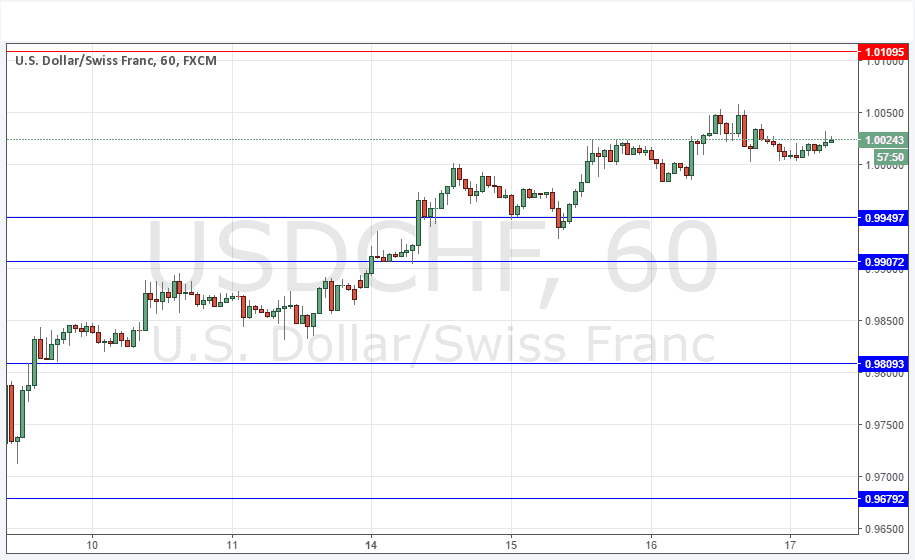

USD/CHF Signal Update

Yesterday’s signals were not triggered as there was no bearish price action when the price reached 1.0000.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Long Trade 1

Go long after bullish price action on the H1 time frame following the next touch of 0.9950.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 1.0110.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

This was again one of the most strongly moving pairs yesterday, with the price making new key highs and remaining above the parity level even after falling off. The price is now rising again, although the move feels artificial ahead of the key U.S. data due later which should turn out to be the main driver of price today. At the time of writing, USD strength is dominating the Forex market, even more so against the Swiss Franc than the Japanese Yen.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of Building Permits, CPI, Unemployment Claims and Philly Fed Manufacturing Index data at 1:30pm London time, followed by the Chair of the Federal Reserve testifying before Congress about the economic outlook later at 3pm.