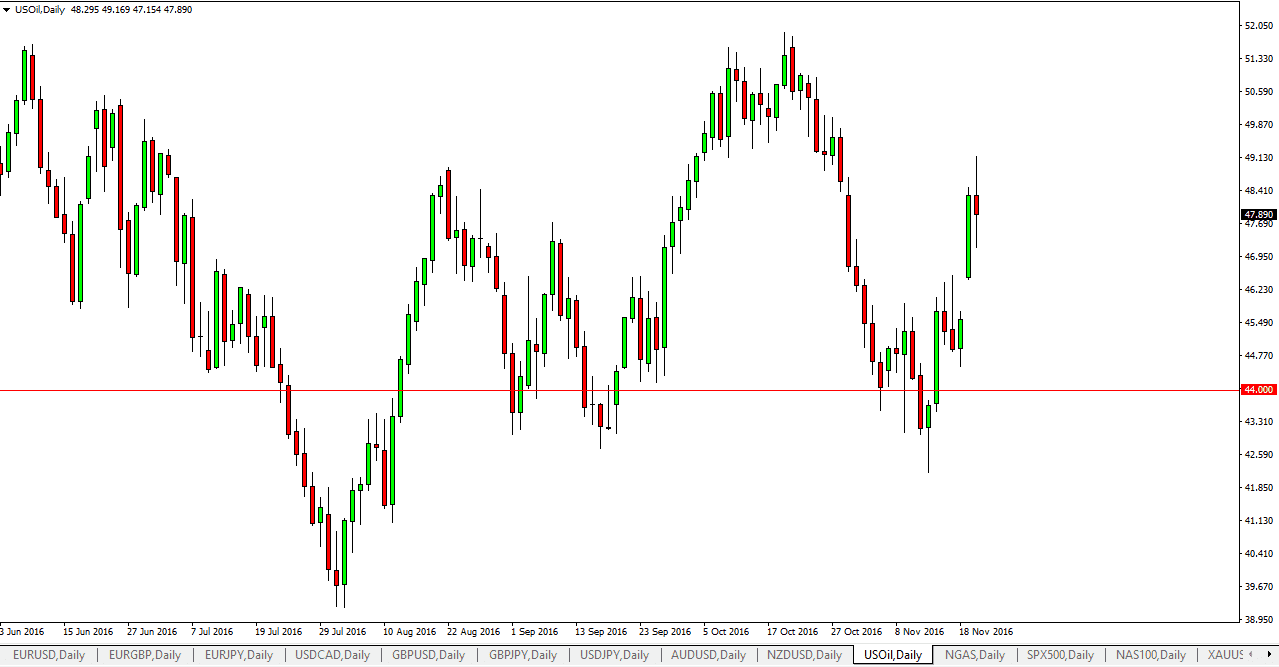

WTI Crude Oil

The WTI Crude Oil market had a wild ride on Tuesday as we went back and forth, testing several areas. There was an uptrend line that previously had been so reliable offering resistance during the session, and with today having the Crude Oil Inventories announcement coming out, it’s likely that volatility will remain. Keep in mind that the Americans are leaving for Thanksgiving holiday on Thursday, so quite frankly this could be a very erotic market over the next 24 hours. A breakdown below the bottom of the candle should send this market looking to fill the gap that started at the open on Monday. I believe there is a significant amount of resistance above, especially the closer you get to the $50 handle. Because of this, I am much more comfortable shorting if I get the opportunity.

Natural Gas

Natural gas markets were very active during the day on Tuesday as we tested the $3 level. This is an area that has a significant amount of psychological importance due to the round, large number affect. I believe that a breakdown below the bottom of the candle is what’s needed to start selling again, as is market most certainly is negative overall. After all, we have a large oversupply of natural gas in both the United States and Canada, and quite frankly the demand doesn’t come anywhere near taking that out. A breakdown below the bottom of the candle for the session on Tuesday should send this market looking for the $2.75 level next. Again though, you have to keep in mind that the Americans are going away to Thanksgiving on Thursday, so with this it’s likely that we will see very thin markets going forward.

Alternately, if we can break above the $3 level, we could go reaching towards the $3.10 level above. However, I feel much more comfortable shorting than buying, and will be much more quick to do so.