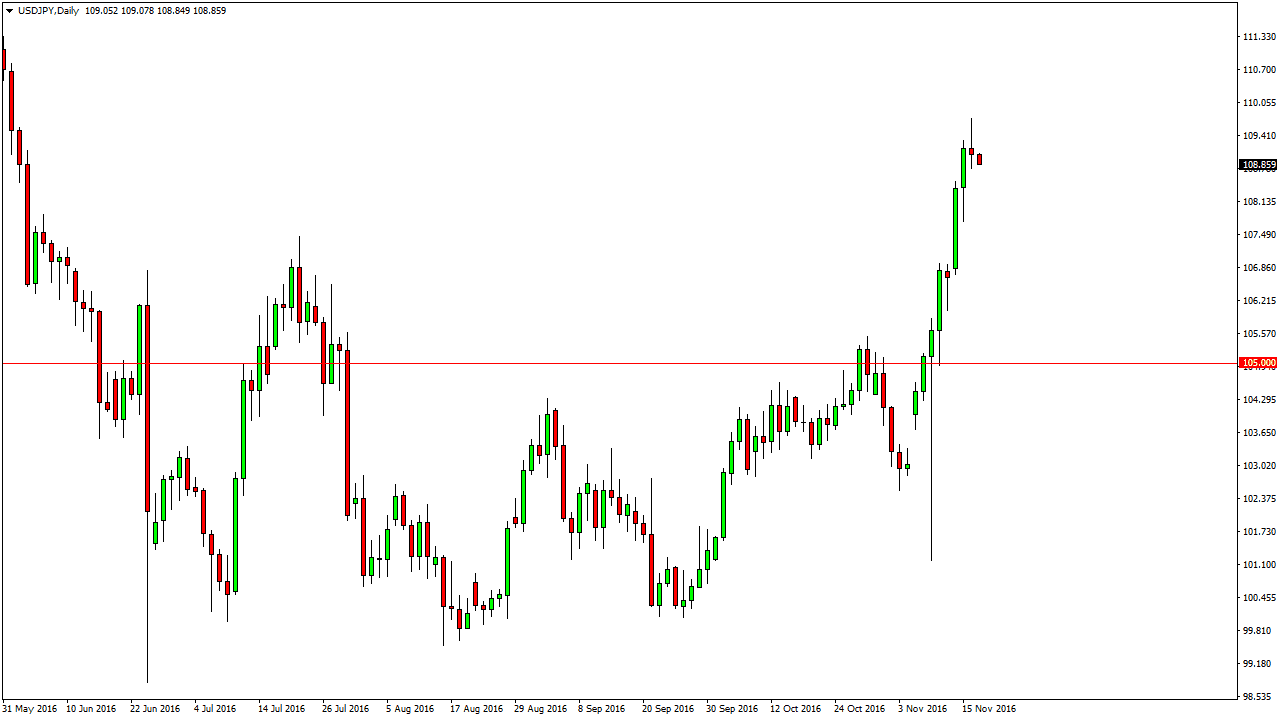

USD/JPY

The US dollar initially tried to rally against the Japanese yen, but turned around to form a shooting star. The shooting star of course is a negative sign, so having said that it’s likely that we will pull back, and perhaps try to reach lower levels, perhaps the 106 level underneath, or maybe even the 105 level below there. Because of this, I think that it’s only a matter of time before we get buying opportunities to go long so given enough time it should be an opportunity to get involved at a cheaper level and take advantage of what is an obvious breakout at this point. I believe that the 105 level is essentially the “floor” in this market now.

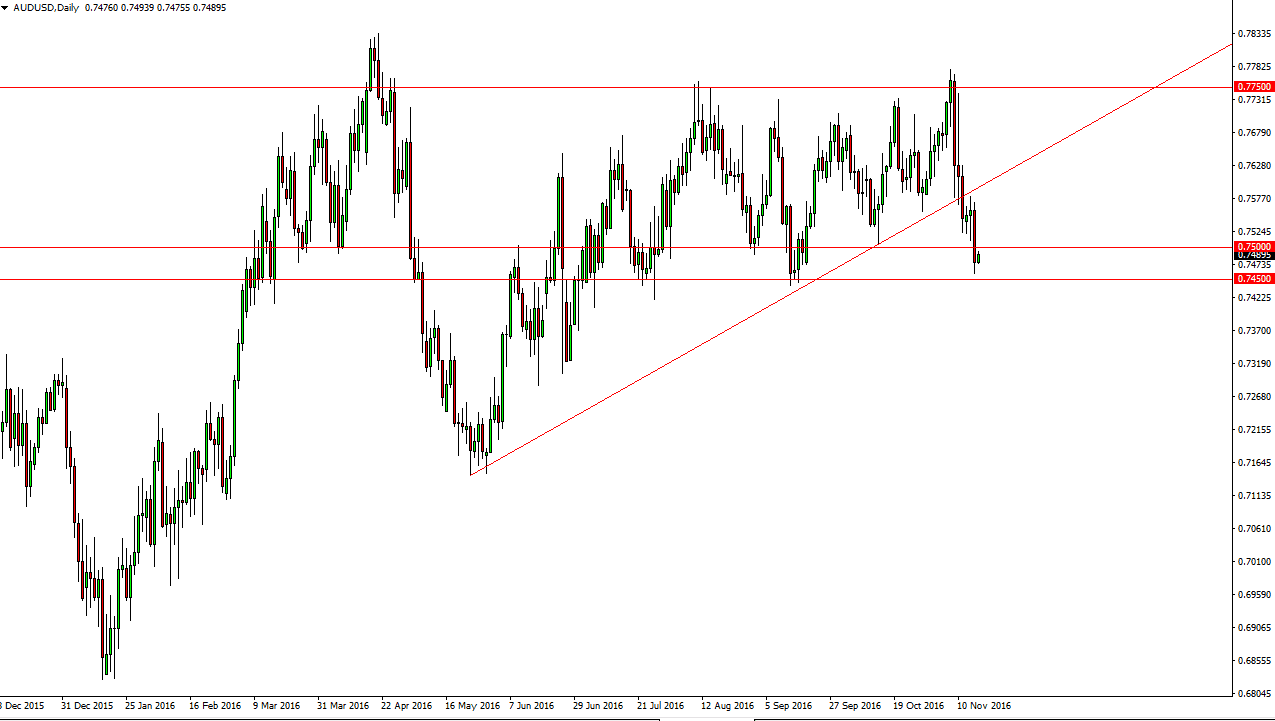

AUD/USD

The Australian dollar fell significantly during the day on Wednesday, slicing through the 0.75 level. The 0.75 level is the beginning of significant support, and a little bit of a bounce wouldn’t be overly shocking. However, I think that if we can breakdown below the 0.7450 level below should send this market much lower. Even if we rally from here I think that the previous uptrend line will cause enough resistance and sooner or later we will get an exhaustive candle that we can take advantage of. Pay attention to the gold market, it looks a bit soft so if we can breakdown below the $1200 level it’s very likely that the Australian dollar will fall as a bit of a “knock on effect.”

I have no real interest in going long, at least not until we break above the 0.76 handle at the very least. I don’t necessarily believe that’s going to happen, especially considering that we have struggled so much over the last several days. Ultimately, I believe that the markets will continue to favor the US dollar due to the changing economic landscape in that country, and that should drive down the value of both gold and the Aussie dollar.