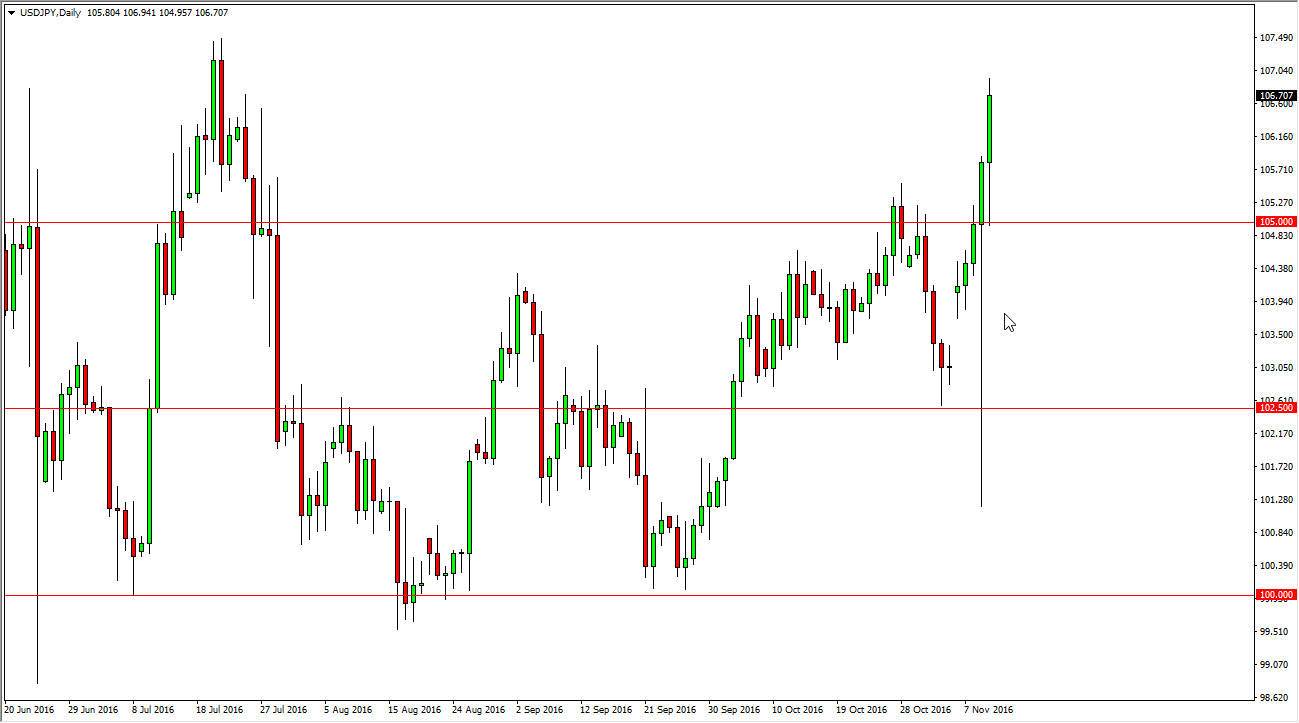

USD/JPY

The US dollar initially fell during the day on Thursday, testing the 105 level below. That’s an area that offered support, and as a result we turned around and formed a fairly bullish candle. Because of this, I think that this market will eventually break out above the 107.50 level going forward, and that would be a longer-term “buy-and-hold” type of situation. Pullbacks from time to time will continue to offer buying opportunities on short-term charts as well. Quite frankly, I have absolutely no interest whatsoever in shorting this pair and believe that longer-term we continue to go much higher. With this in mind, I look at pullbacks as the best way to go into this market as it at least offers us a bit of “value.”

AUD/USD

The Australian dollar had a very volatile session, covering quite a bit of space. In the end, we ended up forming a bit of a neutral candle, and I think this market will be particularly volatile going forward because of all the unknowns when it comes to a Donald Trump presidency. This is a market that is highly volatile have the time anyway, and with that I believe that we will need a couple of days the calm down. However, I do believe that we will have a fair shot breaking above the 0.7750 level, which would be a longer-term “buy-and-hold” type of situation.

Pullbacks will more than likely have quite a bit of support underneath them, especially on the way down to the 0.75 handle. That’s an area where I expect to see quite a bit of buying pressure, as we have been forming a bit of an ascending triangle going forward. This is a market that has been building bullish pressure for some time, so I think we will eventually get the move higher and then reach towards the 0.80 level above.