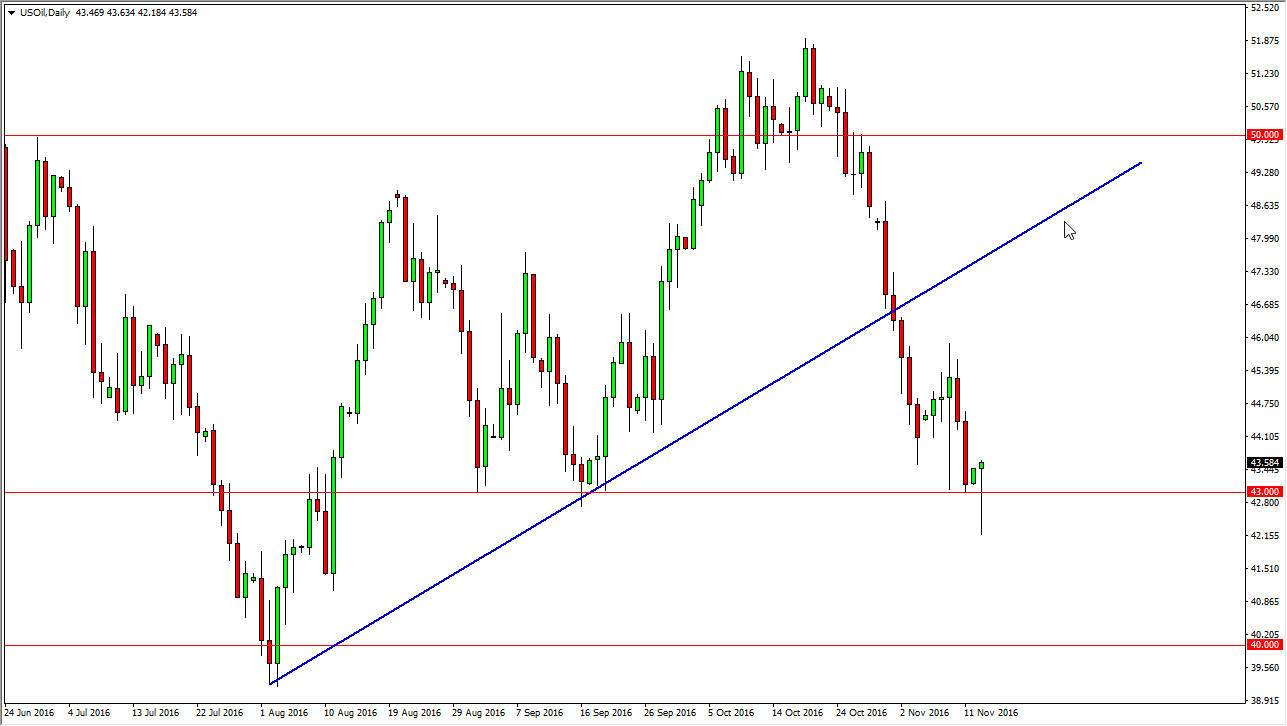

WTI Crude Oil

The WTI Crude Oil market broke down initially on the open for the Monday session, dipping well below the $43 level. However, we found more than enough support to turn things around and form a nice-looking hammer. A break above the top of the hammer should send this market reaching towards the $46 level above which has been massively resistive. Given enough time, I’m waiting to see whether or not there is some type of exhaustion that I can take advantage of and what is a very bearish market. A break down below the bottom of the hammer would be a selling opportunity as well, and at that point in time we should then reach towards the $40 level which has been massively supportive in the past. No interest in buying this market as we continue to trade beneath a longer-term uptrend line that was broken.

Natural Gas

The natural gas markets broke higher during the day on Monday, slamming into the $2.75 level above. There’s quite a bit of resistance extending from there to the $2.85 level, so at this point I’m simply waiting to see some type of resistive candle that we can start selling. A resistive candle is a nice shorting opportunity, as we continue to test the bottom below, reaching towards the $2.50 level. Because of this, I am ignoring any buying opportunities at this point, at least not until we break well above the $2.85 level. The natural gas markets will continue to suffer a serious lack of demand in proportion to the supply, so I have no interest whatsoever in buying this market.

In fact, given enough time I believe that we will break down below the $2.50 level, but is going to take a certain amount of building up of bearish momentum to do that particular move. Until then, short-term selling again and again will be my trading plan.