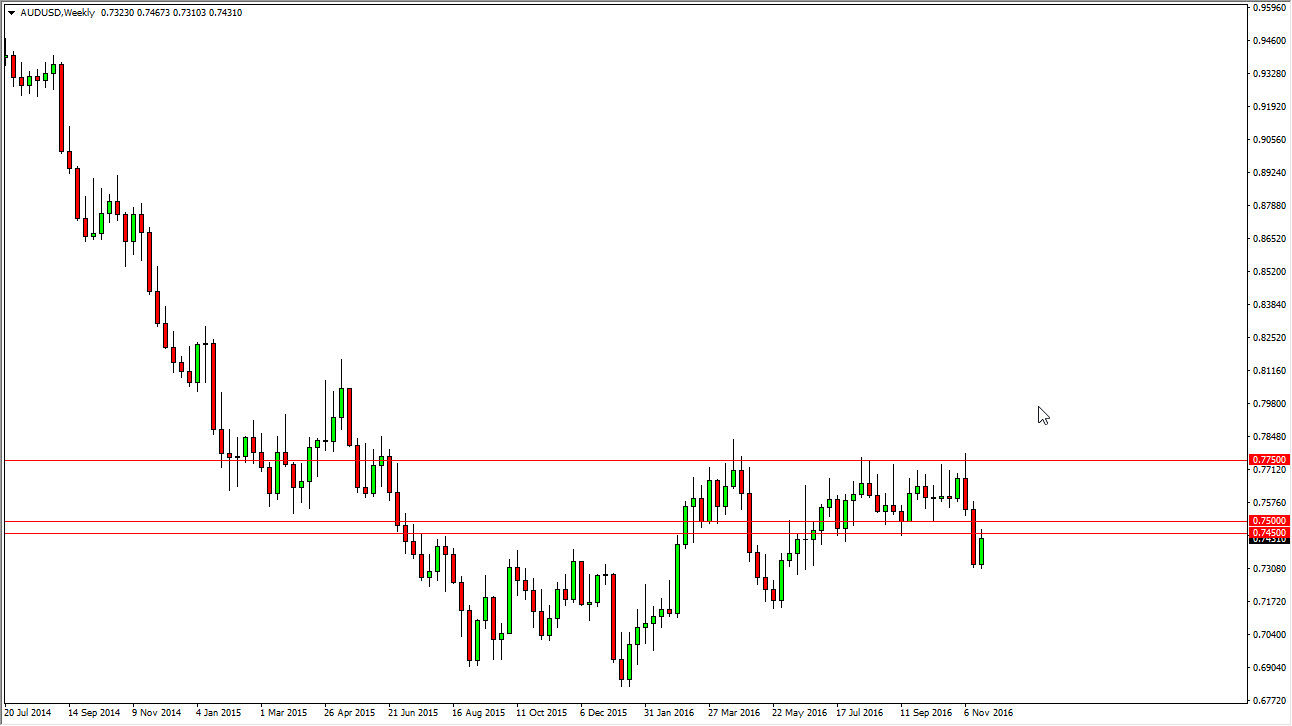

AUD/USD

The AUD/USD pair did rally a bit during the course the week, but struggled at the 0.7450 level. This is the beginning of significant resistance, as I have denoted on the chart by the “double line.” Ultimately, I think that the sellers get involved, especially considering that the gold markets have fallen apart and as long as we can stay below the 0.75 level, I think that this market will continue to have fairly bearish pressure.

