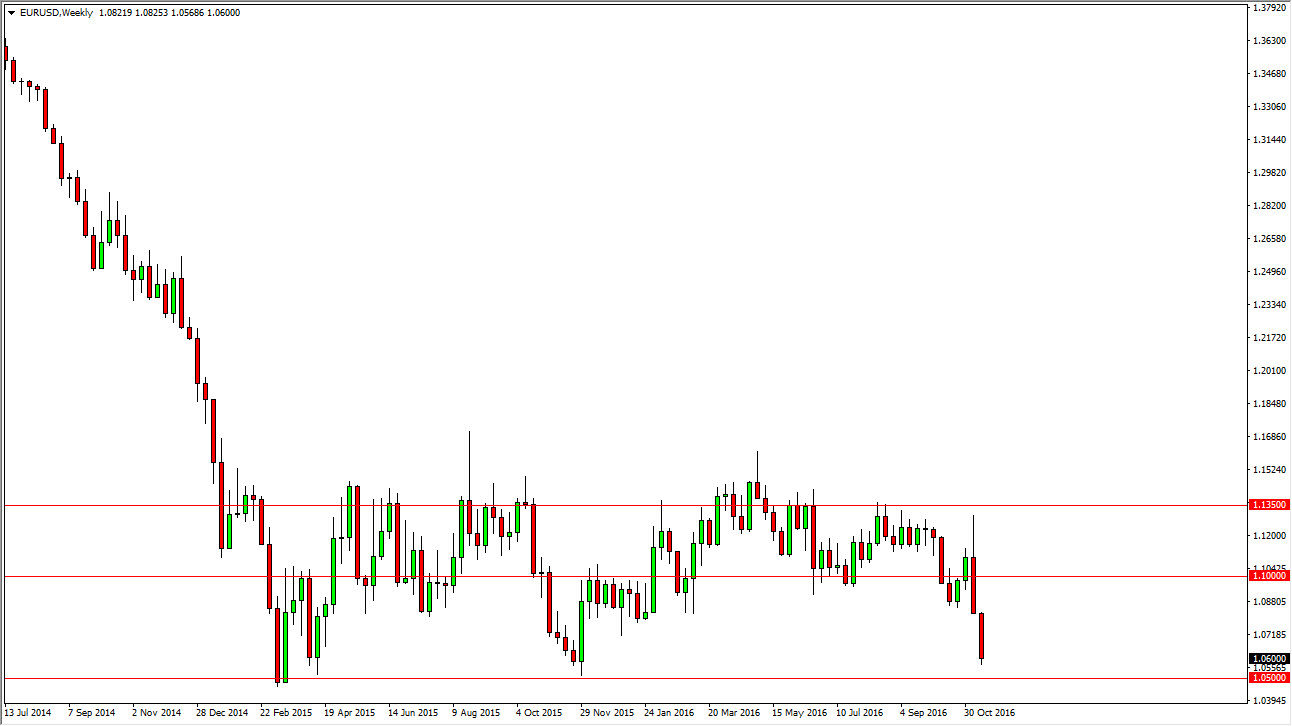

EUR/USD

The Euro has fallen yet again over the last week, and it now all but assures us that we should see the 1.05 level tested fairly soon. I believe eventually we break down below there but I don’t necessarily think that will happen in one shot. Rallies that show signs of exhaustion continue to be selling opportunities, and a break below the 1.05 level should send this market looking for parity.

