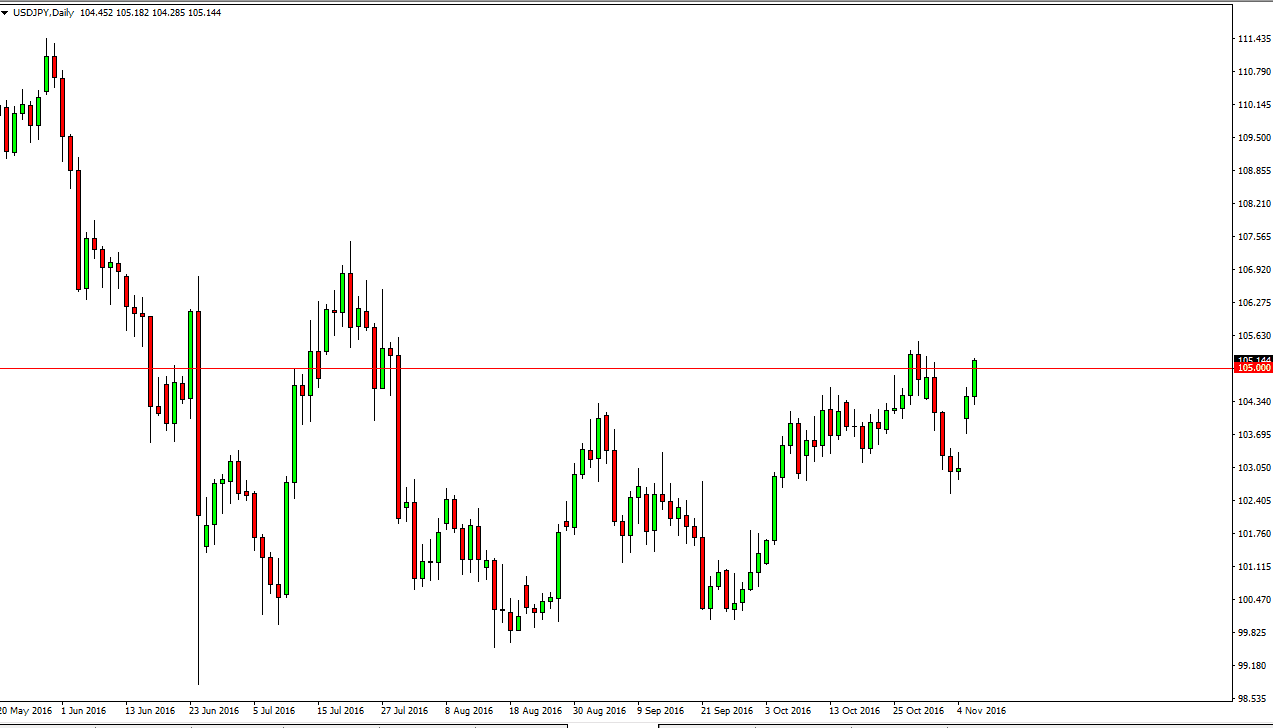

USD/JPY

The USD/JPY pair continues to do very little during the day on Tuesday as we have just broken above the 105 level. With this being the case it looks as if we are trying to break out, but we have to get the election results of the United States in order to continue confidently. The gap higher from a couple of sessions ago course is a very strong sign, but gaps tend to get filled, so there is that argument as well. If we can break above the 105.50 level, the market should continue to go to the 107 handle after that. I think pullbacks will offer buying opportunities, but we should continue to see quite a bit of volatility overall. Given enough time, I believe that we do go higher based upon the Bank of Japan and its desire to devalue the yen.

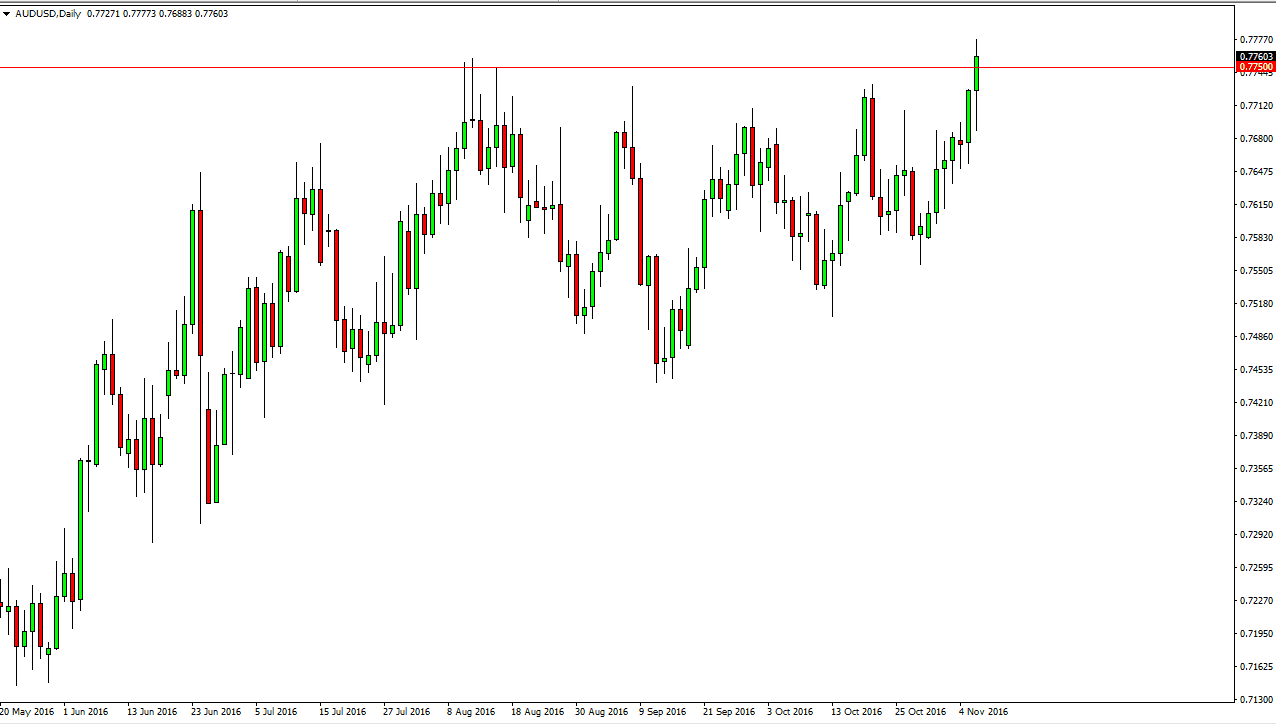

AUD/USD

The AUD/USD pair initially fell during the course of the day on Tuesday, but then turned right back around to break above the 0.7750 level. This is an area that should continue to give the market trouble, but if we can break above their it’s likely that the market should then go to the 0.80 level. The 0.77 level below is supportive, so I believe that pullbacks will probably attract buyers again. Pay attention to the gold markets, they almost always have a major influence on the Australian dollar, and I don’t think that’s going to be any different now.

This market has seen the lows get higher and higher, so it makes sense to me that we continue to go higher over the longer term. That’s not to say that we have to do it right now, just that we will eventually do it. The bullish pressure has been building up for some time, and I think eventually we get released.