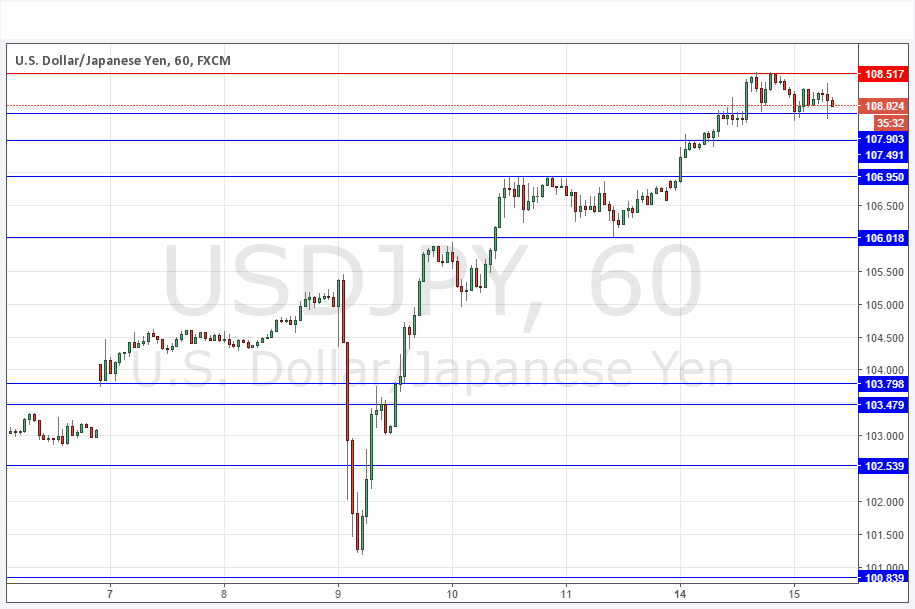

USD/JPY Signal Update

Yesterday’s signals were not triggered as the bearish price action took place a little higher than the resistance level identified at 108.42.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be entered from 8am New York time until 5pm Tokyo time, over the next 24-hour period.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 107.49.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 108.52.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The bullish push continued yesterday, and this pair has been at the heart of the market over recent days, being the best instrument to use to be long of the U.S. Dollar.

There are signs that even here, the rally has halted or at least paused, with the price seeming to begin a consolidation between 108.52 and 107.90. However, it may be that the upwards directional move resumes. It certainly looks too early to be bearish.

There is nothing due today regarding the JPY. Concerning the USD, there will be a release of Retail Sales data at 1:30pm London time.