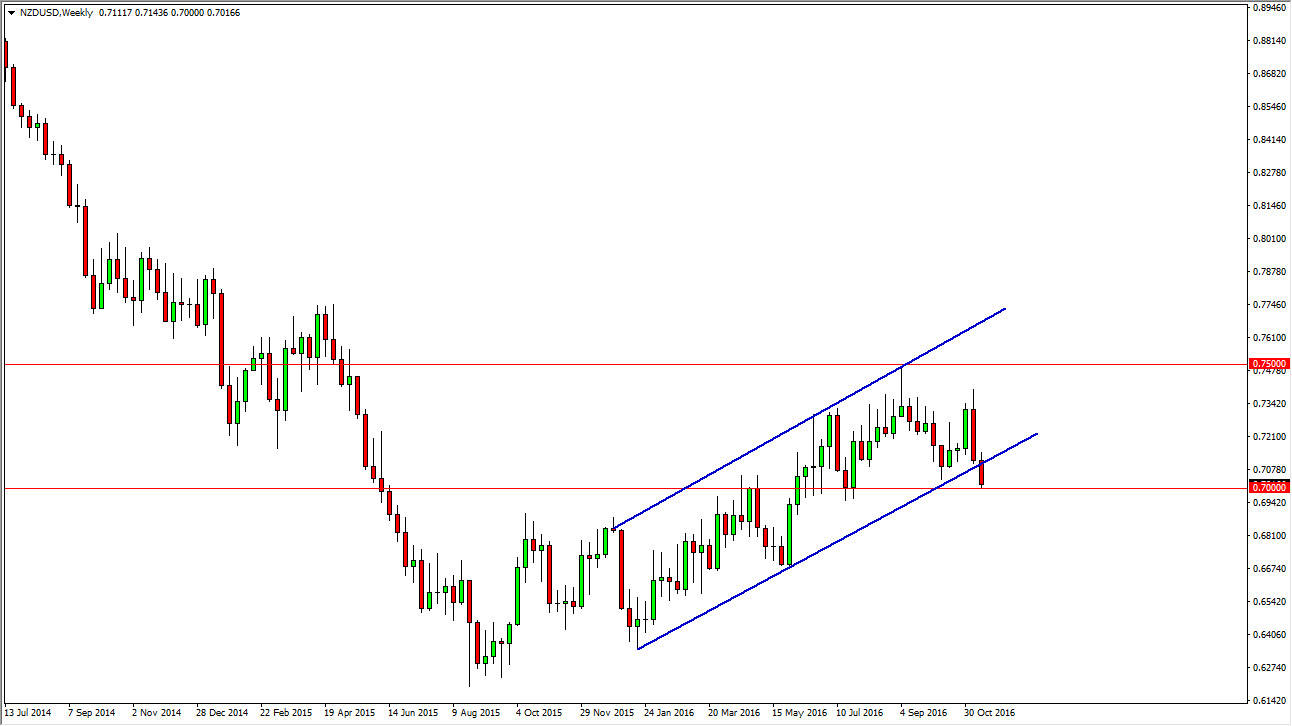

NZD/USD

The New Zealand dollar fell significantly during the course of the week, slamming into the 0.70 level. This is an area that has a certain amount of psychological significance obviously, but it is also an area that has proven itself to be important in the past. Because the Australian dollar is falling at the same time, I feel it’s only a matter time before we break down and a move below the 0.70 level could open the floodgates for a reach down to the 0.68 handle.

