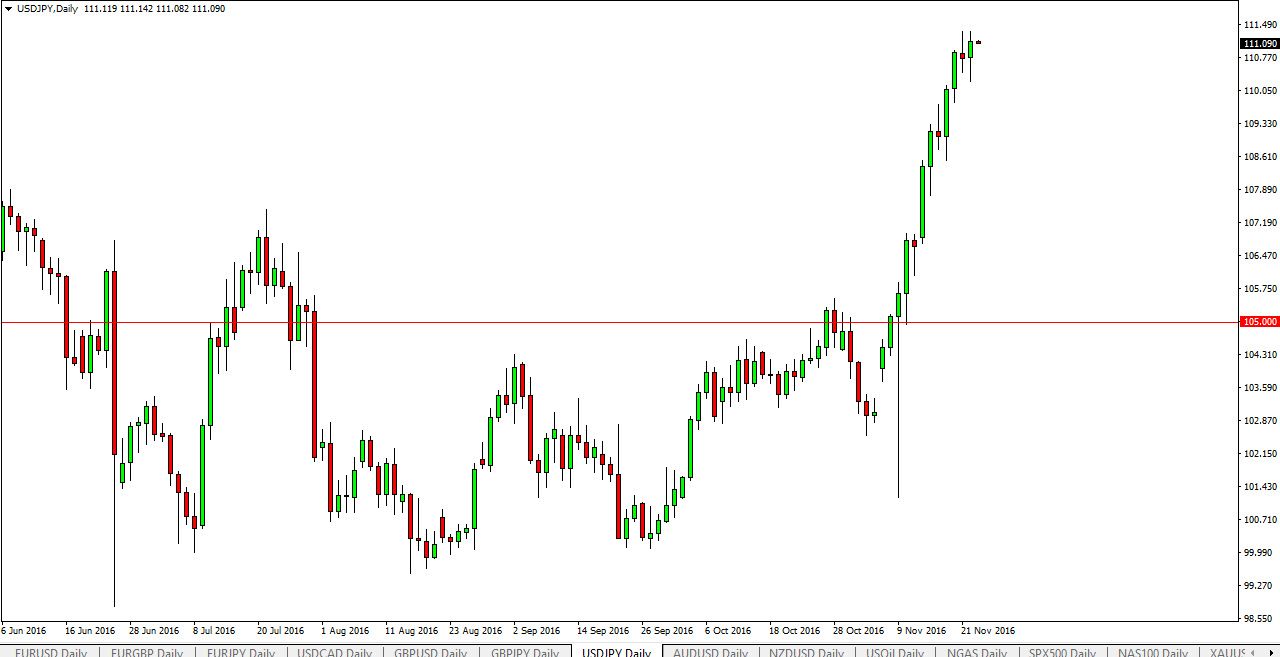

USD/JPY

The US dollar initially fell during the day on Tuesday but found enough support to turn around and form a little bit of a hammer. However, this market is so overextended at this point in time that you cannot safely get involved to the upside at the moment. Having said that, it certainly looks very bullish and it doesn’t look ready to break down quite yet. I welcome any type of breakdown at this point as an opportunity to pick up value below, something I hope to do fairly soon. At this point, if you are not already long of the USD/JPY pair, there just isn’t much to do as you have to wait for a better entry.

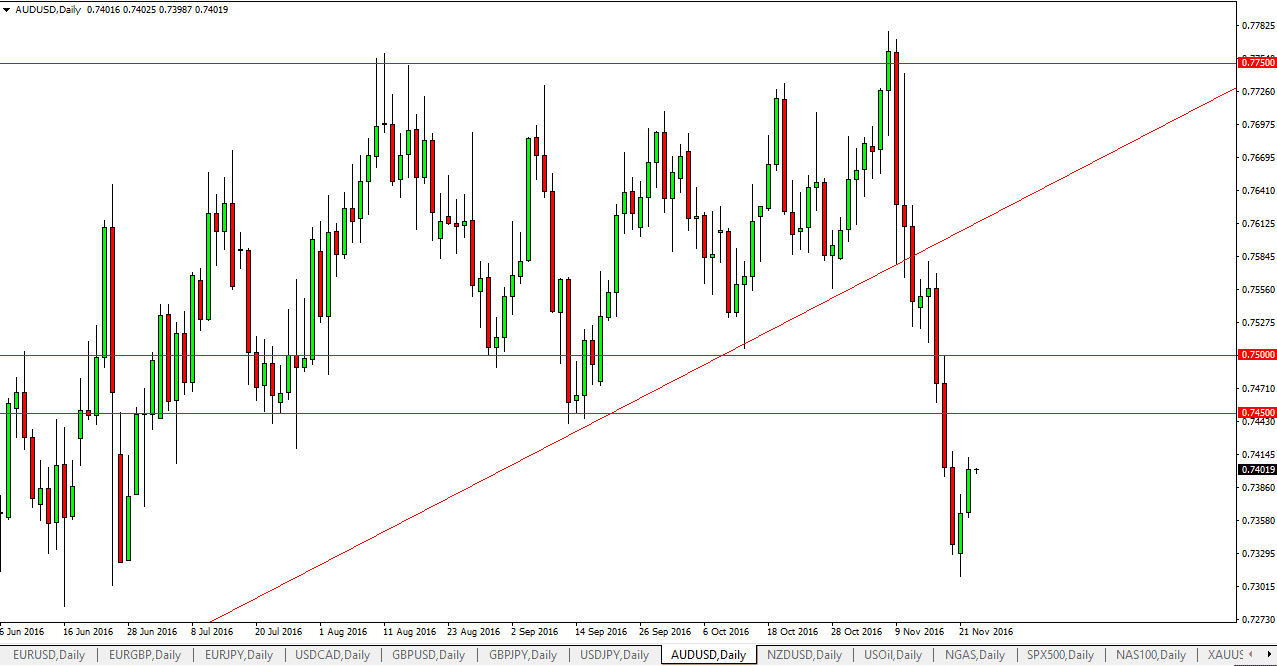

AUD/USD

The Australian dollar rallied during the day on Tuesday but is starting to run into a little bit of trouble near the 0.74 handle. I think above at the 0.7450 level, we start to see quite a bit of resistance that could turn out to be difficult. Because of this, I believe in simply waiting for an exhaustive candle to start selling on the daily chart. With this being a holiday weekend coming up, and of course Thursday being the actual Thanksgiving holiday, liquidity will start to drain from the marketplace today. Pay attention to gold, as it has a massive effect on the Australian dollar itself. Gold finds itself right now trading just above a significant support level so it may be difficult to break down in this environment. Nonetheless, I am waiting to see some type of exhaustive candle that I can search shorting which of course would go with the massive meltdown that we had seen over the last couple of weeks. Quite frankly, the market cannot go in one direction forever, and that’s what I think we are doing at this juncture: simply retracing some of the losses in order to continue the downward momentum.