USD/CHF Signal Update

Last Thursday’s signals were not triggered as there was no bearish price action when the price reached 0.9809.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Long Trades

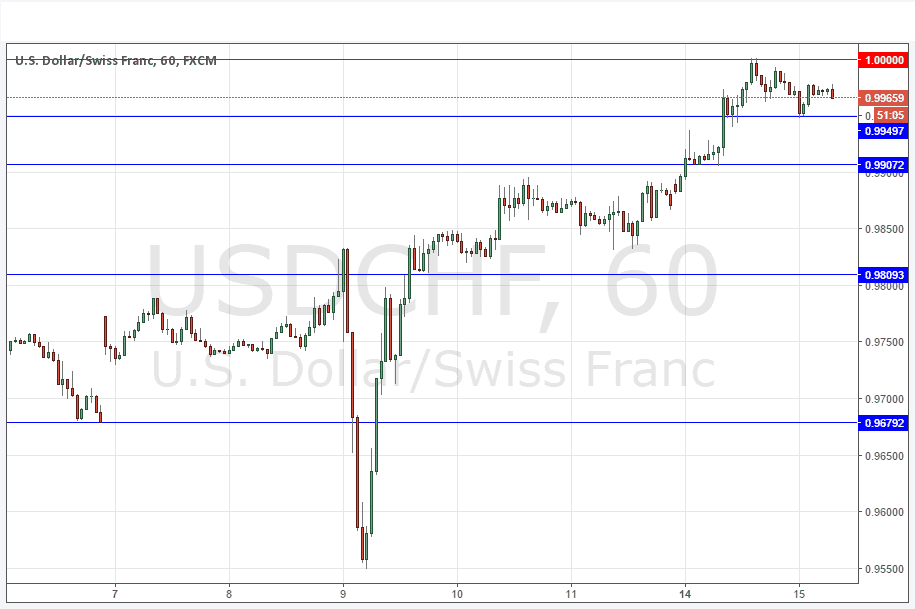

Go long after bullish price action on the H1 time frame following the next touch of 0.9950 or 0.9907.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 1.0000

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

With the recent strength in the USD, this has been one of the most bullish of all pairs along with the USD/JPY. This is because the JPY and CHF are “haven” currencies and have suffered as there is a renewed appetite for risk over recent days. This is contrary to the expectations of many analysts (including myself) and when surprises begin to happen in the market they tend to take off quite strongly.

Nevertheless, we are getting signs over recent hours that this USD rally is starting to run out of steam or at least getting ready for a pause. Alternatively, the price may drop to 0.9950 or 0.9907 and then turn around and get bullish again. Those levels should be watched closely.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm London time.