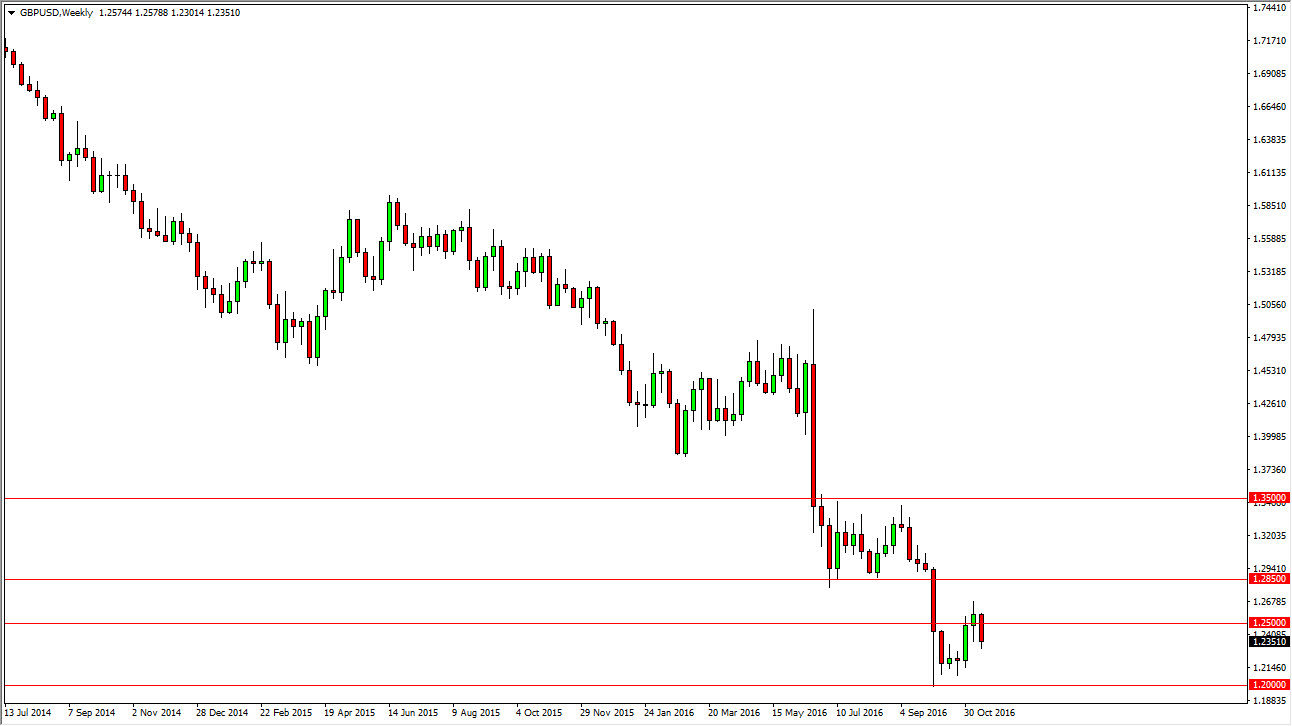

GBP/USD

The British pound fell as well during the week, as the US dollar remains King. I believe that the market will continue to go lower, but it’s not to see the massive selloff that we had previously. I believe that the market will reach towards the 1.21 handle, but it might be a bit of a bumpy ride down there. Rallies and show signs of exhaustion still remain my favorite ways to sell this market.

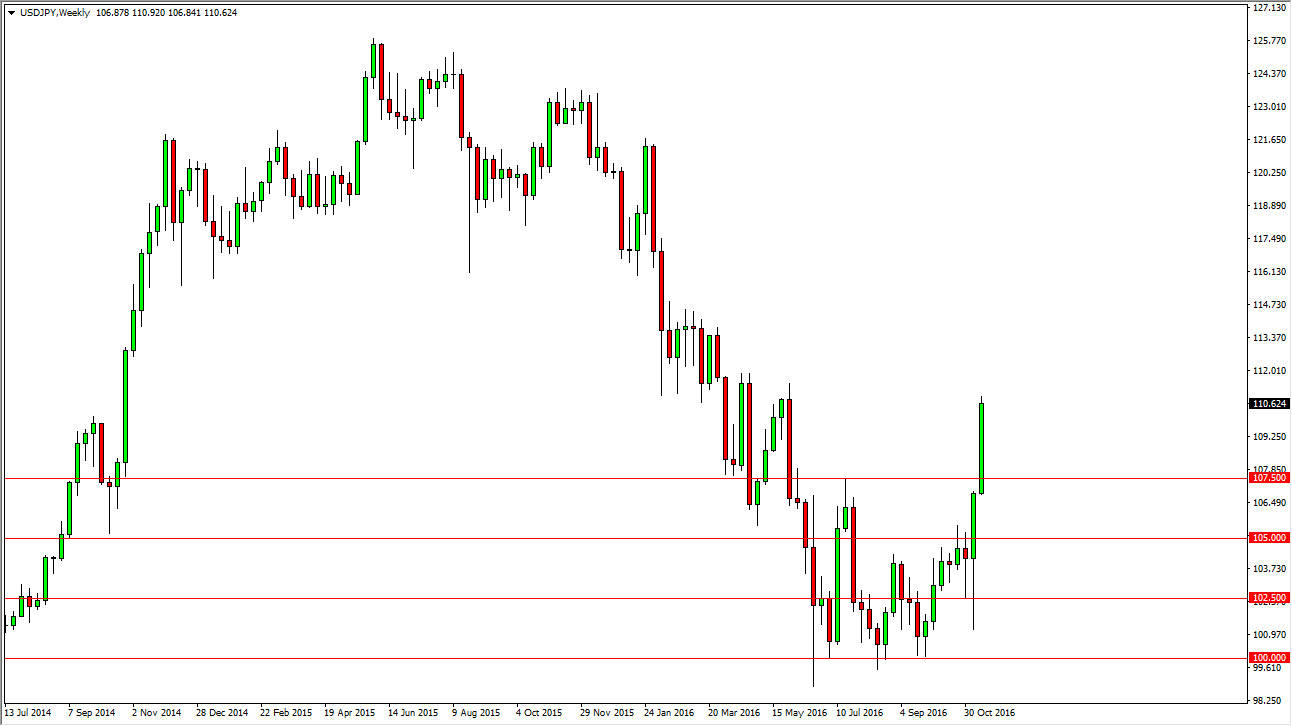

USD/JPY

The US dollar is absolutely exploded against the Japanese yen, reaching above the 110 level on Friday. I believe that this overall trend continues, but we are getting a bit overextended. Because of this, I’m looking for some type of pullback that show signs of support below in order to take advantage of what I feel is a massive trend change after the surprise election of Donald Trump.