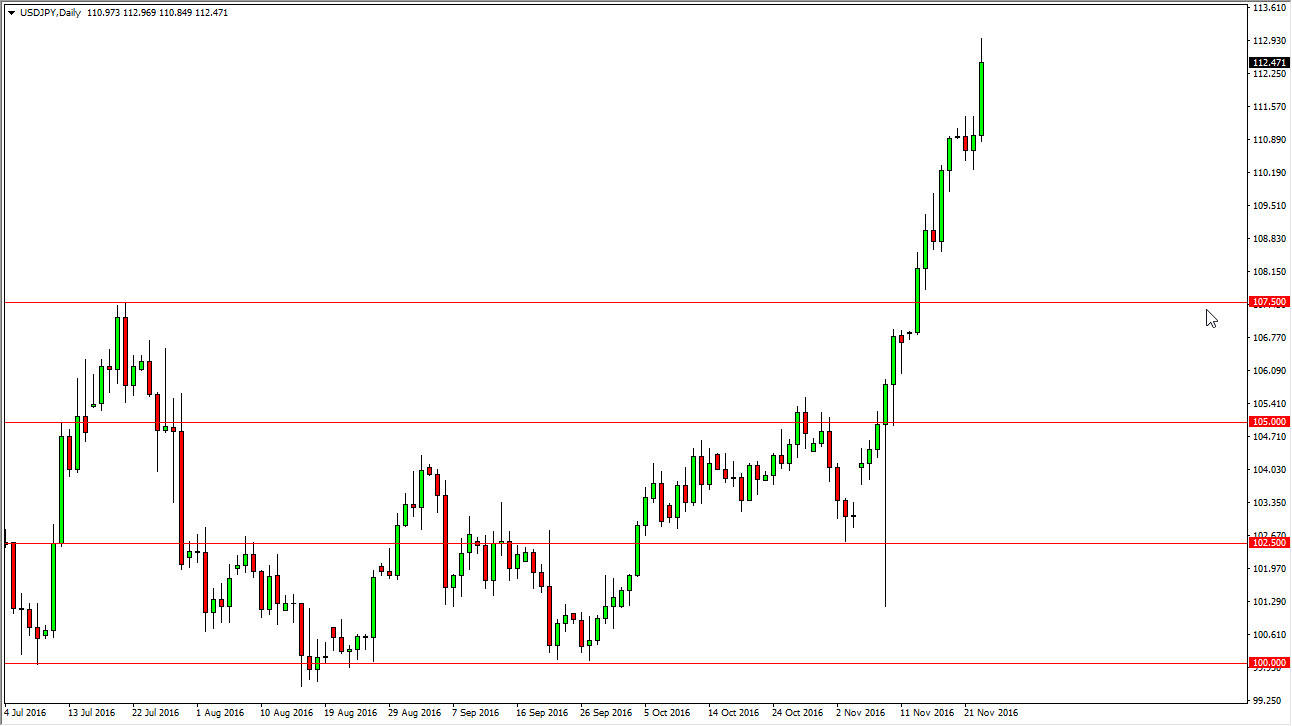

USD/JPY

The US dollar skyrocketed against the Japanese yen yet again on Wednesday, as we broke above the 112 level solidly. In fact, at one point during the day we were testing the 113 handle. This market is absolutely parabolic at this point, so I cannot in good conscience suggest that buying is the best thing to do. I wouldn’t sell this market either though, because quite frankly there’s far too much in the way of bullish pressure. What I do need to see is some type of stabilization or better yet a pullback that show signs of support below in order to take advantage of value. Clearly we have broken out to the upside and the trend has changed. However, this doesn’t mean that there will be opportunities to pick up value below.

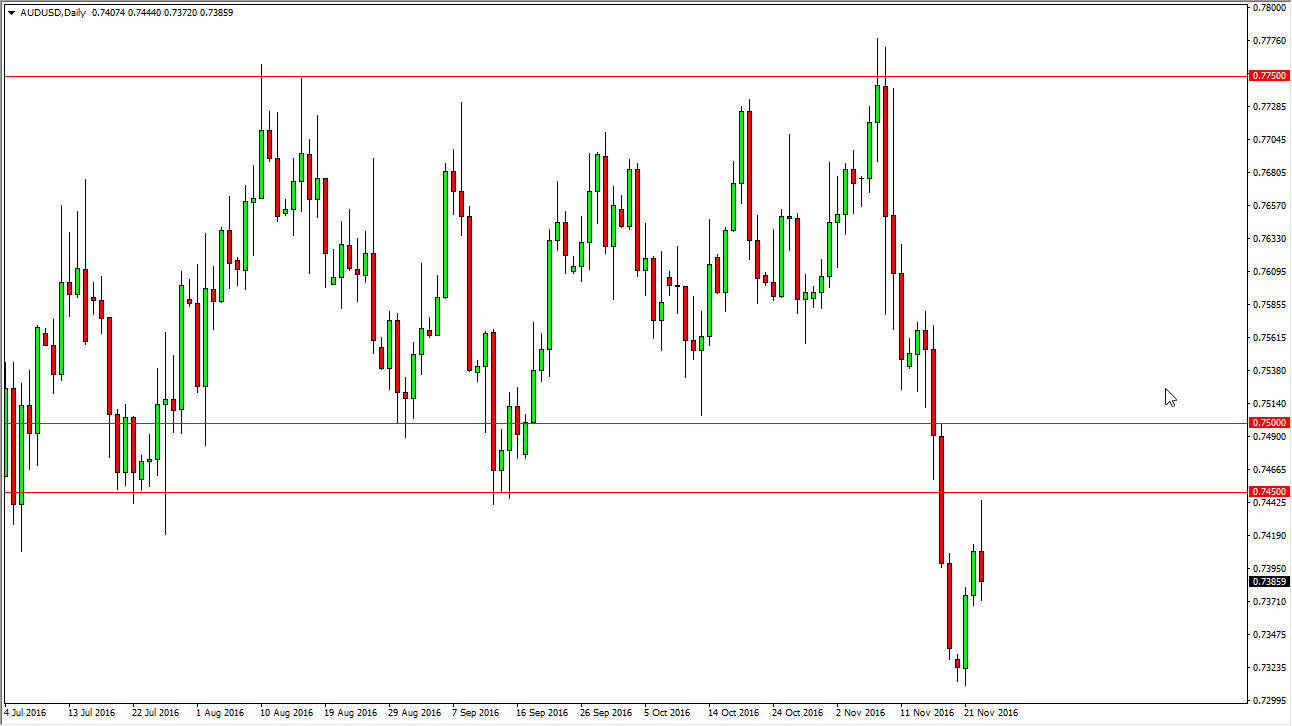

AUD/USD

The AUD/USD pair initially rallied during the day on Wednesday but found enough resistance at the 0.7450 level to turn things around and form a shooting star. The shooting star is a negative candle of course, and as a result it’s likely that the market will turn back around and start selling off. If we can break down below the bottom of the candle, it is a fairly strong signal to start selling. Ultimately, this is a market that quite a bit of bearish pressure in it, and of course gold has broken down so that has more bearish pressure to the Aussie as well. I believe that we will reach towards the 0.73 level, and then perhaps even lower than that given enough time.

Any rally at this point will have to deal with quite a bit of resistance, especially near the 0.7450 level, so I think short-term rallies that show signs of exhaustion would be nice selling opportunities. I have no interest in buying this pair until we get well above the 0.75 handle, something that isn’t going to happen anytime soon.