USD/CHF Signal Update

Last Thursday’s signals were not triggered as none of the key levels were reached that day.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Long Trades

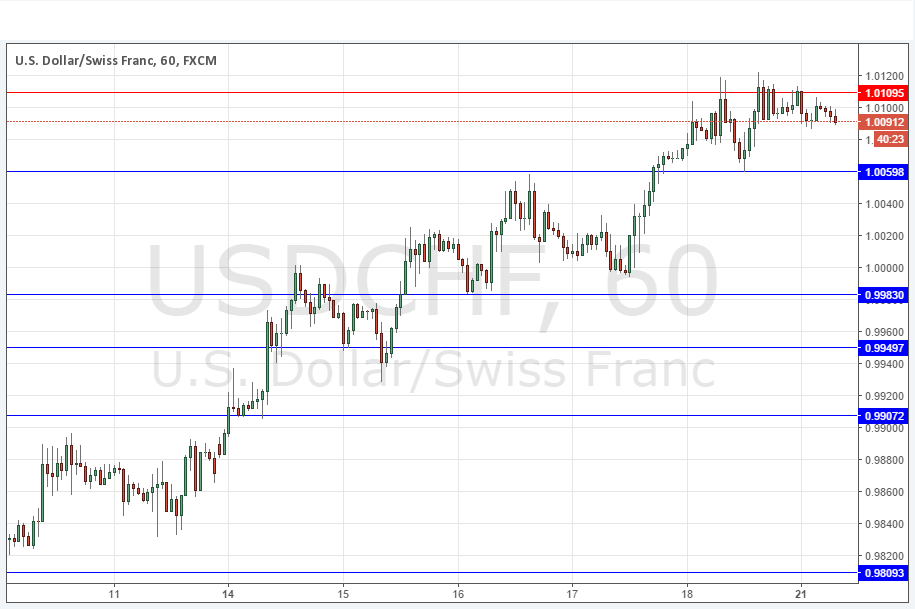

Long entry after bullish price action on the H1 time frame following the next touch of 1.0060 or 0.9950.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 1.0110.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This has been the second most strongly trending pair since the U.S. Presidential election, going on a firm bullish run. However, on Friday and during early action today, the key resistance level at 1.0110 seems to have halted the advance, although it is too soon to say whether this is the beginning of a meaningful and probably due pull back.

Although the level at 1.0110 is key resistance, it might require some good price-reading skill to take a short from there, and it would also be quite dangerous in the present strongly bullish USD environment.

It is worth noting there are no key resistance levels above 1.0110 before the key psychological number of 1.0250, so a bullish break here could travel a good distance.

At the time of writing, it looks as if the price is starting to show a definite bearish pull back.

There is nothing due today concerning either the CHF or the USD.