The WTI Crude Oil market has been extraordinarily volatile over the last couple of weeks. This makes quite a bit of sense, as the market has been reacting to comments coming out of OPEC, and the talk of a potential production cut. The idea is that they would be able to bring down the supply in the market to drive a price, but the biggest problem that OPEC has now is that they are the only game in town anymore. Quite frankly, any type of production cut will have limited in fact as the United States and Canada will do it gladly keep drilling. We also have the Russians that could get involved in more drilling, and the Iranians have already suggested that they are not going to join the cut. In other words, it’s a bit of a moot point.

US Dollar

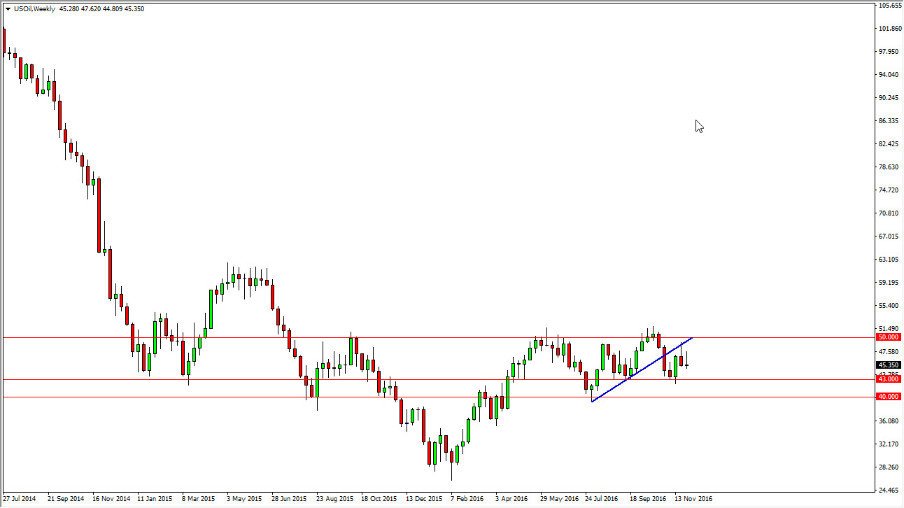

The US dollar continues to strengthen overall, so this works against the value of crude oil as well. After all, it’s going to take less of those very strong US dollars to buy barrels of crude oil. The last couple of weeks of form shooting stars, so I feel it’s only a matter of time before we reach down to the crucial $43 level. Below there, the next support level is the $40 handle, and I think we will eventually get there. It’s at that point that the market will have to decide whether or not we can continue to the downside. I think we will, based upon the fact that we have already broken down below a fairly significant uptrend line.

If we do rally from here, I’m not comfortable buying WTI Crude Oil until yet well above the $50 handle. I think it would take quite a bit to do that, so I still believe that the easier to trade is going to be to the downside over the course of the month. I look at rallies as potential selling opportunities.