USD/CAD Signal Update

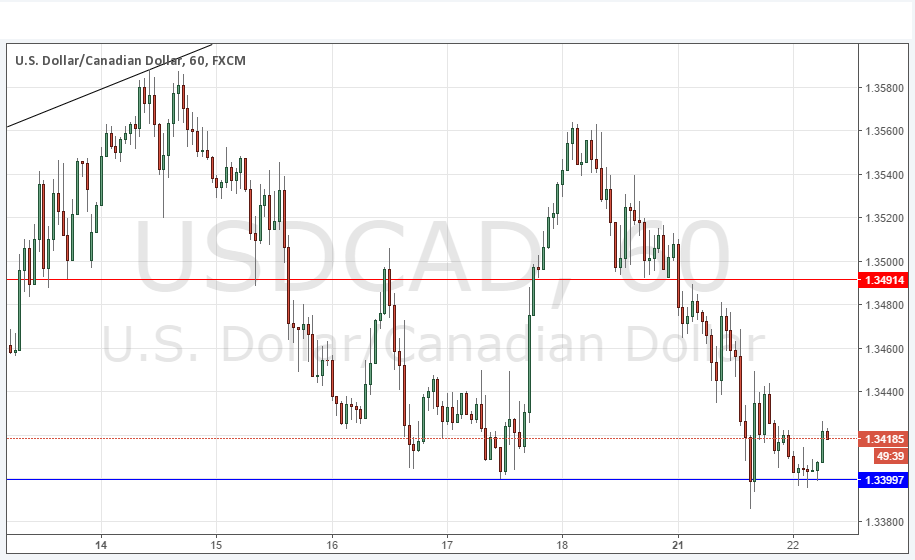

Yesterday’s signals were correct in seeing likely support at 1.3400, but the bounce happened too quickly and strongly to take advantage of using the given hourly time frame.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm New York time today only.

Long Trades

Go long after the next bullish price action rejection following a first touch of 1.3400 or 1.3362.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short after the next bearish price action rejection following a first touch of 1.3491.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run

USD/CAD Analysis

There are no big changes here. The level at 1.3400 has acted as good support twice and could even be used again, especially ahead of the major Canadian data release due later.

This pair has been outside the strong USD push that has been prevalent since 8th November as the Canadian Dollar has also been strong. This means there is a ranging environment, so good support and resistance levels, especially when confluent with round numbers, are likely to hold.

There is nothing due today concerning the USD. Regarding the CAD, there will be a release of Core Retail Sales data at 1:30pm