USD/CHF Signal Update

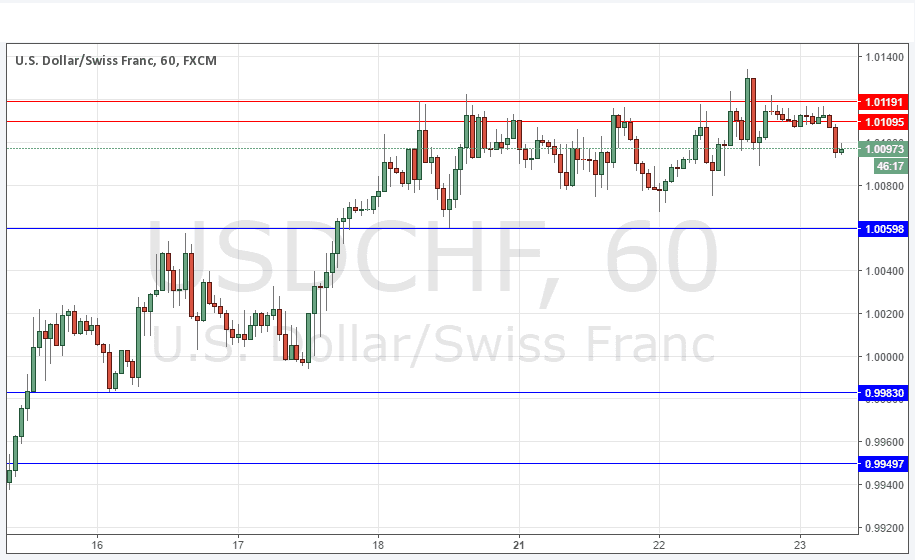

Yesterday’s signals were not triggered as the bearish price action took place a little above the resistance level identified at 1.0110.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Long Trades

* Long entry after bullish price action on the H1 time frame following the next touch of 1.0060 or 0.9950.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry after bearish price action on the H1 time frame following the next touch of 1.0119.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This pair is in a difficult situation for traders. On the one hand, it still has some bullish momentum, and is making new highs. However, the hourly chart below shows the price is having trouble staying above the 1.0110 level, although there would seem to be support very close by starting at about 1.0080.

This means that trading here can be unpredictable and a sudden sharp downwards movement could be arriving soon. Nevertheless, for the time being, the impetus still seems to be with the bulls. It might be very quiet anyway until the U.S. data due later.

There is nothing due today regarding the CHF. Concerning the USD, there will be releases of Core Durable Goods Orders and Unemployment Claims data at 1:30pm London time, followed later by Crude Oil Inventories at 3:30pm and FOMC Meeting Minutes at 7pm.