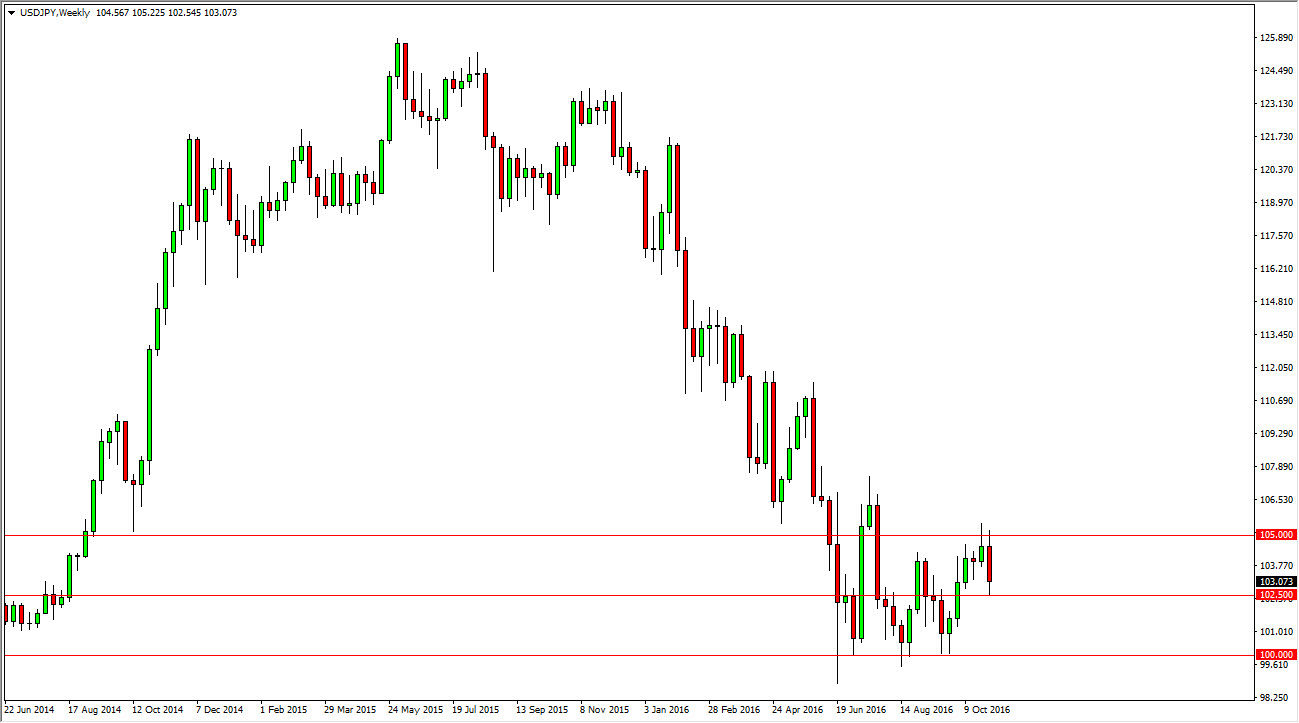

USD/JPY

The USD/JPY pair initially rallied during the course of the week but found the area above the 105 level to be a bit too resistive. We ended up falling all the way down to the 102.50 level, which means that of course we have quite a bit of volatility. I think if we break down below the 102.50 handle, we will more than likely try to reach towards the 100 level. Any signs of support at the 102.50 level should send this market higher.