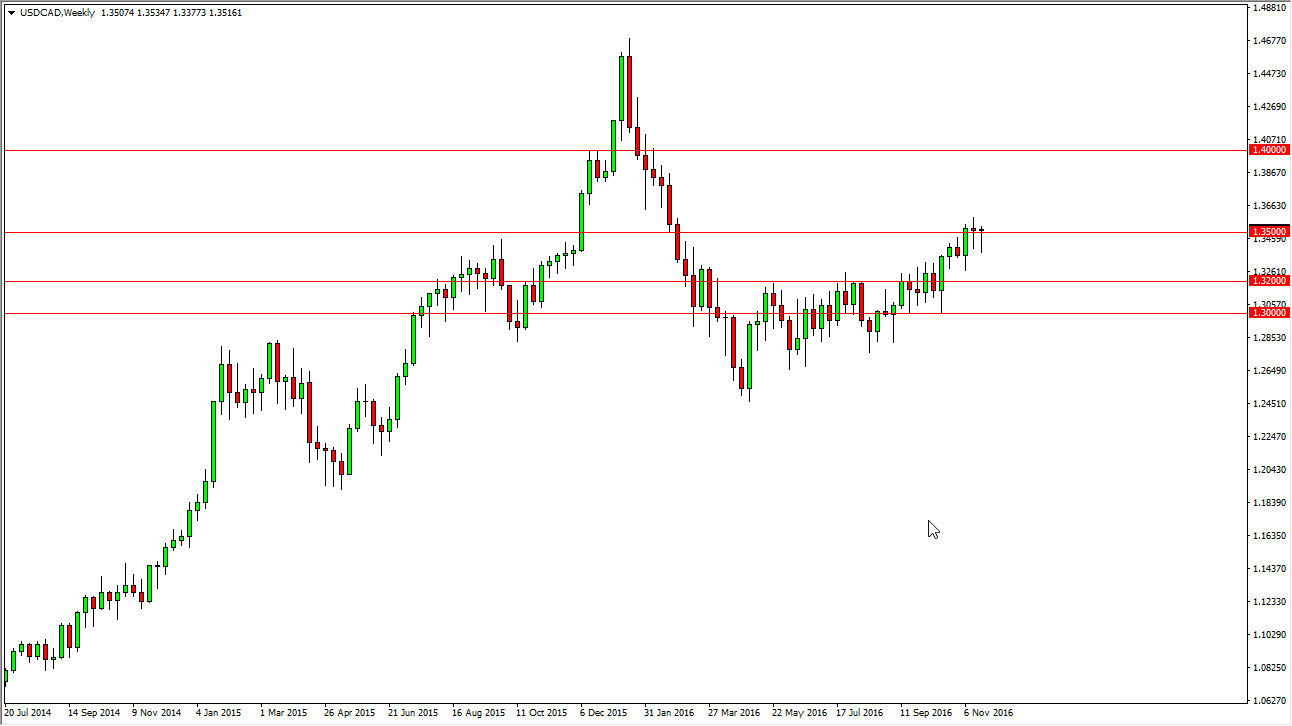

USD/CAD

The US dollar initially fell against the Canadian dollar, but turned around to form a hammer for the week. It is sitting on top of the 1.35 handle, which of course is a very bullish sign and with the oil markets looking likely to roll over, that should continue to put bullish pressure in this pair. I still have a target of 1.40, but realize that is could take several weeks to get there. I have no interest in selling.

