By: DailyForex.com

USD/JPY Signal Update

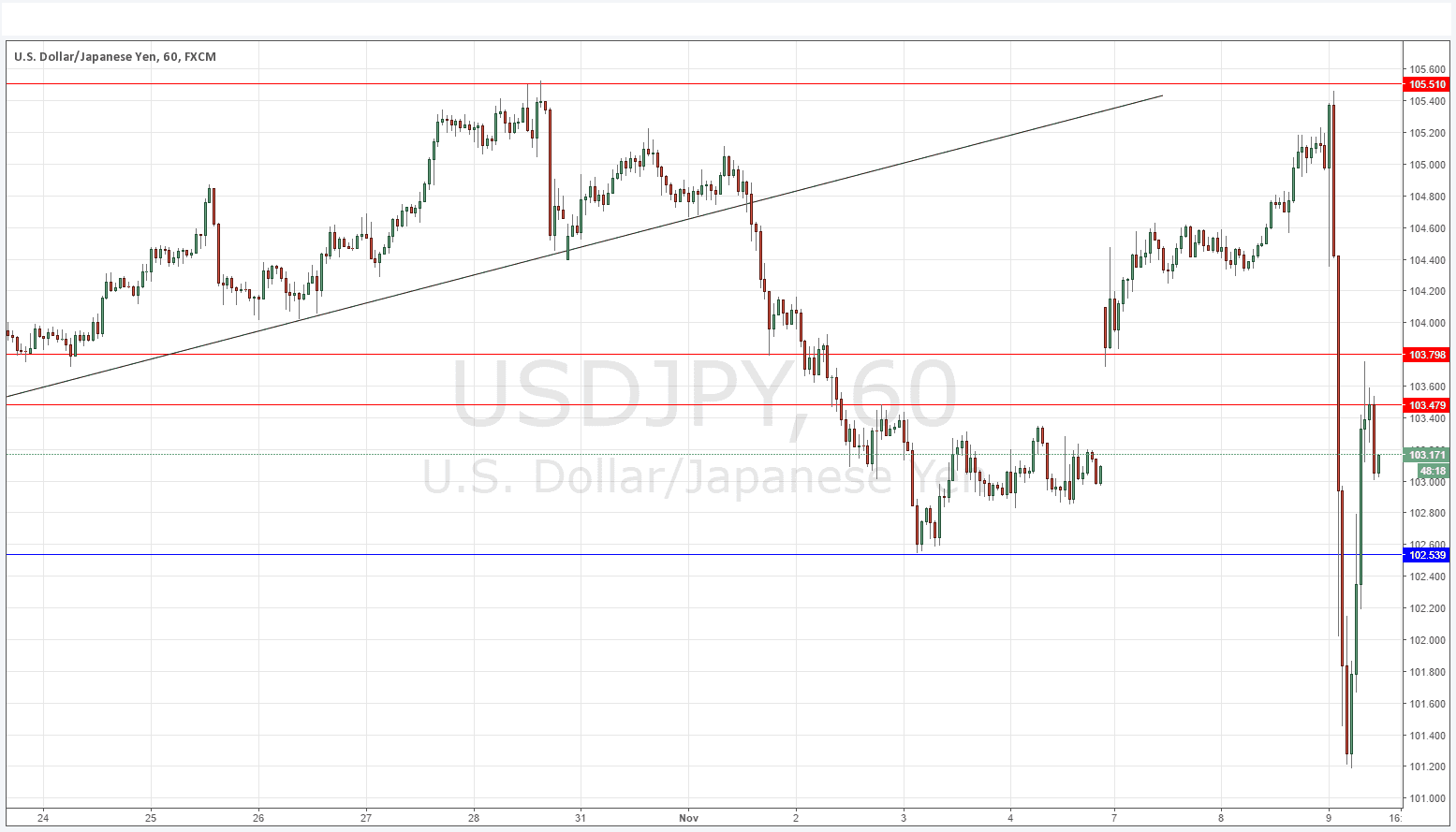

Yesterday’s signals were not triggered as there was no bullish price action at either 103.80 or 103.48.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken between 8am New York time and 5pm Tokyo time, during the next 24-hour period only.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 102.54.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 103.48 or 103.80.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

This pair was always going to be a good instrument to use to trade the U.S. election, being very sensitive to the outcome with the JPY being something of a “haven” currency. As initial results seemed to favour Clinton, it rose to a price very close to the key resistance level at 105.51 before dropping very dramatically as the results began to turn in Trump’s favour. Once the result became clear the price then retraced to about half of the swing, emphasizing a new resistance level at 103.48.

It is hard to say what will happen next. I expect the price to take on a bearish bias overall, but it will probably begin to consolidate as volatility dies out over the coming hours.

There is nothing due today regarding the JPY. Concerning the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time.