USD/CHF Signal Update

Last Thursday’s signals were not triggered as none of the key levels were ever reached.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Long Trades

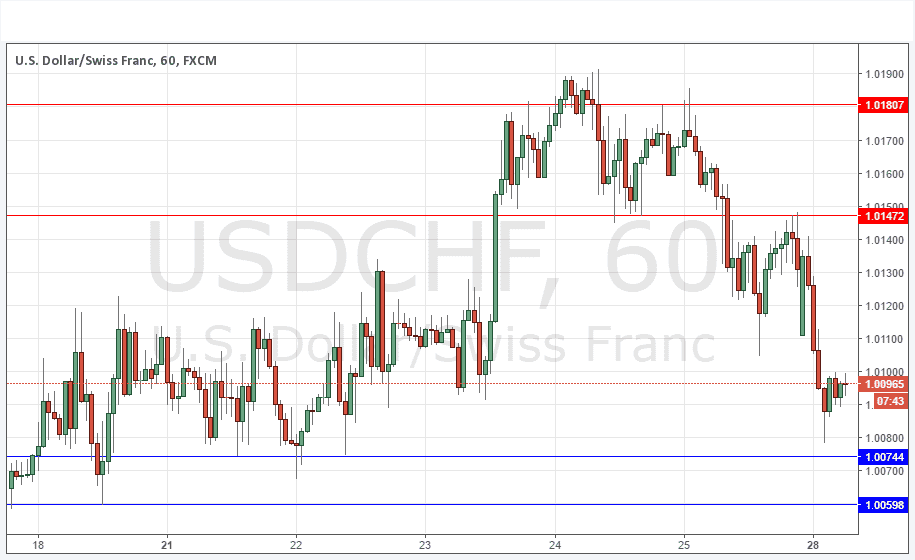

Long entry after bullish price action on the H1 time frame following the next touch of 1.0074 or 1.0060.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Short entry after bearish price action on the H1 time frame following the next touch of 1.0147 or 1.0181.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This pair has been selling off strongly ever since the end of the New York session last Thursday. This is partly due to profit-taking in the USD after its recent very strong run, and it is probably especially pronounced in this pair, as it is also in the JPY, as these were the two pairs that saw the strongest rise in the USD, with both JPY and CHF suffering as out-of-favour haven currencies during the Trump Bump.

If 1.0074 continues to hold as support, there should be a decent bullish pull back over the next couple of days, as strong trends rarely turn around this quickly.

There is nothing due today concerning either the CHF or the USD.