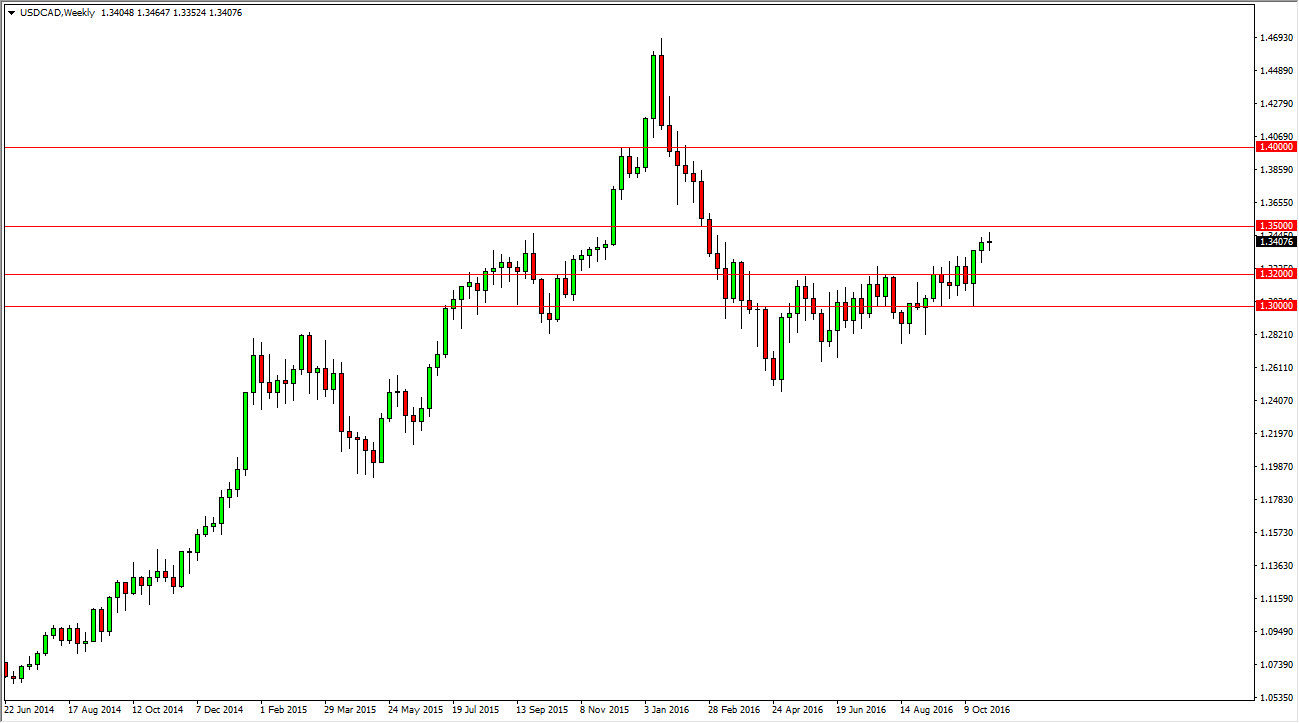

USD/CAD

The USD/CAD pair went back and forth during the course of the past week, as we continue to see quite a bit of volatility. The 1.35 level above continues to offer resistance, so having said that it’s likely that the market will struggle to get above there, at least before the US presidential election. A pullback at this time should find plenty of support near the 1.32 handle below.

