USD/CHF Signal Update

Yesterday’s signals were not triggered as the price did not reach any of the key levels until after the London session.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Long Trade 1

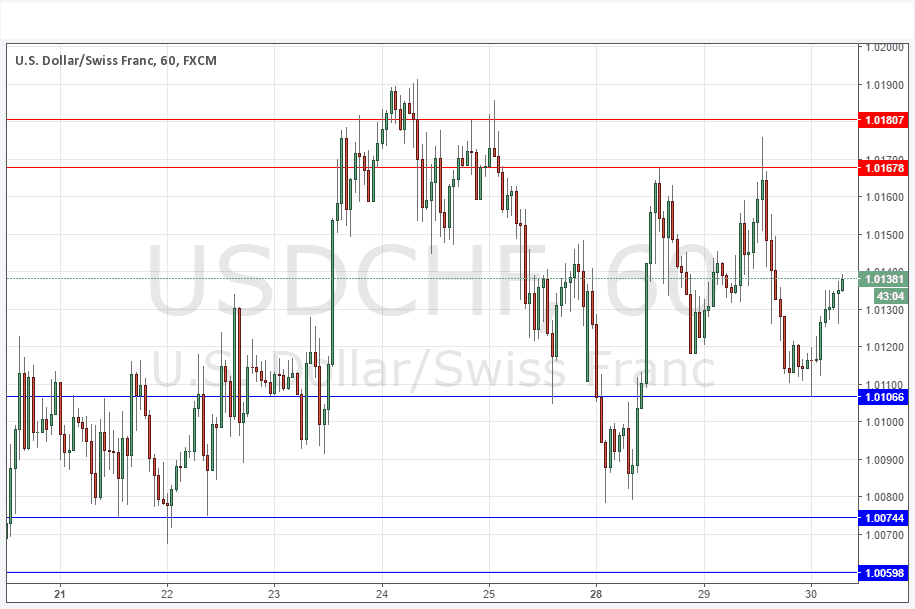

Go long after bullish price action on the H1 time frame following the next touch of 1.0107.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 1.0168 or 1.0181.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This pair seemed bullish early yesterday, but that promised faded and it really seems to be exhibiting more of a ranging type of behaviour.

Nevertheless, the chart is interesting, with a bullish Quaismodo pattern already formed at the nearest support level below, and the final leg of a bearish Quasimodo looking as if it could logically form at 1.0168.

I hold a bullish bias, but the resistance above has proven to be very strong repeatedly over recent days.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of the ADP Non-Farm Employment Change at 1:15pm London time, followed later by Crude Oil Inventories at 3:30pm.