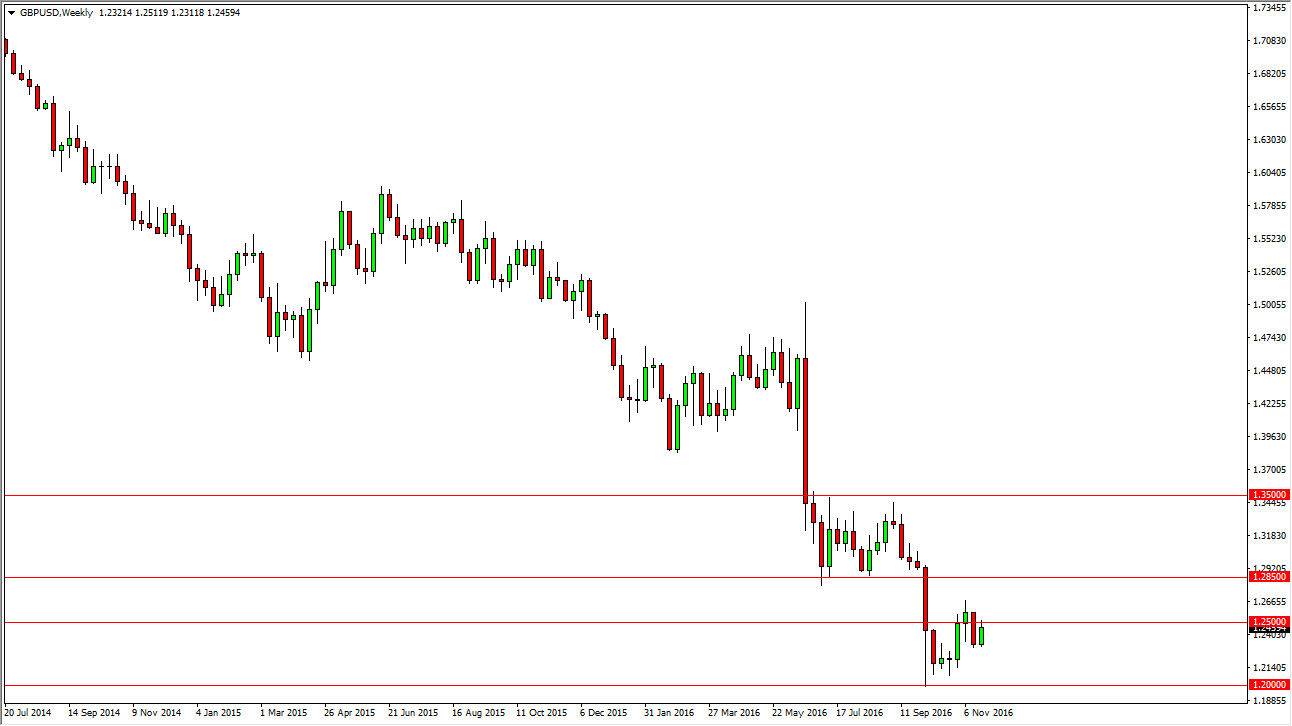

GBP/USD

The British pound rose during the week but continues to struggle at the 1.25 handle. This is a market that has been very bearish for some time, so I think that overall if you’re going to trade this pair, you have to do it to the negative sign, but I also recognize that we could be finding a nice “fair value” in the form of the 1.25 handle. Ultimately, expect choppy short-term trading at best.

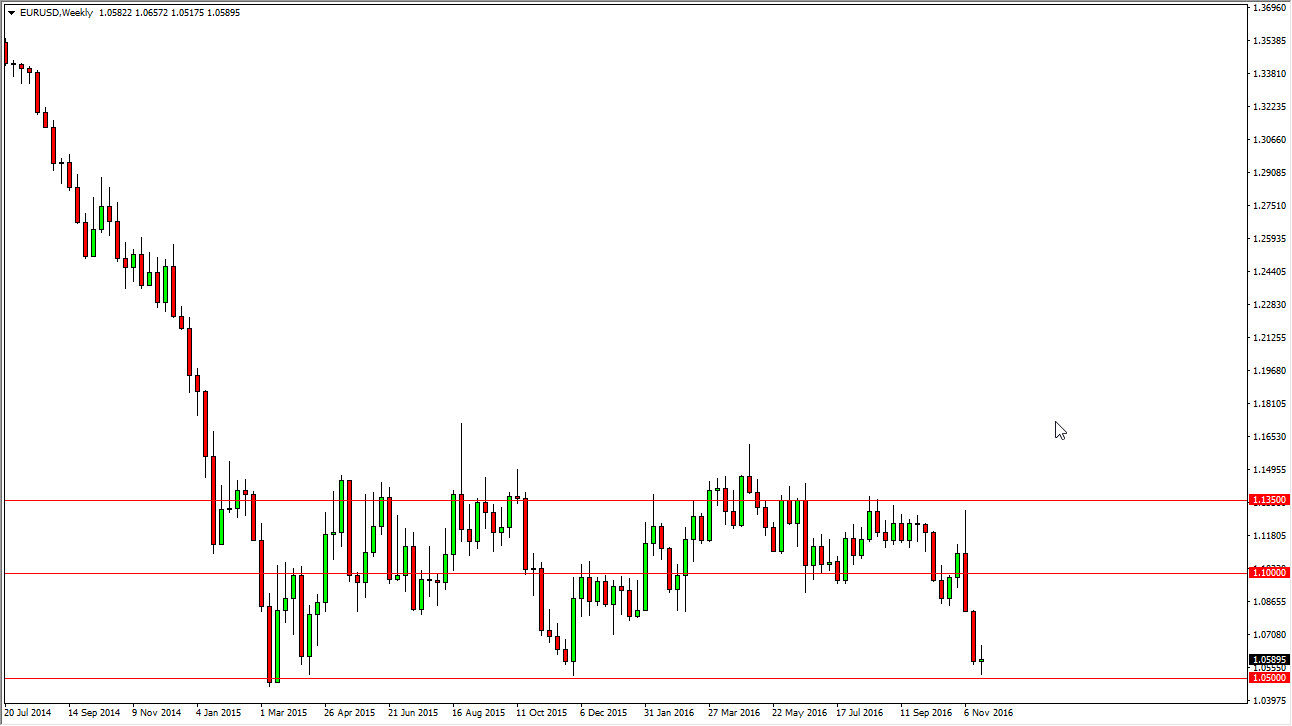

EUR/USD

The Euro bounce around during the previous week, using the 1.05 level as support. As you can see on the weekly chart, we have used this level 3 times, so if we can break down below the 1.05 level, I think that would be an extraordinarily bearish sign. On the other hand, if we can break above the top of the range during the previous week, we could find yourselves bouncing yet again. This will be a very interesting several sessions coming out.