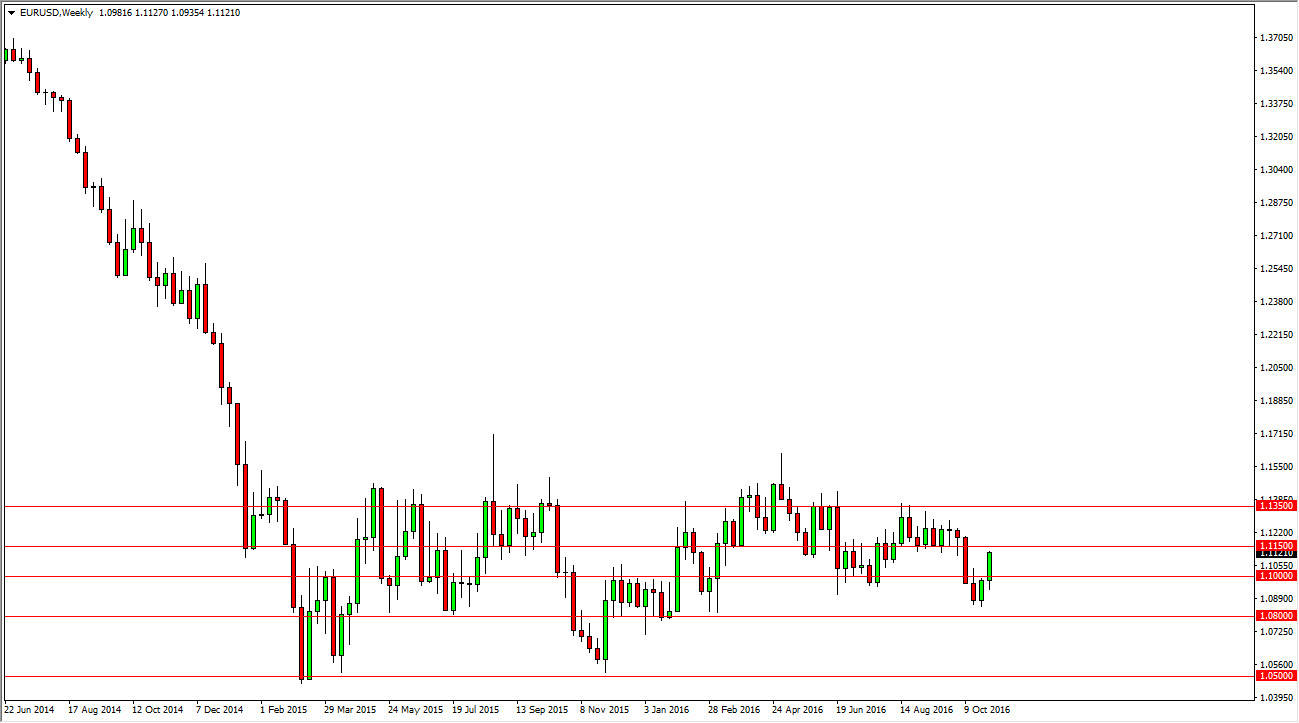

EUR/USD

The Euro fell initially fell during the past week, but we found 1.1150 above the be resistive as expected. I think we will probably pull back slightly at first during the week and then quite frankly it will come down to the US elections. At this point, I think it is going to be very difficult if not impossible to trade this market this week.

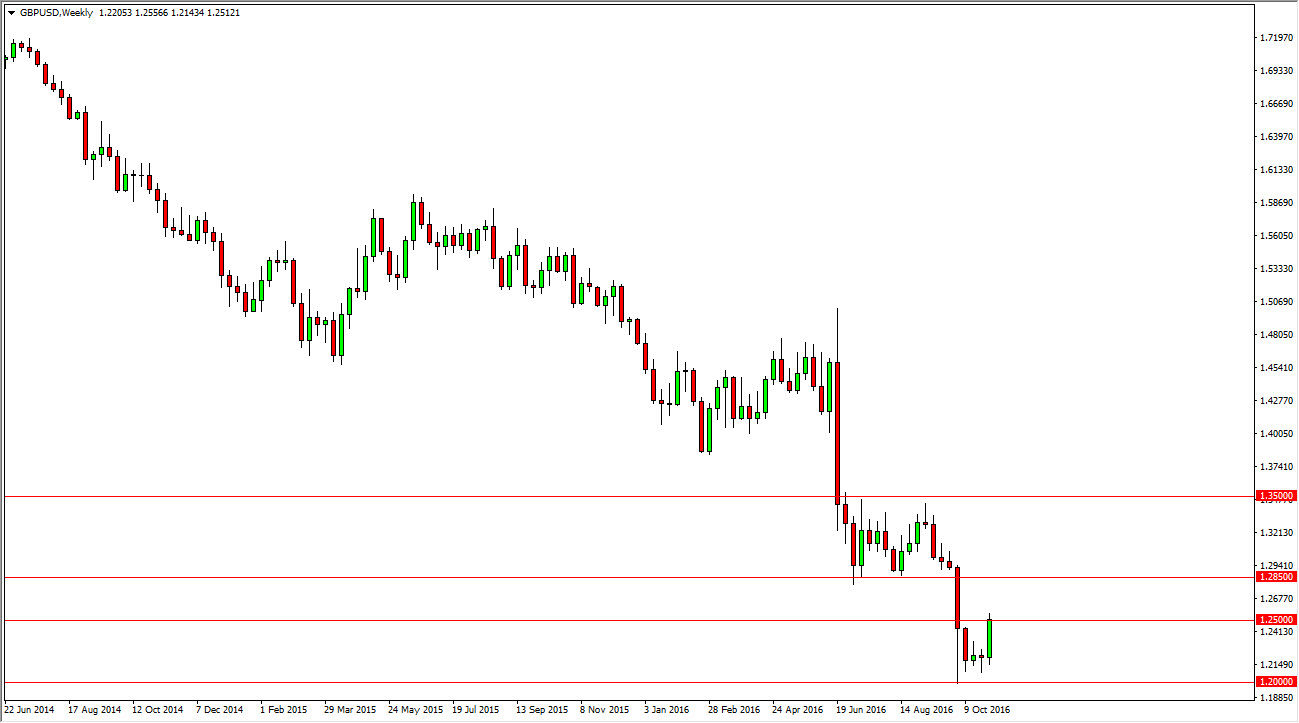

GBP/USD

The British pound initially fell early this week, but then ended up rallying all the way to the 1.25 level above. That area offered enough resistance to form a shooting star during the Friday session, which is negative. Regardless, I have no interest in buying this pair and quite frankly hope it goes to the 1.2850 level, so that I consider selling their instead. This market should continue to struggle overall, and selling opportunities should abound.