USD/CHF Signal Update

Yesterday’s signals were not triggered as none of the key levels were reached during the London session.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today only.

Long Trade 1

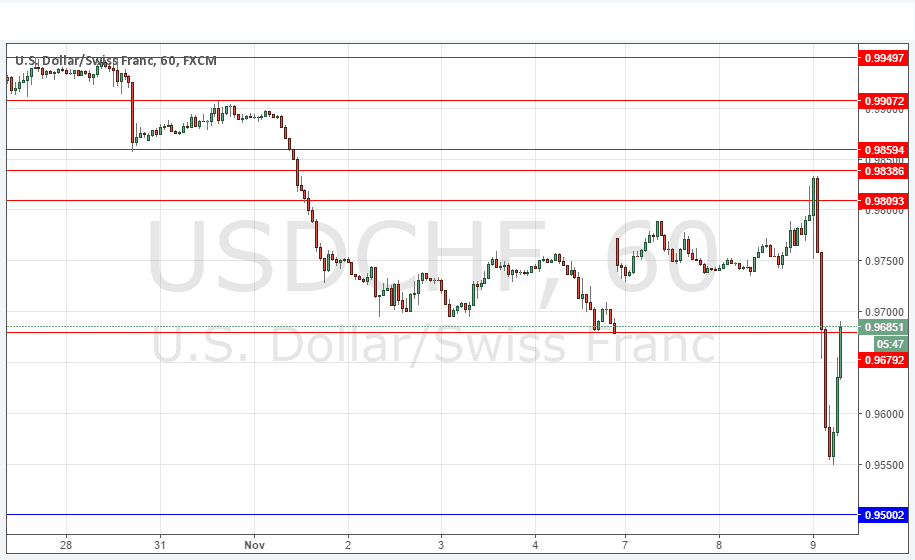

Go long after bullish price action on the H1 time frame following the next touch of 0.9500.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 0.9679, or 0.9809.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

At the time of writing, it is clear Donald Trump has pulled off a huge political upset victory and has been elected as the next President of the United States.

This has created great market turmoil, with stocks, the U.S. Dollar and risk assets generally falling sharply, while havens and the Swiss Franc have risen sharply.

This has rocketed this pair to new lows but it is still within its long-term range and may be beginning to stabilize already. Although the volatility is huge, support and resistance are “working” and holding, with the price level at 0.9680 seeming to act as new resistance.

As stunning upsets, such as this tend to move markets for more than just a few hours, short trades are probably going to remain the best opportunity for today, but be careful as volatility is very large. Whole and half numbers might be important, such as 0.9750.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.