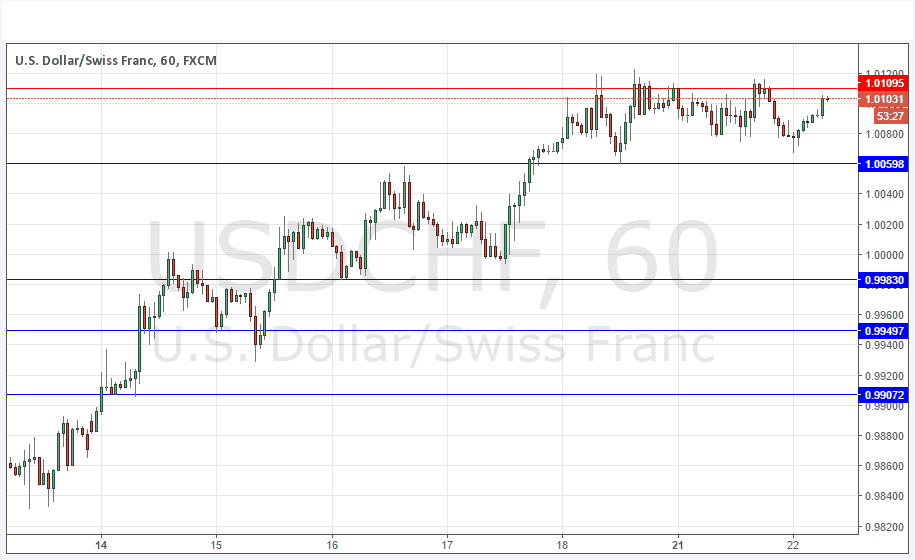

USD/CHF Signal Update

Yesterday’s signals were not triggered as the bearish price action at 1.0110 was insufficiently bearish and came too late in the day.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Long Trades

Go long after bullish price action on the H1 time frame following the next touch of 1.0060 or 0.9950.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next touch of 1.0110.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

This pair remains quite bullish. Even though the USD pulled back yesterday, the pair rose again from its lows during the Asian session. The price is being held by the key resistance at 1.0110 although the action wasn’t clean or early enough to take advantage of yesterday. It might come into play today and if the rejection is more emphatic, could provide a shorting opportunity, but be careful as the long-term USD trend is strongly bullish.

There is nothing due today concerning either the CHF or the USD.